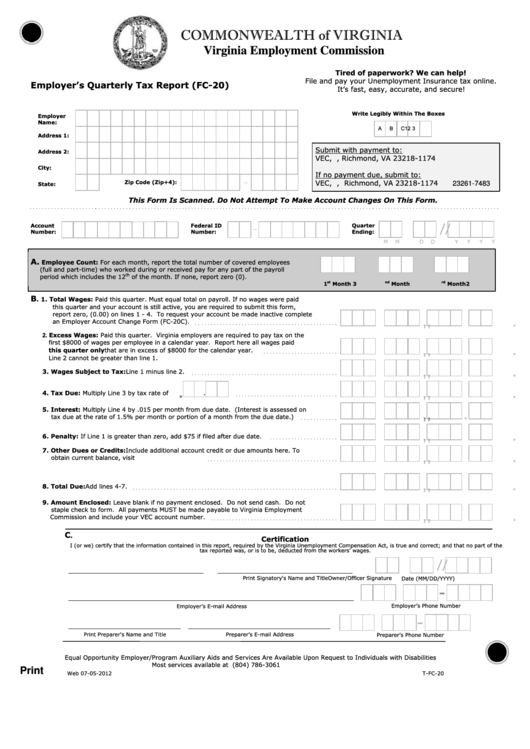

COMMONWEALTH of VIRGINIA

Virginia Employment Commission

Tired of paperwork? We can help!

File and pay your Unemployment Insurance tax online.

Employer’s Quarterly Tax Report (FC-20)

It’s fast, easy, accurate, and secure!

Write Legibly Within The Boxes

Employer

Name:

A

1

B

C

2

3

Address 1:

Submit with payment to:

Address 2:

VEC, P.O. Box 1174, Richmond, VA 23218-1174

City:

If no payment due, submit to:

_

Zip Code (Zip+4):

VEC, P.O. Box 27483, Richmond, VA 23218-1174

23261-7483

State:

This Form Is Scanned. Do Not Attempt To Make Account Changes On This Form.

Account

Federal ID

Quarter

/

/

_

Number:

Number:

Ending:

M

M

D

D

Y

Y

Y

Y

A.

Employee Count: For each month, report the total number of covered employees

(full and part-time) who worked during or received pay for any part of the payroll

th

period which includes the 12

of the month. If none, report zero (0).

st

nd

rd

1

Month

2

Month

3

Month

B

. 1. Total Wages: Paid this quarter. Must equal total on payroll. If no wages were paid

this quarter and your account is still active, you are required to submit this form,

report zero, (0.00) on lines 1 - 4. To request your account be made inactive complete

,

,

.

an Employer Account Change Form (FC-20C).

2. Excess Wages: Paid this quarter. Virginia employers are required to pay tax on the

first $8000 of wages per employee in a calendar year. Report here all wages paid

,

,

.

this quarter only that are in excess of $8000 for the calendar year.

Line 2 cannot be greater than line 1.

,

,

.

3. Wages Subject to Tax: Line 1 minus line 2.

.

,

,

.

4. Tax Due: Multiply Line 3 by tax rate of

.

5. Interest: Multiply Line 4 by .015 per month from due date. (Interest is assessed on

,

,

.

tax due at the rate of 1.5% per month or portion of a month from the due date.)

,

,

.

6. Penalty: If Line 1 is greater than zero, add $75 if filed after due date.

7. Other Dues or Credits: Include additional account credit or due amounts here. To

,

,

.

obtain current balance, visit .

,

,

.

8. Total Due: Add lines 4-7.

9. Amount Enclosed: Leave blank if no payment enclosed. Do not send cash. Do not

staple check to form. All payments MUST be made payable to Virginia Employment

,

,

.

Commission and include your VEC account number.

C

.

Certification

I (or we) certify that the information contained in this report, required by the Virginia Unemployment Compensation Act, is true and correct; and that no part of the

tax reported was, or is to be, deducted from the workers’ wages.

/

/

Owner/Officer Signature

Print Signatory's Name and Title

Date (MM/DD/YYYY)

-

Employer’s Phone Number

Employer’s E-mail Address

-

Print Preparer's Name and Title

Preparer’s E-mail Address

Preparer’s Phone Number

Equal Opportunity Employer/Program Auxiliary Aids and Services Are Available Upon Request to Individuals with Disabilities

Most services available at

(804) 786-3061

Print

Web 07-05-2012

T-FC-20

1

1