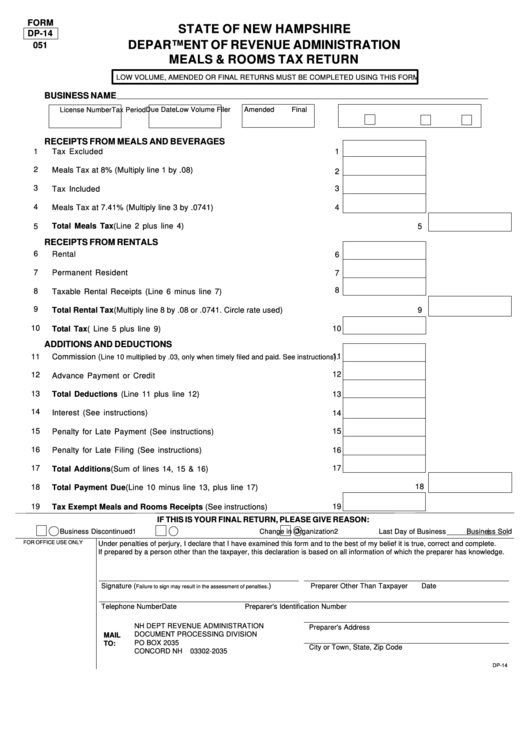

FORM

STATE OF NEW HAMPSHIRE

DP-14

DEPARTMENT OF REVENUE ADMINISTRATION

051

MEALS & ROOMS TAX RETURN

LOW VOLUME, AMENDED OR FINAL RETURNS MUST BE COMPLETED USING THIS FORM

BUSINESS NAME

Due Date

Low Volume Filer

Amended

Final

License Number

Tax Period

RECEIPTS FROM MEALS AND BEVERAGES

1

Tax Excluded Receipts.......................................................................................

1

2

Meals Tax at 8% (Multiply line 1 by .08).................................................................

2

3

Tax Included Receipts........................................................................................

3

4

Meals Tax at 7.41% (Multiply line 3 by .0741)........................................................

4

5

Total Meals Tax (Line 2 plus line 4).......................................................................................................

5

RECEIPTS FROM RENTALS

6

Rental Receipts.................................................................................................

6

7

Permanent Resident Receipts............................................................................

7

8

8

Taxable Rental Receipts (Line 6 minus line 7)....................................................

9

Total Rental Tax (Multiply line 8 by .08 or .0741. Circle rate used).............................................................

9

10

Total Tax ( Line 5 plus line 9).............................................................................

10

ADDITIONS AND DEDUCTIONS

11

11

Commission (

) .

Line 10 multiplied by .03, only when timely filed and paid. See instructions

12

12

Advance Payment or Credit Memo.....................................................................

13

Total Deductions (Line 11 plus line 12).............................................................

13

14

Interest (See instructions)...................................................................................

14

15

15

Penalty for Late Payment (See instructions).......................................................

16

Penalty for Late Filing (See instructions).............................................................

16

17

17

Total Additions (Sum of lines 14, 15 & 16)........................................................

18

18

Total Payment Due (Line 10 minus line 13, plus line 17)........................................................................

19

Tax Exempt Meals and Rooms Receipts (See instructions)............................

19

IF THIS IS YOUR FINAL RETURN, PLEASE GIVE REASON:

3

1

Business Discontinued

2

Change in Organization

Business Sold

Last Day of Business

FOR OFFICE USE ONLY

Under penalties of perjury, I declare that I have examined this form and to the best of my belief it is true, correct and complete.

If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

Signature (

.)

Preparer Other Than Taxpayer

Date

Failure to sign may result in the assessment of penalties

Telephone Number

Date

Preparer's Identification Number

NH DEPT REVENUE ADMINISTRATION

Preparer's Address

DOCUMENT PROCESSING DIVISION

MAIL

PO BOX 2035

TO:

City or Town, State, Zip Code

CONCORD NH

03302-2035

DP-14

1

1