Form Vec-Fc-20 - Employer'S Quarterly Tax Report

ADVERTISEMENT

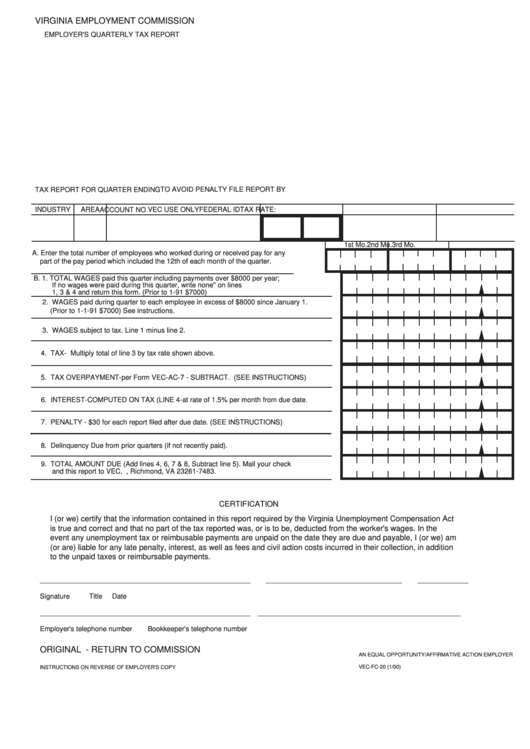

VIRGINIA EMPLOYMENT COMMISSION

EMPLOYER'S QUARTERLY TAX REPORT

TO AVOID PENALTY FILE REPORT BY

TAX REPORT FOR QUARTER ENDING

INDUSTRY

AREA

VEC USE ONLY

FEDERAL ID

TAX RATE:

ACCOUNT NO.

1st Mo.

2nd Mo.

3rd Mo.

A. Enter the total number of employees who worked during or received pay for any

part of the pay period which included the 12th of each month of the quarter.

B. 1. TOTAL WAGES paid this quarter including payments over $8000 per year;

If no wages were paid during this quarter, write none'' on lines

1, 3 & 4 and return this form. (Prior to 1-91 $7000)

2. WAGES paid during quarter to each employee in excess of $8000 since January 1.

(Prior to 1-1-91 $7000) See instructions.

3. WAGES subject to tax. Line 1 minus line 2.

4. TAX- Multiply total of line 3 by tax rate shown above.

5. TAX OVERPAYMENT-per Form VEC-AC-7 - SUBTRACT. (SEE INST RUCTIONS)

6. INTEREST-COMPUTED ON TAX (LINE 4-at rate of 1.5% per month from due date.

7. PENALTY - $30 for each report filed after due date. (SEE INSTRUCTIONS)

8. Delinquency Due from prior quarters (if not recently paid).

9. TOTAL AMOUNT DUE (Add lines 4, 6, 7 & 8, Subtract line 5 ). Mail your check

and this report to VEC, P.O. Box 27483, Richmond, VA 23261-7 483.

CERTIFICATION

I (or we) certify that the information contained in this report required by the Virginia Unemployment Compensation Act

is true and correct and that no part of the tax reported was, or is to be, deducted from the worker's wages. In the

event any unemployment tax or reimbusable payments are unpaid on the date they are due and payable, I (or we) am

(or are) liable for any late penalty, interest, as well as fees and civil action costs incurred in their collection, in addition

to the unpaid taxes or reimbursable payments.

______________________________________________________

___________________________________

_____________

Signature

Title

Date

______________________________________________________

____________________________________________________

Employer's telephone number

Bookkeeper's telephone number

ORIGINAL - RETURN TO COMMISSION

AN EQUAL OPPORTUNITY/AFFIRMATIVE ACTION EMPLOYER

VEC-FC-20 (1/00)

INSTRUCTIONS ON REVERSE OF EMPLOYER'S COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1