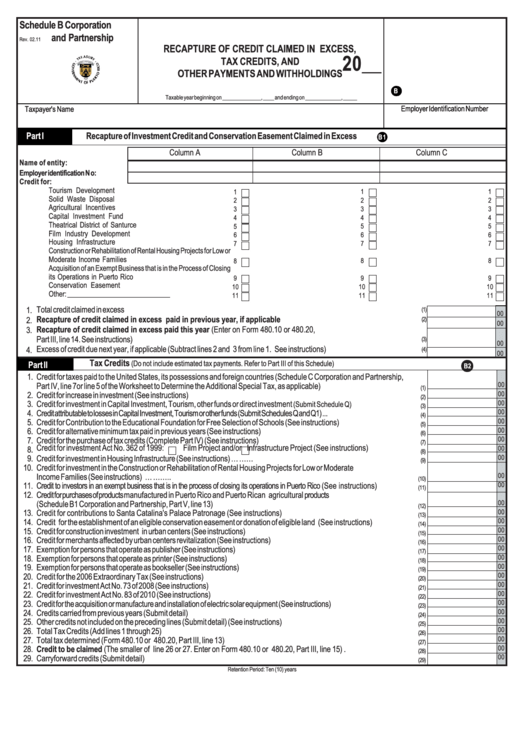

Schedule B Corporation And Partnership - Recapture Of Credit Claimed In Excess, Tax Credits, And Other Payments And Withholdings - 2011

ADVERTISEMENT

Schedule B Corporation

and Partnership

Rev. 02.11

RECAPTURE OF CREDIT CLAIMED IN EXCESS,

20__

TAX CREDITS, AND

OTHER PAYMENTS AND WITHHOLDINGS

B

Taxable year beginning on ______________, ____ and ending on _____________, _____

Employer Identification Number

Taxpayer's Name

Part I

Recapture of Investment Credit and Conservation Easement Claimed in Excess

B1

Column A

Column B

Column C

Name of entity:

Employer identification No:

Credit for:

Tourism Development ..........................................................

.....................................................

.....................................................

1

1

1

Solid Waste Disposal ...........................................................

.....................................................

.....................................................

2

2

2

Agricultural Incentives .........................................................

.....................................................

.....................................................

3

3

3

Capital Investment Fund ......................................................

.....................................................

.....................................................

4

4

4

Theatrical District of Santurce ................................................

.....................................................

.....................................................

5

5

5

Film Industry Development ...................................................

.....................................................

.....................................................

6

6

6

Housing Infrastructure ..........................................................

.....................................................

.....................................................

7

7

7

Construction or Rehabilitation of Rental Housing Projects for Low or

Moderate Income Families ..............................................

.....................................................

.....................................................

8

8

8

Acquisition of an Exempt Business that is in the Process of Closing

its Operations in Puerto Rico ..........................................

.....................................................

.....................................................

9

9

9

Conservation Easement .....................................................

.....................................................

.....................................................

10

10

10

Other: _____________________________................................

.....................................................

.....................................................

11

11

11

Total credit claimed in excess ...................................................................................................................................................

1.

(1)

00

Recapture of credit claimed in excess paid in previous year, if applicable .................................................................

2.

(2)

00

Recapture of credit claimed in excess paid this year (Enter on Form 480.10 or 480.20,

3.

Part III, line 14. See instructions) ..............................................................................................................................................

(3)

00

Excess of credit due next year, if applicable (Subtract lines 2 and 3 from line 1. See instructions) ..........................................

4.

(4)

00

Tax Credits

(Do not include estimated tax payments. Refer to Part III of this Schedule)

Part II

B2

1.

Credit for taxes paid to the United States, its possessions and foreign countries (Schedule C Corporation and Partnership,

Part IV, line 7or line 5 of the Worksheet to Determine the Additional Special Tax, as applicable) ...........................................

00

(1)

2.

Credit for increase in investment (See instructions) ...............................................................................................................

00

(2)

3.

Credit for investment in Capital Investment, Tourism, other funds or direct investment

............................

00

(Submit Schedule Q)

(3)

4.

Credit attributable to losses in Capital Investment, Tourism or other funds (Submit Schedules Q and Q1) ...........................................

00

(4)

5.

Credit for Contribution to the Educational Foundation for Free Selection of Schools (See instructions) ..................................

00

(5)

6.

Credit for alternative minimum tax paid in previous years (See instructions)..........................................................................

00

(6)

7.

Credit for the purchase of tax credits (Complete Part IV) (See instructions) ..........................................................................

00

(7)

8.

Credit for investment Act No. 362 of 1999:

Film Project and/or

Infrastructure Project (See instructions) ..................

00

(8)

9.

Credit for investment in Housing Infrastructure (See instructions) …...............................................................................……

00

(9)

10.

Credit for investment in the Construction or Rehabilitation of Rental Housing Projects for Low or Moderate

Income Families (See instructions) ................................................................…..........................................................……..

00

(10)

11.

Credit to investors in an exempt business that is in the process of closing its operations in Puerto Rico (See instructions) .............

00

(11)

12.

Credit for purchases of products manufactured in Puerto Rico and Puerto Rican agricultural products

(Schedule B1 Corporation and Partnership, Part V, line 13) .................................................................................................

00

(12)

13.

Credit for contributions to Santa Catalina's Palace Patronage (See instructions) ..............................................................

00

(13)

14.

Credit for the establishment of an eligible conservation easement or donation of eligible land (See instructions) ..................

00

(14)

00

15.

Credit for construction investment in urban centers (See instructions) ..................................................................................

(15)

00

16.

Credit for merchants affected by urban centers revitalization (See instructions) .....................................................................

(16)

00

17.

Exemption for persons that operate as publisher (See instructions) .......................................................................................

(17)

00

18.

Exemption for persons that operate as printer (See instructions) ...........................................................................................

(18)

00

19.

Exemption for persons that operate as bookseller (See instructions) .....................................................................................

(19)

00

20.

Credit for the 2006 Extraordinary Tax (See instructions) ......................................................................................................

(20)

00

21.

Credit for investment Act No. 73 of 2008 (See instructions) ......................................................................................................

(21)

00

22.

Credit for investment Act No. 83 of 2010 (See instructions) ...................................................................................................

(22)

00

23.

Credit for the acquisition or manufacture and installation of electric solar equipment (See instructions) ........................................

(23)

00

24.

Credits carried from previous years (Submit detail) ...............................................................................................................

(24)

00

25.

Other credits not included on the preceding lines (Submit detail) (See instructions) ...............................................................

(25)

00

26.

Total Tax Credits (Add lines 1 through 25) ...........................................................................................................................

(26)

00

27.

Total tax determined (Form 480.10 or 480.20, Part III, line 13) ...........................................................................................

(27)

28.

Credit to be claimed (The smaller of line 26 or 27. Enter on Form 480.10 or 480.20, Part III, line 15) ................................

00

(28)

29.

Carryforward credits (Submit detail) .....................................................................................................................................

00

(29)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2