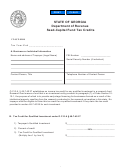

Food and Beverage Tax or County Supplemental Food and Beverage Tax

Filing Status

All

(Instructions for completing Form FAB−103)

The following instructions are to assist you in completing Form FAB−103. The instructions are valid for this form only.

A. Total Rental Receipts − Enter the total receipts from food and beverage sales. Do not include sales tax or food and beverage tax on this line.

B. Total Exempt Rentals − Enter the total exempt food and beverage sales. This figure cannot be greater than the amount on Line A.

C. Net Taxable Receipts − Subtract Line B from Line A. This figure must never be greater than Line A.

D. County Innkeepers Tax Due − Multiply Line C by the county tax rate listed on your return. If there is an entry on this line, there must be entries

on Lines A and Line C.

E. Discount (Collection Allowance) − Use this line only if your return is postmarked or your EFT payments were made on or before the due date. The discount is

available only when the full payment is remitted timely. For further information, please refer to this Web site:

F. Net Tax Due − Subtract Line E from Line D.

G. Penalty/Interest Due − A payment made after the due date is subject to penalty and interest on the total on Line D. The penalty is 10 percent of the total on

Line D, or $5, whichever is greater. To calculate interest, multiply the amount due by the annual interest rate and divide the result by 365. Multiply that result by the

number of days the payment is late. Interest is computed from the due date of the return to the date payment is made. Interest is not computed on the penalty.

H. Adjustments − Adjustments can be an overpayment or underpayment. If Line H has a negative entry, place <brackets> around the amount. A negative

adjustment must have an explanation attached or the adjustment will be disallowed. This line cannot be greater than the amount due.

I. Total Amount Due − Add Lines F and G plus or minus Line H. Include this amount with your return.

Please do not send cash. Make check payable (in U.S. funds) to the Indiana Department of Revenue.

Food and Beverage Tax

FAB-103

0808

State Form 44465

.

,

,

Total Sales of Food & Beverages (Do Not Include Tax)..............

A.

X

Authorized

.

,

,

Signature

Total Exempt Food & Beverage Sales ............................................

B.

I declare under penalties of perjury that this is a true, correct and complete return.

F

.

,

,

Net Taxable Sales (Subtract Line B from Line A).........................

C.

Date ____________ Phone # (_____)______________

.

,

,

Tax Due (2% of Line C).................................................................

D.

CHUMLEYS BEER HOUSE

Collection Allowance (.83% of Line D)

.

,

,

Do Not Use this Line if the Payment is Late..................................

E.

Taxpayer ID Number

For Tax Period

.

,

,

F.

Net Tax Due (Subtract Line E from Line D)..................................

0007177020 001 8

JAN 2008

Penalty is Greater of $5 or 10% of Line F (Plus Interest)*

County/Town

Due on or Before

.

,

,

Use this line only if return is filed late...........................................

G.

Marion

MAR 03 2008

*The 2008 Annual Interest Rate is 7 %

2009

.

,

,

H.

Adjustments (An explanation must be attached)............................

(2506308(

.

,

,

Total Amount Due (Total Lines F and G plus or minus H)

I.

$

INDIANA DEPARTMENT OF REVENUE

P.O. BOX 7229

INDIANAPOLIS, IN 46207-7229

(46207722929

04108032226000001025013120080303200809

Food and Beverage Tax

FAB-103

0808

State Form 44465

.

,

,

Total Sales of Food & Beverages (Do Not Include Tax)..............

A.

X

Authorized

.

,

,

Signature

B.

Total Exempt Food & Beverage Sales ............................................

I declare under penalties of perjury that this is a true, correct and complete return.

F

.

,

,

Net Taxable Sales (Subtract Line B from Line A).........................

C.

Date ____________ Phone # (_____)______________

.

,

,

Tax Due (2% of Line C).................................................................

D.

CHUMLEYS BEER HOUSE

Collection Allowance (.83% of Line D)

.

,

,

Do Not Use this Line if the Payment is Late..................................

E.

Taxpayer ID Number

For Tax Period

.

,

,

F.

Net Tax Due (Subtract Line E from Line D)..................................

0007177020 001 8

FEB 2008

Penalty is Greater of $5 or 10% of Line F (Plus Interest)*

County/Town

Due on or Before

.

,

,

Use this line only if return is filed late...........................................

G.

Marion

MAR 31 2008

*The 2008 Annual Interest Rate is 7 %

2009

.

,

,

H.

Adjustments (An explanation must be attached)............................

(2509108(

.

,

,

Total Amount Due (Total Lines F and G plus or minus H)

I.

$

INDIANA DEPARTMENT OF REVENUE

P.O. BOX 7229

INDIANAPOLIS, IN 46207-7229

(46207722929

04108032226000001025022920080331200803

1

1 2

2 3

3