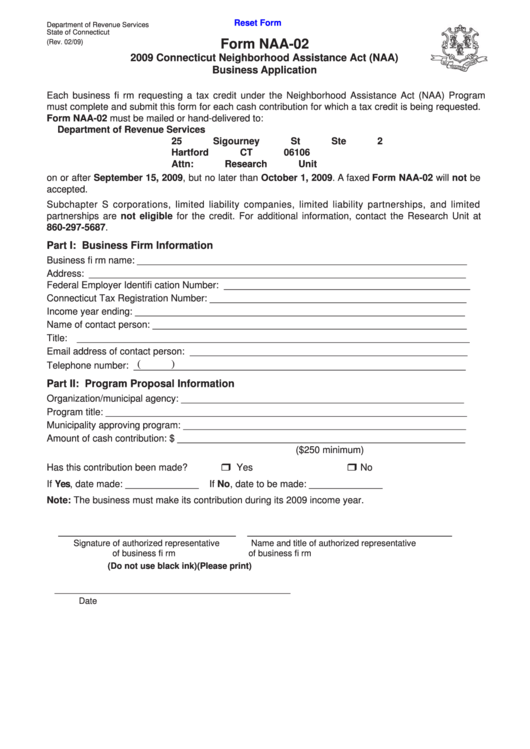

Reset Form

Department of Revenue Services

State of Connecticut

Form NAA-02

(Rev. 02/09)

2009 Connecticut Neighborhood Assistance Act (NAA)

Business Application

Each business fi rm requesting a tax credit under the Neighborhood Assistance Act (NAA) Program

must complete and submit this form for each cash contribution for which a tax credit is being requested.

Form NAA-02 must be mailed or hand-delivered to:

Department of Revenue Services

25 Sigourney St Ste 2

Hartford CT 06106

Attn: Research Unit

on or after September 15, 2009, but no later than October 1, 2009. A faxed Form NAA-02 will not be

accepted.

Subchapter S corporations, limited liability companies, limited liability partnerships, and limited

partnerships are not eligible for the credit. For additional information, contact the Research Unit at

860-297-5687.

Part I: Business Firm Information

Business fi rm name: _______________________________________________________________

Address: ________________________________________________________________________

Federal Employer Identifi cation Number: _______________________________________________

Connecticut Tax Registration Number: _________________________________________________

Income year ending: _______________________________________________________________

Name of contact person: ____________________________________________________________

Title: ___________________________________________________________________________

Email address of contact person: _____________________________________________________

(

)

__________________________________________________________

Telephone number:

Part II: Program Proposal Information

Organization/municipal agency: ______________________________________________________

Program title: _____________________________________________________________________

Municipality approving program: ______________________________________________________

Amount of cash contribution: $ _______________________________________________________

($250 minimum)

Has this contribution been made?

Yes

No

If Yes, date made: ______________

If No, date to be made: ______________

Note: The business must make its contribution during its 2009 income year.

__________________________

______________________________

Signature of authorized representative

Name and title of authorized representative

of business fi rm

of business fi rm

(Do not use black ink)

(Please print)

_____________________________________________

Date

1

1