Arizona Form 316 - Construction Materials Credit - 2002

ADVERTISEMENT

Construction Materials Credit

ARIZONA FORM

2002

316

YYYY

YYYY

MM

MM

DD

DD

YYYY

YYYY

For taxable year beginning ______/______/________, and ending ______/______/________,

MM

MM

DD

DD

Attach to your return

Name(s) as shown on Forms 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X

Your social security number or federal employer ID number

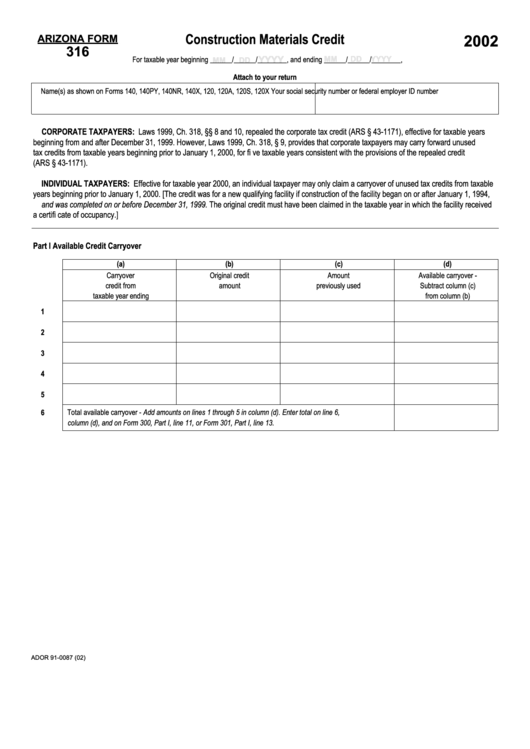

CORPORATE TAXPAYERS: Laws 1999, Ch. 318, §§ 8 and 10, repealed the corporate tax credit (ARS § 43-1171), effective for taxable years

beginning from and after December 31, 1999. However, Laws 1999, Ch. 318, § 9, provides that corporate taxpayers may carry forward unused

tax credits from taxable years beginning prior to January 1, 2000, for fi ve taxable years consistent with the provisions of the repealed credit

(ARS § 43-1171).

INDIVIDUAL TAXPAYERS: Effective for taxable year 2000, an individual taxpayer may only claim a carryover of unused tax credits from taxable

years beginning prior to January 1, 2000. [The credit was for a new qualifying facility if construction of the facility began on or after January 1, 1994,

and was completed on or before December 31, 1999. The original credit must have been claimed in the taxable year in which the facility received

a certifi cate of occupancy.]

Part I Available Credit Carryover

(a)

(b)

(c)

(d)

Carryover

Original credit

Amount

Available carryover -

credit from

amount

previously used

Subtract column (c)

taxable year ending

from column (b)

1

2

3

4

5

6

Total available carryover - Add amounts on lines 1 through 5 in column (d). Enter total on line 6,

column (d), and on Form 300, Part I, line 11, or Form 301, Part I, line 13. ................................................................

ADOR 91-0087 (02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1