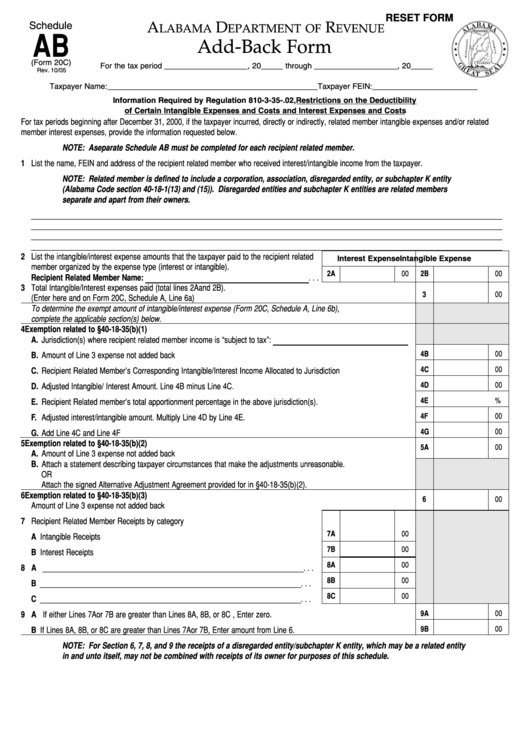

Form 20c - Schedule Ab - Add-Back Form With Instructions - 2005

ADVERTISEMENT

RESET FORM

A

D

R

Schedule

LABAMA

EPARTMENT OF

EVENUE

AB

Add-Back Form

(Form 20C)

For the tax period ___________________, 20_____ through ___________________, 20_____

Rev. 10/05

Taxpayer Name: ________________________________________________ Taxpayer FEIN: ________________________

Information Required by Regulation 810-3-35-.02, Restrictions on the Deductibility

of Certain Intangible Expenses and Costs and Interest Expenses and Costs

For tax periods beginning after December 31, 2000, if the taxpayer incurred, directly or indirectly, related member intangible expenses and/or related

member interest expenses, provide the information requested below.

NOTE: A separate Schedule AB must be completed for each recipient related member.

1 List the name, FEIN and address of the recipient related member who received interest/intangible income from the taxpayer.

NOTE: Related member is defined to include a corporation, association, disregarded entity, or subchapter K entity

(Alabama Code section 40-18-1(13) and (15)). Disregarded entities and subchapter K entities are related members

separate and apart from their owners.

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________

2 List the intangible/interest expense amounts that the taxpayer paid to the recipient related

Interest Expense

Intangible Expense

member organized by the expense type (interest or intangible).

_______________________

2A

00

2B

00

Recipient Related Member Name:

. . .

3 Total Intangible/Interest expenses paid (total lines 2A and 2B).

3

00

(Enter here and on Form 20C, Schedule A, Line 6a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

To determine the exempt amount of intangible/interest expense (Form 20C, Schedule A, Line 6b),

complete the applicable section(s) below.

4 Exemption related to §40-18-35(b)(1)

___________________

A. Jurisdiction(s) where recipient related member income is “subject to tax”:

4B

00

B. Amount of Line 3 expense not added back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4C

00

C. Recipient Related Member’s Corresponding Intangible/Interest Income Allocated to Jurisdiction . . . . . . . . . . . . . . . . . .

4D

00

D. Adjusted Intangible/ Interest Amount. Line 4B minus Line 4C. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4E

%

E. Recipient Related member’s total apportionment percentage in the above jurisdiction(s). . . . . . . . . . . . . . . . . . . . . . . .

4F

00

F. Adjusted interest/intangible amount. Multiply Line 4D by Line 4E. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4G

00

G. Add Line 4C and Line 4F . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Exemption related to §40-18-35(b)(2)

5A

00

A. Amount of Line 3 expense not added back. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B. Attach a statement describing taxpayer circumstances that make the adjustments unreasonable.

OR

Attach the signed Alternative Adjustment Agreement provided for in §40-18-35(b)(2).

6 Exemption related to §40-18-35(b)(3)

6

00

Amount of Line 3 expense not added back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Recipient Related Member Receipts by category

7A

00

A Intangible Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7B

00

B Interest Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8A

00

8 A ___________________________________________________________________ . . .

8B

00

B ___________________________________________________________________ . . .

8C

00

C ___________________________________________________________________ . . .

9A

00

9 A If either Lines 7A or 7B are greater than Lines 8A, 8B, or 8C , Enter zero. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9B

00

B If Lines 8A, 8B, or 8C are greater than Lines 7A or 7B, Enter amount from Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: For Section 6, 7, 8, and 9 the receipts of a disregarded entity/subchapter K entity, which may be a related entity

in and unto itself, may not be combined with receipts of its owner for purposes of this schedule.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2