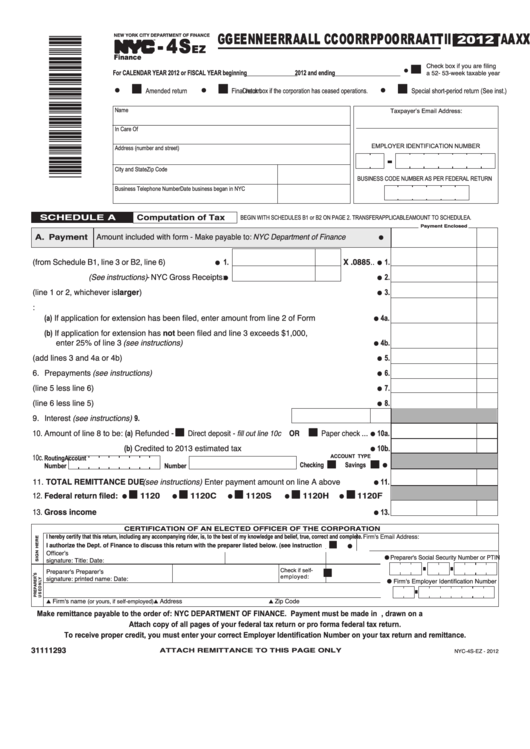

- - 4 4 S S

G G E E N N E E R R A A L L C C O O R R P P O O R R A A T T I I O O N N T T A A X X R R E E T T U U R R N N

2012

NEW YORK CITY DEPARTMENT OF FINANCE

E E Z Z

TM

Finance

I I

Check box if you are filing

a 52- 53-week taxable year

For CALENDAR YEAR 2012 or FISCAL YEAR beginning _______________ 2012 and ending ___________________

G

I I

I I

I I

Amended return

Final return

Check box if the corporation has ceased operations.

Special short-period return (See inst.)

G

G

G

-

Name

Taxpayer’s Email Address:

__________________________________________

In Care Of

EMPLOYER IDENTIFICATION NUMBER

Address (number and street)

City and State

Zip Code

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

Business Telephone Number

Date business began in NYC

S C H E D U L E A

Computation of Tax

BEGIN WITH SCHEDULES B1 or B2 ON PAGE 2. TRANSFER APPLICABLE AMOUNT TO SCHEDULE A.

Payment Enclosed

A. Payment

Amount included with form - Make payable to: NYC Department of Finance

G

X .0885..

1. Net income (from Schedule B1, line 3 or B2, line 6)

1.

1.

G

G

2. Minimum tax (See instructions) - NYC Gross Receipts:

...............

2.

G

G

3. Tax (line 1 or 2, whichever is larger) ..............................................................................................

3.

G

4. First installment of 2013 estimated tax:

(a) If application for extension has been filed, enter amount from line 2 of Form NYC-EXT..........

4a.

G

(b) If application for extension has not been filed and line 3 exceeds $1,000,

enter 25% of line 3 (see instructions) .......................................................................................

4b.

G

5. Total before prepayments (add lines 3 and 4a or 4b)......................................................................

5.

G

6. Prepayments (see instructions) .......................................................................................................

6.

G

7. Balance due (line 5 less line 6)........................................................................................................

7.

G

8. Overpayment (line 6 less line 5)......................................................................................................

8.

G

9. Interest (see instructions) .................................................................... 9.

10. Amount of line 8 to be: (a) Refunded -

Direct deposit - fill out line 10c OR

Paper check ...

I I

I I

10a.

G

(b) Credited to 2013 estimated tax .........................................................

10b.

10c.

G

Routing

Account

ACCOUNT TYPE

I I

I I

Checking

Savings

Number

Number

G

11. TOTAL REMITTANCE DUE (see instructions) Enter payment amount on line A above ...............

11.

G

12. Federal return filed:

1120

1120C

1120S

1120H

1120F

I I

I I

I I

I I

I I

G

G

G

G

G

13. Gross income...............................................................................................................................

13.

G

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

Firm's Email Address:

I I

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions)...YES

G ____________________________________

Officerʼs

G Preparer's Social Security Number or PTIN

signature:

Title:

Date:

I I

Check if self-

Preparer's

Preparerʼs

employed:

signature:

printed name:

Date:

G Firm's Employer Identification Number

Firm's name

Address

Zip Code

(or yours, if self-employed)

L

L

L

Make remittance payable to the order of: NYC DEPARTMENT OF FINANCE. Payment must be made in U.S.dollars, drawn on a U.S. bank.

Attach copy of all pages of your federal tax return or pro forma federal tax return.

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

31111293

AT TA C H R E M I T TA N C E T O T H I S PA G E O N LY

NYC-4S-EZ - 2012

1

1 2

2