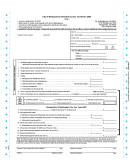

Individual Income Tax Return Instructions - City Of Cincinnati - 2006 Page 2

ADVERTISEMENT

LINE 7: Line 5 plus Line 6. (Losses may not be used to offset W-2 income from Line 5).

LINE 8: Multiply Line 7 by 2.1% (.021).

LINE 9a: Enter the amount of Cincinnati Tax withheld by employers.

LINE 9b: Enter the amount of estimated tax payments including any amounts paid with an extension. Estimated payments may be

subject to the underpayment of estimated tax penalty. The total of the quarterly estimates should equal 100% of the prior year’s tax or

90% of the current year’s tax.

LINE 9c: Enter the amount of taxes withheld for or paid to another city. Residents of the City of Cincinnati may claim taxes paid to

another city up to 2.1% of the Qualifying Wages reported on each individual W-2. Credit is limited to the local tax rate used (2.1% or

less) multiplied by the Qualifying Wages, and is further restricted if the municipality has a wage cap. Part-year residents may claim

taxes paid to other cities for the part of the year they were a resident. Nonresidents may not claim taxes paid to another municipality.

(Provide documentation in the form of W-2s or tax returns submitted to other municipalities). Partners claiming credit for taxes

withheld by a partnership must provide documentation to support this credit.

LINE 10: Add Lines 9a, 9b and 9c.

LINE 11: If Line 8 is greater than Line 10, enter the tax due. Payment is not required if the amount is less than $5.

LINE 12: If Line 10 is greater than Line 8, enter the overpayment.

LINE 13: Enter the amount from Line 12 to be refunded. Amounts less than $5 will not be refunded.

LINE 14: Enter the amount from Line 12 to be credited to the tax year 2007 estimated tax liability.

Part B - Declaration of Estimated Tax for 2007

LINE 15: Base your estimated income on the amount subject to tax in the preceding full year, or by annualizing income if the

preceding tax year was not for a full 12-month period. Although you have the option to pay only 90% of the estimated

annual tax liability in four quarterly installments, use of this option will subject you to the possibility of an interest and

penalty assessment if the installment payments total less than 90 percent of the ultimate tax liability.

LINE 16: Enter the total estimated tax due for 2007.

LINE 17: Enter the estimated amount of Cincinnati and other allowable municipal taxes to be withheld from your wages by your

employer.

LINE 18: Line 16 less Line 17.

LINE 19: Divide Line 18 by 4 to determine the amount of estimated tax to be paid for the first quarter.

LINE 20: Enter the amount of credits from Line 14.

LINE 21: Enter and remit the net estimated tax due if Line 19 minus Line 20 is greater than zero. This is the first of four quarterly

estimated tax payments. We will not bill you for the remaining quarterly installments. The second payment is due on July 31,

2007 and is equal to the total estimated tax on line 18 divided by 4 less any overpayment still available from prior years. The

third payment is due October 31, 2007 and the final estimated payment is due January 31, 2008. Failure to remit timely

estimated payments may result in the assessment of interest and penalties.

LINE 22: Total amount due with return - Combine Line 11 and Line 21

Make Checks Payable to: City of Cincinnati

Mail to: 805 Central Ave Suite 600, Cincinnati OH 45202-5756

Due Date for 2006 Returns: April 16, 2007

** To prevent delays in processing, please do not use staples **

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2