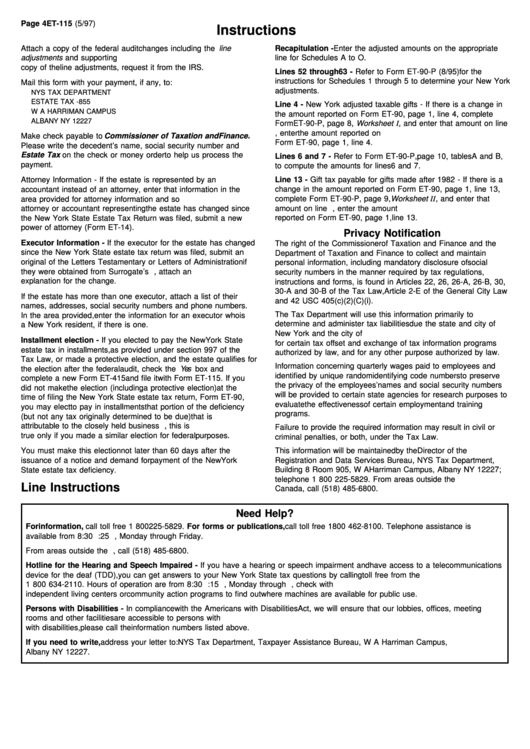

Form Et-115 - New York State Estate Tax Report Of Federal Audit Changes Instructions

ADVERTISEMENT

Page 4

ET-115 (5/97)

Instructions

Attach a copy of the federal audit changes including the line

Recapitulation - Enter the adjusted amounts on the appropriate

adjustments and supporting schedules. If you did not receive a

line for Schedules A to O.

copy of the line adjustments, request it from the IRS.

Lines 52 through 63 - Refer to Form ET-90-P (8/95) for the

instructions for Schedules 1 through 5 to determine your New York

Mail this form with your payment, if any, to:

adjustments.

NYS TAX DEPARTMENT

ESTATE TAX - 855

Line 4 - New York adjusted taxable gifts - If there is a change in

W A HARRIMAN CAMPUS

the amount reported on Form ET-90, page 1, line 4, complete

ALBANY NY 12227

Form ET-90-P, page 8, Worksheet I , and enter that amount on line

4. If there is no change, enter the amount reported on

Make check payable to Commissioner of Taxation and Finance.

Form ET-90, page 1, line 4.

Please write the decedent’s name, social security number and

Estate Tax on the check or money order to help us process the

Lines 6 and 7 - Refer to Form ET-90-P, page 10, tables A and B,

payment.

to compute the amounts for lines 6 and 7.

Line 13 - Gift tax payable for gifts made after 1982 - If there is a

Attorney Information - If the estate is represented by an

change in the amount reported on Form ET-90, page 1, line 13,

accountant instead of an attorney, enter that information in the

complete Form ET-90-P, page 9, Worksheet II , and enter that

area provided for attorney information and so indicate. If the

attorney or accountant representing the estate has changed since

amount on line 13. If there is no change, enter the amount

the New York State Estate Tax Return was filed, submit a new

reported on Form ET-90, page 1, line 13.

power of attorney (Form ET-14).

Privacy Notification

Executor Information - If the executor for the estate has changed

The right of the Commissioner of Taxation and Finance and the

since the New York State estate tax return was filed, submit an

Department of Taxation and Finance to collect and maintain

original of the Letters Testamentary or Letters of Administration if

personal information, including mandatory disclosure of social

they were obtained from Surrogate’s Court. Otherwise, attach an

security numbers in the manner required by tax regulations,

explanation for the change.

instructions and forms, is found in Articles 22, 26, 26-A, 26-B, 30,

30-A and 30-B of the Tax Law, Article 2-E of the General City Law

If the estate has more than one executor, attach a list of their

and 42 USC 405(c)(2)(C)(i).

names, addresses, social security numbers and phone numbers.

The Tax Department will use this information primarily to

In the area provided, enter the information for an executor who is

determine and administer tax liabilities due the state and city of

a New York resident, if there is one.

New York and the city of Yonkers. We will also use this information

Installment election - If you elected to pay the New York State

for certain tax offset and exchange of tax information programs

estate tax in installments, as provided under section 997 of the

authorized by law, and for any other purpose authorized by law.

Tax Law, or made a protective election, and the estate qualifies for

Information concerning quarterly wages paid to employees and

the election after the federal audit, check the Yes box and

identified by unique random identifying code numbers to preserve

complete a new Form ET-415 and file it with Form ET-115. If you

the privacy of the employees’ names and social security numbers

did not make the election (including a protective election) at the

will be provided to certain state agencies for research purposes to

time of filing the New York State estate tax return, Form ET-90,

evaluate the effectiveness of certain employment and training

you may elect to pay in installments that portion of the deficiency

programs.

(but not any tax originally determined to be due) that is

attributable to the closely held business interest. However, this is

Failure to provide the required information may result in civil or

true only if you made a similar election for federal purposes.

criminal penalties, or both, under the Tax Law.

You must make this election not later than 60 days after the

This information will be maintained by the Director of the

issuance of a notice and demand for payment of the New York

Registration and Data Services Bureau, NYS Tax Department,

State estate tax deficiency.

Building 8 Room 905, W A Harriman Campus, Albany NY 12227;

telephone 1 800 225-5829. From areas outside the U.S. and

Line Instructions

Canada, call (518) 485-6800.

Need Help?

For information, call toll free 1 800 225-5829. For forms or publications, call toll free 1 800 462-8100. Telephone assistance is

available from 8:30 a.m. to 4:25 p.m., Monday through Friday.

From areas outside the U.S. and Canada, call (518) 485-6800.

Hotline for the Hearing and Speech Impaired - If you have a hearing or speech impairment and have access to a telecommunications

device for the deaf (TDD), you can get answers to your New York State tax questions by calling toll free from the U.S. and Canada

1 800 634-2110. Hours of operation are from 8:30 a.m. to 4:15 p.m., Monday through Friday. If you do not own a TDD, check with

independent living centers or community action programs to find out where machines are available for public use.

Persons with Disabilities - In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting

rooms and other facilities are accessible to persons with disabilities. If you have questions about special accommodations for persons

with disabilities, please call the information numbers listed above.

If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus,

Albany NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1