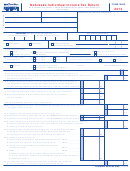

Form 1040n - Nebraska Individual Income Tax Return - Department Of Revenue - 2012 Page 2

ADVERTISEMENT

00

18 Amount from line 17 (Total Nebraska tax) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Nebraska personal exemption credit for residents only ($123 per exemption) . . 19

00

20 a Credit for tax paid to another state Nebr . Sch . II, line 63 . . . 20 a $__________

(attach Nebr . Sch . II and the other state's return) plus

b Prior year AMT credit (attach Form 8801) . . . . . . . . . . . . .20 b $__________ .

Enter the total of 20a and 20b on line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

00

21 Credit for the elderly or disabled (attach copy of Federal Schedule R) . . . . . . . . . . 21

00

22 CDAA credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

00

23 Form 3800N nonrefundable credit (attach Form 3800N) . . . . . . . . . . . . . . . . . . . . . 23

00

24 Nebraska child/dependent care nonrefundable credit, only if line 5 is more

than $29,000 (attach a copy of Federal Form 2441 and see instructions) . . . . . . . . . . 24

00

25 Credit for financial institution tax (see instructions) (attach Form NFC) . . . . . . . . . . 25

00

26 Total nonrefundable credits (add lines 19 through 25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

00

27 Subtract line 26 from line 18 (if line 26 is more than line 18, enter -0-) . If result is more than your

federal tax liability (and line 12 is less than $5,000), see instructions . If entering federal tax, check box:

00

and attach a copy of the federal return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Nebr . income tax withheld (attach 2012 Forms W-2, W-2G, 1099-R,1099-MISC, or K-1N) . 28

00

29 2012 estimated tax payments (include any 2011 overpayment credited to 2012 and

any payments submitted with an extension request) . . . . . . . . . . . . . . . . . . . . . . . . . 29

00

30 Form 3800N refundable credit (attach Form 3800N) . . . . . . . . . . . . . . . . . . . . . . . . 30

00

31 Nebraska child/dependent care refundable credit, if line 5 is $29,000 or less

(attach a copy of Federal Form 2441 or Nebraska Form 2441N) . . . . . . . . . . . . . . . . . . 31

00

32 Beginning Farmer credit (attach Form 1099 BFC) . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

00

33 Nebraska earned income credit . Enter number of qualifying children

97

Federal credit

$

.00 x .10 (10%) (attach federal return,

98

pages 1 and 2 – see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

00

34 Angel Investment Tax Credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

00

00

35 Total refundable credits (add lines 28 through 34) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

36 Penalty for underpayment of estimated tax (see instructions) . If you calculated a Form 2210N penalty of (-0-)

00

or greater, or used the annualized income method, attach Form 2210N, and check this box

. . . . . . . . 36

96

00

37 TOTAL TAX AND PENALTY. Add lines 27 and 36 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

38 Use tax due on Internet and out-of–state purchases . See instructions .

Enter purchases subject to tax

$___________;

92

State tax

$ _________ .00 (purchases x 5 .5%); Local code

__ __ __ (see local rate schedule);

93

94

Local tax

$ _________ .00 (purchases x local rate of _____%, from local rate schedule)

95

00

$ _________ .00 Add state and local taxes and enter on line 38 . If no use tax, enter (-0-) on line 38 . . . . . 38

Total tax

39 TOTAL AMOUNT DUE . If line 35 is less than total of lines 37 and 38, subtract line 35 from the total of lines 37

00

and 38 . Pay this amount in full . For electronic or credit card payment, check here

and see instructions 39

00

40 OVERPAYMENT. If line 35 is more than total of lines 37 and 38, subtract total of lines 37 and 38 from line 35 . 40

41 Amount of line 40 you want APPLIED TO YOUR 2013 ESTIMATED TAX . . . . . . .

41

00

42 Wildlife Conservation Fund DONATION of $1 or more . . . . . . . . . . . . . . . . . . . . . .

42

00

43 Amount of line 40 you want REFUNDED to you (line 40 minus lines 41 and 42) .

00

File early! It may take three months to receive your refund if you file a paper return

. . . . . . . . . . . . . . . . 43

Expecting a Refund? Have it sent directly to your bank account!

(see instructions)

44a Routing Number

44b Type of Account

1 = Checking

2 = Savings

(Enter 9 digits, first two digits must be 01 through 12, or 21 through 32;

use an actual check or savings account number, not a deposit slip)

44c Account Number

(Can be up to 17 characters . Omit hyphens, spaces, and special symbols . Enter from left to right and leave any unused boxes blank .)

44d

Check this box if this refund will go to a bank account outside the United States .

Under penalties of perjury, I declare that, as taxpayer or preparer, I have examined this return and to the best of my knowledge and belief, it is correct and complete .

sign

here

Your Signature

Date

Email Address

(

)

Keep a copy of

this return for

Spouse’s Signature (if filing jointly, both must sign)

Daytime Phone

your records .

paid

preparer’s

Preparer’s Signature

Date

Preparer’s PTIN

use only

(

)

Print Firm’s Name (or yours if self-employed), Address and Zip Code

EIN

Daytime Phone

Mail returns REQUESTING A REFUND to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 98912, LINCOLN, NE 68509-8912.

Mail returns NOT REQUESTING A REFUND to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 98934, LINCOLN, NE 68509-8934.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2