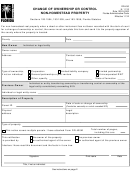

Form 5498-Sa - Hsa, Archer Msa, Or Medicare Advantage Msa Information - 2012 Page 3

ADVERTISEMENT

Instructions for Participant

However, the issuer has reported your complete identification number to the

IRS, and, where applicable, to state and/or local governments.

This information is submitted to the Internal Revenue Service by the trustee of

Account number. May show an account or other unique number the trustee

your health savings account (HSA), Archer MSA, or Medicare Advantage MSA

assigned to distinguish your account.

(MA MSA).

Box 1. Shows contributions you made to your Archer MSA in 2012 and through

Generally, contributions you make to your Archer MSA are deductible.

April 15, 2013, for 2012. You may be able to deduct this amount on your 2012

Employer contributions are excluded from your income and are not deductible

Form 1040. See the Form 1040 instructions.

by you. If your employer makes a contribution to one of your Archer MSAs, you

Note. The information in boxes 2 and 3 is provided for IRS use only.

cannot contribute to any Archer MSA for that year. If you made a contribution to

Box 2. Shows the total contributions made in 2012 to your HSA or Archer MSA.

your Archer MSA when your employer has contributed, you cannot deduct your

See Pub. 969 for who can make contributions. This includes qualified HSA

contribution, and you will have an excess contribution. If your spouse’s

funding distributions (trustee-to-trustee transfers) from your IRA to fund your

employer makes a contribution to your spouse’s Archer MSA, you cannot make

HSA. The trustee of your MA MSA is not required to, but may, show

a contribution to your Archer MSA if your spouse is covered under a high

contributions to your MA MSA.

deductible health plan that also covers you.

Box 3. Shows the total HSA or Archer MSA contributions made in 2013 for

Contributions that the Social Security Administration makes to your MA MSA

2012.

are not includible in your gross income nor are they deductible. Neither you nor

your employer can make contributions to your MA MSA.

Box 4. Shows any rollover contribution from an Archer MSA to this Archer MSA

in 2012 or any rollover from an HSA or Archer MSA to this HSA. See Form 8853

Generally, contributions you or someone other than your employer make to

or Form 8889 and their instructions for information about how to report

your HSA are deductible on your tax return. Employer contributions to your HSA

distributions. This amount is not included in box 1, 2, or 3.

may be excluded from your income and are not deductible by you. You and your

employer can make contributions to your HSA in the same year.

Box 5. Shows the fair market value of your HSA, Archer MSA, or MA MSA at the

end of 2012.

See Form 8853 and its instructions or Form 8889 and its instructions. Any

employer contributions made to an Archer MSA are shown on your Form W-2 in

Box 6. Shows the type of account that is reported on this Form 5498-SA.

box 12 (code R); employer contributions made to an HSA are shown in box 12

Other information. The trustee of your HSA, Archer MSA, or MA MSA may

(code W). For more information, see Pub. 969.

provide other information about your account on this form.

Participant's identification number. For your protection, this form may show

Note. Do not attach Form 5498-SA to your income tax return. Instead, keep it

only the last four digits of your social security number (SSN), individual taxpayer

for your records.

identification number (ITIN), or adoption taxpayer identification number (ATIN).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5