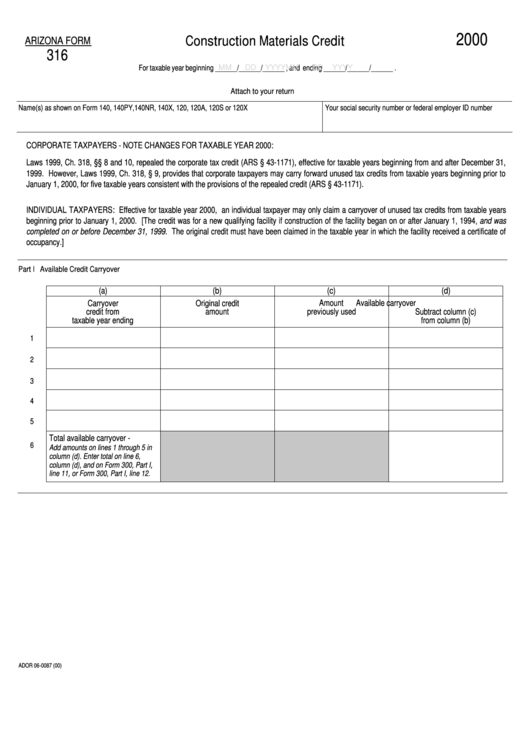

Form 316 - Construction Materials Credit - 2000

ADVERTISEMENT

2000

Construction Materials Credit

ARIZONA FORM

316

For taxable year beginning ______/______/______ , and ending ______/______/______ .

MM

DD

YYYY

MM

DD

YYYY

Attach to your return

Name(s) as shown on Form 140, 140PY,140NR, 140X, 120, 120A, 120S or 120X

Your social security number or federal employer ID number

CORPORATE TAXPAYERS - NOTE CHANGES FOR TAXABLE YEAR 2000:

Laws 1999, Ch. 318, §§ 8 and 10, repealed the corporate tax credit (ARS § 43-1171), effective for taxable years beginning from and after December 31,

1999. However, Laws 1999, Ch. 318, § 9, provides that corporate taxpayers may carry forward unused tax credits from taxable years beginning prior to

January 1, 2000, for five taxable years consistent with the provisions of the repealed credit (ARS § 43-1171).

INDIVIDUAL TAXPAYERS: Effective for taxable year 2000, an individual taxpayer may only claim a carryover of unused tax credits from taxable years

beginning prior to January 1, 2000. [The credit was for a new qualifying facility if construction of the facility began on or after January 1, 1994, and was

completed on or before December 31, 1999. The original credit must have been claimed in the taxable year in which the facility received a certificate of

occupancy.]

Part I Available Credit Carryover

(a)

(b)

(c)

(d)

Carryover

Original credit

Amount

Available carryover

credit from

amount

previously used

Subtract column (c)

taxable year ending

from column (b)

1

2

3

4

5

Total available carryover -

6

Add amounts on lines 1 through 5 in

column (d). Enter total on line 6,

column (d), and on Form 300, Part I,

line 11, or Form 300, Part I, line 12.

ADOR 06-0087 (00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1