Business Income Tax Return Form - City Of Massillon, Ohio - 2002

ADVERTISEMENT

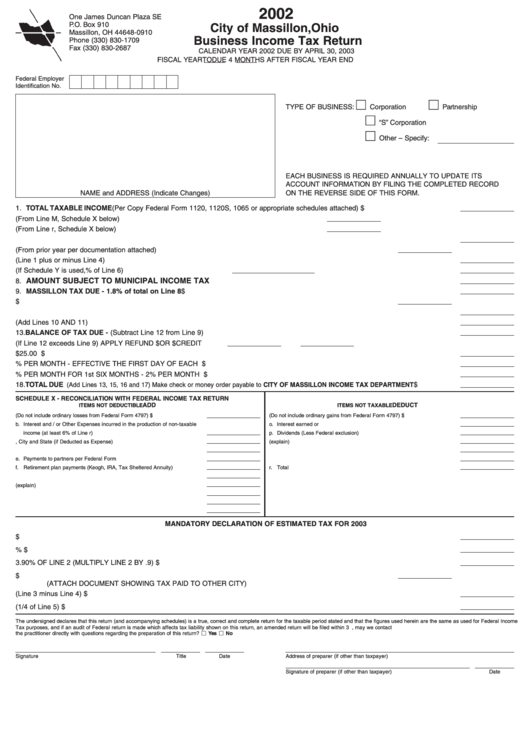

2002

One James Duncan Plaza SE

P.O. Box 910

City of Massillon, Ohio

Massillon, OH 44648-0910

Business Income Tax Return

Phone (330) 830-1709

Fax (330) 830-2687

CALENDAR YEAR 2002 DUE BY APRIL 30, 2003

FISCAL YEAR

TO

DUE 4 MONTHS AFTER FISCAL YEAR END

Federal Employer

Identification No.

TYPE OF BUSINESS:

Corporation

Partnership

“S” Corporation

Other – Specify:

EACH BUSINESS IS REQUIRED ANNUALLY TO UPDATE ITS

ACCOUNT INFORMATION BY FILING THE COMPLETED RECORD

NAME and ADDRESS (Indicate Changes)

ON THE REVERSE SIDE OF THIS FORM.

1. TOTAL TAXABLE INCOME (Per Copy Federal Form 1120, 1120S, 1065 or appropriate schedules attached) ..................................................$

2.

ITEMS NOT DEDUCTIBLE (From Line M, Schedule X below) ......................................ADD

3.

ITEMS NOT TAXABLE (From Line r, Schedule X below) ................................................DEDUCT

4.

ENTER EXCESS OF LINE 2 or 3 ......................................................................................................................................................................

5.

ENTER NET OPERATING LOSS CARRYFORWARD (From prior year per documentation attached) ................DEDUCT

6.

ADJUSTED NET INCOME (Line 1 plus or minus Line 4) ..................................................................................................................................

7.

AMOUNT ALLOCABLE TO MASSILLON (If Schedule Y is used,

% of Line 6) ....................................................

AMOUNT SUBJECT TO MUNICIPAL INCOME TAX

8.

..................................................................................................................................

9. MASSILLON TAX DUE - 1.8% of total on Line 8................................................................................................................................................$

10. ESTIMATED PAYMENTS....................................................................................................................................................$

11. PRIOR YEAR OVERPAYMENTS ........................................................................................................................................................................

12. TOTAL CREDITS (Add Lines 10 AND 11) ..........................................................................................................................................................

13. BALANCE OF TAX DUE - (Subtract Line 12 from Line 9)....................................................................................................................................

14. OVERPAYMENT (If Line 12 exceeds Line 9) APPLY REFUND $

OR $

CREDIT

15. LATE FILING PENALTY - ENTER $25.00 FINE ................................................................................................................................................$

16. INTEREST - 1% PER MONTH - EFFECTIVE THE FIRST DAY OF EACH MONTH ........................................................................................$

17.

LATE PAYMENT PENALTY - 1% PER MONTH FOR 1st SIX MONTHS - 2% PER MONTH THEREAFTER ..................................................$

18. TOTAL DUE

(Add Lines 13, 15, 16 and 17) Make check or money order payable to CITY OF MASSILLON INCOME TAX DEPARTMENT

......................$

SCHEDULE X - RECONCILIATION WITH FEDERAL INCOME TAX RETURN

ITEMS NOT DEDUCTIBLE

ADD

ITEMS NOT TAXABLE

DEDUCT

a. Capital Losses (Do not include ordinary losses from Federal Form 4797)........$

n. Capital Gains (Do not include ordinary gains from Federal Form 4797) ..........$

b. Interest and / or Other Expenses incurred in the production of non-taxable

o. Interest earned or accrued ................................................................................

income (at least 6% of Line r) ............................................................................

p. Dividends (Less Federal exclusion)....................................................................

c. Income Taxes, City and State (if Deducted as Expense) ..................................

q. Other items not taxable (explain) ......................................................................

d. Net operating loss deduction per Federal return................................................

............................................................................................................................

e. Payments to partners per Federal Form 1065 ..................................................

............................................................................................................................

f. Retirement plan payments (Keogh, IRA, Tax Sheltered Annuity) ......................

r. Total Deductions ................................................................................................

g. Portion State of Ohio Franchise Tax based on Income ......................................

h. Other items not deductible (explain) ..................................................................

............................................................................................................................

............................................................................................................................

m. Total Additions ....................................................................................................

MANDATORY DECLARATION OF ESTIMATED TAX FOR 2003

1.

TOTAL ESTIMATED EARNINGS FOR 2003 ......................................................................................................................................................$

2.

LINE 1 MULTIPLIED BY 1.8% ............................................................................................................................................................................$

3.

90% OF LINE 2 (MULTIPLY LINE 2 BY .9) ........................................................................................................................................................$

4.

LESS CREDITS FROM TAXES PAID TO OTHER CITIES OR OVERPAYMENT CARRIED FORWARD ..........................$

(ATTACH DOCUMENT SHOWING TAX PAID TO OTHER CITY)

5.

TOTAL ESTIMATED TAX (Line 3 minus Line 4)..................................................................................................................................................$

6.

QUARTERLY ESTIMATE PAYMENTS FOR 2003 (1/4 of Line 5) ......................................................................................................................$

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the same as used for Federal Income

Tax purposes, and if an audit of Federal return is made which affects tax liability shown on this return, an amended return will be filed within 3 months. If this return was prepared by a tax practitioner, may we contact

the practitioner directly with questions regarding the preparation of this return?

Yes

No

Signature

Title

Date

Address of preparer (if other than taxpayer)

Signature of preparer (if other than taxpayer)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2