Form Ar1100s - State Of Arkansas S Corporation Income Tax Return - 2016

ADVERTISEMENT

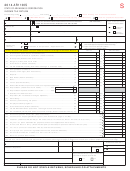

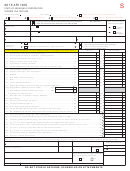

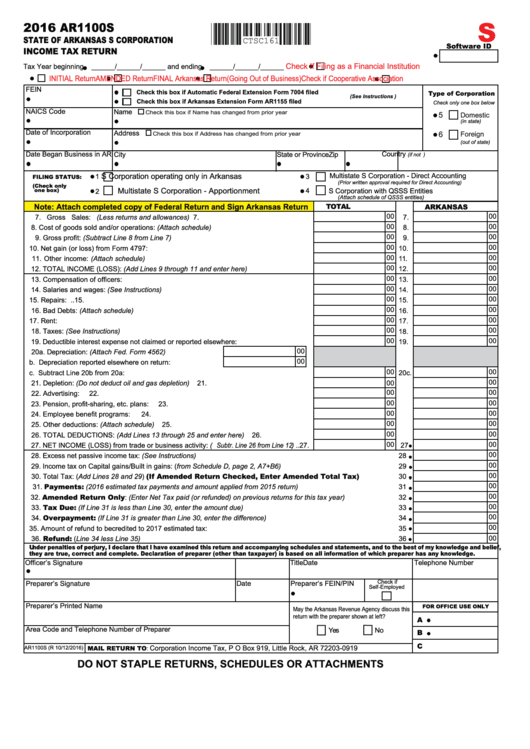

2016 AR1100S

S

CTSC161

STATE OF ARKANSAS S CORPORATION

Software ID

INCOME TAX RETURN

Check If Filing as a Financial Institution

Tax Year beginning

______/______/______ and ending

______/______/______

INITIAL Return

AMENDED Return

FINAL Arkansas Return(Going Out of Business)

Check if Cooperative Association

FEIN

&KHFN WKLV ER[ LI $XWRPDWLF )HGHUDO ([WHQVLRQ )RUP ¿OHG

Type of Corporation

(See Instructions )

&KHFN WKLV ER[ LI $UNDQVDV ([WHQVLRQ )RUP $5 ¿OHG

Check only one box below

NAICS Code

Name

Check this box if Name has changed from prior year

5

Domestic

(in state)

Date of Incorporation

Address

Check this box if Address has changed from prior year

6

Foreign

(out of state)

Date Began Business in AR

Country

City

State or Province

Zip

(if not U.S.)

0XOWLVWDWH 6 &RUSRUDWLRQ 'LUHFW $FFRXQWLQJ

S Corporation operating only in Arkansas

1

3

FILING STATUS:

(Prior written approval required for Direct Accounting)

(Check only

0XOWLVWDWH 6 &RUSRUDWLRQ $SSRUWLRQPHQW

one box)

4

S Corporation with QSSS Entities

2

(Attach schedule of QSSS entities)

Note: Attach completed copy of Federal Return and Sign Arkansas Return

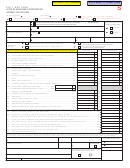

TOTAL

ARKANSAS

00

00

7.

Gross Sales: (Less returns and allowances) ............................................................. 7.

7.

00

00

8.

Cost of goods sold and/or operations: (Attach schedule) .......................................... 8.

8.

00

00

*URVV SUR¿W

(Subtract Line 8 from Line 7) ................................................................ 9.

9.

00

00

10.

Net gain (or loss) from Form 4797: ......................................................................... 10.

10.

00

00

11.

11.

Other income: (Attach schedule) ............................................................................. 11.

00

00

12.

TOTAL INCOME (LOSS): (Add Lines 9 through 11 and enter here) ....................... 12.

12.

00

00

&RPSHQVDWLRQ RI RI¿FHUV

........................................................................................ 13.

13.

00

00

14.

Salaries and wages: (See Instructions) ................................................................... 14.

14.

00

00

15.

Repairs: ...................................................................................................................15.

15.

00

00

16.

Bad Debts: (Attach schedule) .................................................................................. 16.

16.

00

00

17.

Rent: ........................................................................................................................17.

17.

00

00

18.

Taxes: (See Instructions) ......................................................................................... 18.

18.

00

00

19.

Deductible interest expense not claimed or reported elsewhere: ............................ 19.

19.

00

20a. Depreciation: (Attach Fed. Form 4562)......................20a.

00

b. Depreciation reported elsewhere on return:...............20b.

00

00

c. Subtract Line 20b from 20a: ...................................................................................20c.

20c.

00

21.

Depletion: (Do not deduct oil and gas depletion) .................................................... 21.

00

21.

00

00

22.

Advertising: ..............................................................................................................22.

22.

00

00

3HQVLRQ SUR¿WVKDULQJ HWF SODQV

.......................................................................... 23.

23.

00

00

(PSOR\HH EHQH¿W SURJUDPV

................................................................................... 24.

24.

00

00

25.

Other deductions: (Attach schedule) ....................................................................... 25.

25.

00

00

26.

TOTAL DEDUCTIONS: (Add Lines 13 through 25 and enter here) ........................ 26.

26.

00

00

27. NET INCOME (LOSS) from trade or business activity: (Subtr. Line 26 from Line 12) ..27.

27

00

28.

Excess net passive income tax: (See Instructions).......................................................................................................

28

00

29.

Income tax on Capital gains/Built in gains: (from Schedule D, page 2, A7+B6)...........................................................

29

00

30.

Total Tax: (Add Lines 28 and 29) (If Amended Return Checked, Enter Amended Total Tax)..................

30

00

31.

Payments: (2016 estimated tax payments and amount applied from 2015 return)...................................................

31

00

32.

Amended Return Only: (Enter Net Tax paid (or refunded) on previous returns for this tax year)..........................

32

00

33.

Tax Due: (If Line 31 is less than Line 30, enter the amount due)...............................................................................

33

00

34.

Overpayment: (If Line 31 is greater than Line 30, enter the difference)...................................................................

34

00

35.

Amount of refund to be credited to 2017 estimated tax:...............................................................................................

35

36.

Refund: (Line 34 less Line 35)....................................................................................................................................

36

00

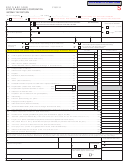

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

2I¿FHU¶V 6LJQDWXUH

Telephone Number

Date

Title

Check if

Date

3UHSDUHU¶V )(,13,1

3UHSDUHU¶V 6LJQDWXUH

6HOI(PSOR\HG

3UHSDUHU¶V 3ULQWHG 1DPH

FOR OFFICE USE ONLY

May the Arkansas Revenue Agency discuss this

return with the preparer shown at left?

A

Area Code and Telephone Number of Preparer

Yes

No

B

C

&RUSRUDWLRQ ,QFRPH 7D[ 3 2 %R[

/LWWOH 5RFN $5

AR1100S (R 10/12/2016)

MAIL RETURN TO:

DO NOT STAPLE RETURNS, SCHEDULES OR ATTACHMENTS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2