Instructions for Completing the GA-V

Taxes are withheld when wages are paid, not when the payroll period ends.

Form GA-V must be used to submit monthly payments on or before the 15th of the following month. ANY payment

received after the 15th of the following month will be subject to late charges. Do not send penalty or interest with a

payment. If the 15th is a weekend or holiday, the due date is the next business day.

Taxpayers who withhold $500 or more on any one return (quarterly total) must submit payments by Electronic Funds

Transfer (EFT).

Form GA-V is NOT required if no tax is withheld for a particular month or if payment was made via EFT.

Mail this completed form with your payment to:

Processing Center

Georgia Department of Revenue

PO Box 740387

Atlanta, Georgia 30374-0387

Contact the Withholding Tax Unit at 1-877-GADOR11 (1-877-423-6711) if you need additional information or assistance.

PLEASE DO NOT mail this entire page. Please cut along dotted line and mail only voucher and payment.

PLEASE DO NOT STAPLE OR PAPER CLIP. PLEASE REMOVE ALL CHECK STUBS.

Cut on dotted line

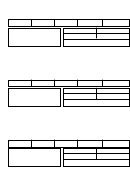

Name and Address:

GA-V

(Rev. 03/23/16)

Withholding Payment Voucher

GA Withholding ID

FEI Number

Tax Period

Due Date

Vendor Code

040

Under penalty of perjury, I declare that this voucher has been examined by

PLEASE DO NOT STAPLE OR PAPER CLIP. REMOVE ALL CHECK STUBS.

me and to the best of my knowledge and belief it is true, correct and

complete.

Signature

Title

Telephone

Date

PROCESSING CENTER

GEORGIA DEPARTMENT OF REVENUE

PO BOX 740387

$

Amount Paid

ATLANTA GA 30374-0387

0010000000000000004000000000003

1

1 2

2