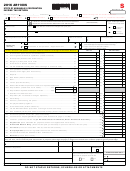

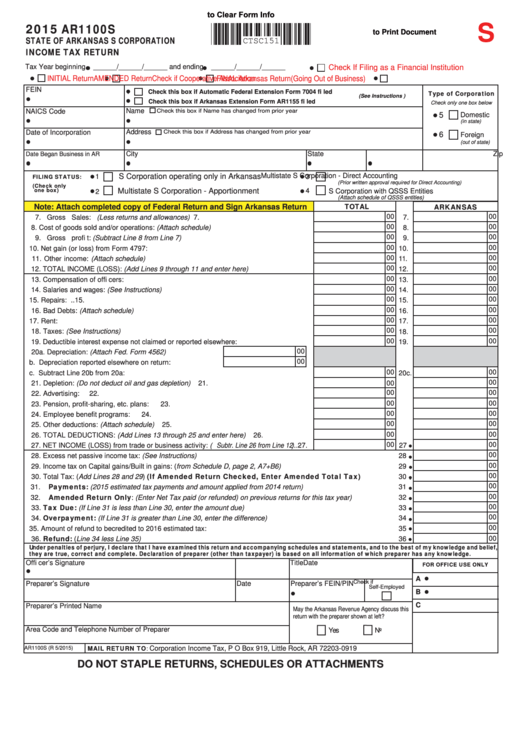

Click Here to Clear Form Info

S

2015

AR1100S

Click Here to Print Document

STATE OF ARKANSAS S CORPORATION

CTSC151

INCOME TAX RETURN

Tax Year beginning

______/______/______ and ending

______/______/______

Check If Filing as a Financial Institution

INITIAL Return

AMENDED Return

FINAL Arkansas Return(Going Out of Business)

Check if Cooperative Association

FEIN

Check this box if Automatic Federal Extension Form 7004 fi led

Type of Corporation

(See Instructions )

Check this box if Arkansas Extension Form AR1155 fi led

Check only one box below

NAICS Code

Name

Check this box if Name has changed from prior year

5

Domestic

(in state)

Address

Check this box if Address has changed from prior year

Date of Incorporation

6

Foreign

(out of state)

City

State

Zip

Telephone Number

Date Began Business in AR

FILING STATUS:

S Corporation operating only in Arkansas

Multistate S Corporation - Direct Accounting

3

1

(Prior written approval required for Direct Accounting)

(Check only

one box)

Multistate S Corporation - Apportionment

4

S Corporation with QSSS Entities

2

(Attach schedule of QSSS entities)

TOTAL

ARKANSAS

Note: Attach completed copy of Federal Return and Sign Arkansas Return

00

00

7.

Gross Sales: (Less returns and allowances) .............................................................7.

7.

00

00

8.

Cost of goods sold and/or operations: (Attach schedule).......................................... 8.

8.

00

00

9.

Gross profi t: (Subtract Line 8 from Line 7) ................................................................ 9.

9.

00

00

10.

Net gain (or loss) from Form 4797: ......................................................................... 10.

10.

00

00

11.

11.

Other income: (Attach schedule) ............................................................................. 11.

00

00

12.

TOTAL INCOME (LOSS): (Add Lines 9 through 11 and enter here) ....................... 12.

12.

00

00

13.

Compensation of offi cers: ........................................................................................ 13.

13.

00

00

14.

Salaries and wages: (See Instructions) ................................................................... 14.

14.

00

00

15.

Repairs: ................................................................................................................... 15.

15.

00

00

16.

Bad Debts: (Attach schedule).................................................................................. 16.

16.

00

00

17.

Rent: ........................................................................................................................ 17.

17.

00

00

18.

Taxes: (See Instructions) ......................................................................................... 18.

18.

00

00

19.

Deductible interest expense not claimed or reported elsewhere: ............................ 19.

19.

00

20a. Depreciation: (Attach Fed. Form 4562)......................20a.

00

b. Depreciation reported elsewhere on return:...............20b.

00

00

c. Subtract Line 20b from 20a: ...................................................................................20c.

20c.

00

21.

Depletion: (Do not deduct oil and gas depletion) .................................................... 21.

00

21.

00

00

22.

Advertising: .............................................................................................................. 22.

22.

00

00

23.

Pension, profi t-sharing, etc. plans: .......................................................................... 23.

23.

00

00

24.

Employee benefi t programs: ................................................................................... 24.

24.

00

00

25.

Other deductions: (Attach schedule) ....................................................................... 25.

25.

00

00

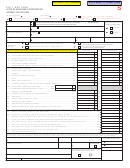

26.

TOTAL DEDUCTIONS: (Add Lines 13 through 25 and enter here) ........................ 26.

26.

00

00

27. NET INCOME (LOSS) from trade or business activity: (Subtr. Line 26 from Line 12)..27.

27

00

28.

Excess net passive income tax: (See Instructions).......................................................................................................

28

00

29.

Income tax on Capital gains/Built in gains: (from Schedule D, page 2, A7+B6)...........................................................

29

Total Tax: (Add Lines 28 and 29) (If Amended Return Checked, Enter Amended Total Tax)..................

00

30.

30

Payments: (2015 estimated tax payments and amount applied from 2014 return)...................................................

00

31.

31

Amended Return Only: (Enter Net Tax paid (or refunded) on previous returns for this tax year)..........................

00

32.

32

Tax Due: (If Line 31 is less than Line 30, enter the amount due)...............................................................................

00

33.

33

Overpayment: (If Line 31 is greater than Line 30, enter the difference)...................................................................

00

34.

34

00

35.

Amount of refund to be credited to 2016 estimated tax:..................................................................................

35

Refund: (Line 34 less Line 35)....................................................................................................................................

00

36.

36

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Offi cer’s Signature

Date

Title

FOR OFFICE USE ONLY

A

Check if

Preparer’s Signature

Date

Preparer’s FEIN/PIN

Self-Employed

B

C

Preparer’s Printed Name

May the Arkansas Revenue Agency discuss this

return with the preparer shown at left?

Area Code and Telephone Number of Preparer

Yes

No

MAIL RETURN TO:

Corporation Income Tax, P O Box 919, Little Rock, AR 72203-0919

AR1100S (R 5/2015)

DO NOT STAPLE RETURNS, SCHEDULES OR ATTACHMENTS

1

1 2

2