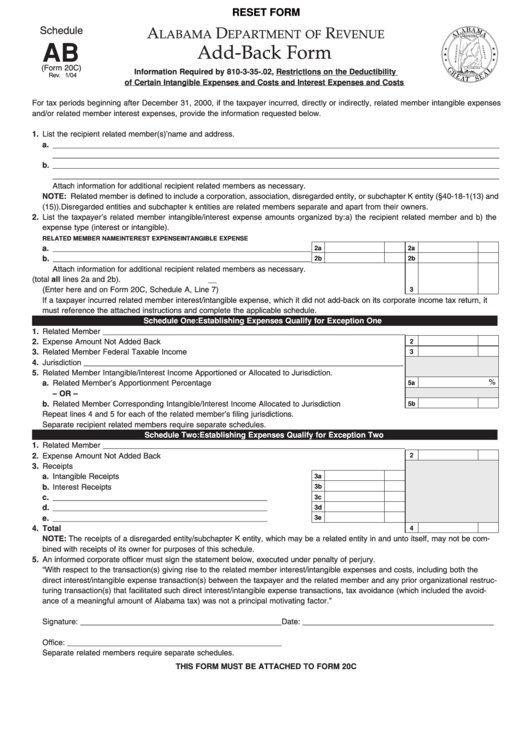

RESET FORM

Schedule

A

D

R

LABAMA

EPARTMENT OF

EVENUE

AB

Add-Back Form

(Form 20C)

Information Required by 810-3-35-.02, Restrictions on the Deductibility

Rev. 1/04

of Certain Intangible Expenses and Costs and Interest Expenses and Costs

For tax periods beginning after December 31, 2000, if the taxpayer incurred, directly or indirectly, related member intangible expenses

and/or related member interest expenses, provide the information requested below.

1. List the recipient related member(s)’ name and address.

a. ______________________________________________________________________________________________________

______________________________________________________________________________________________________

b. ______________________________________________________________________________________________________

______________________________________________________________________________________________________

Attach information for additional recipient related members as necessary.

NOTE: Related member is defined to include a corporation, association, disregarded entity, or subchapter K entity (§40-18-1(13) and

(15)). Disregarded entities and subchapter k entities are related members separate and apart from their owners.

2. List the taxpayer’s related member intangible/interest expense amounts organized by: a) the recipient related member and b) the

expense type (interest or intangible).

RELATED MEMBER NAME

INTEREST EXPENSE

INTANGIBLE EXPENSE

2a

2a

a. ___________________________________________________________

2b

2b

b. ___________________________________________________________

Attach information for additional recipient related members as necessary.

3. Total interest/intangible expenses paid (total all lines 2a and 2b).

3

(Enter here and on Form 20C, Schedule A, Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If a taxpayer incurred related member interest/intangible expense, which it did not add-back on its corporate income tax return, it

must reference the attached instructions and complete the applicable schedule.

Schedule One: Establishing Expenses Qualify for Exception One

1. Related Member _____________________________________________________________________

2

2. Expense Amount Not Added Back. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Related Member Federal Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Jurisdiction _________________________________________________________________________

5. Related Member Intangible/Interest Income Apportioned or Allocated to Jurisdiction.

%

5a

a. Related Member’s Apportionment Percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

– OR –

5b

b. Related Member Corresponding Intangible/Interest Income Allocated to Jurisdiction . . . . . . . . . . . . . .

Repeat lines 4 and 5 for each of the related member’s filing jurisdictions.

Separate recipient related members require separate schedules.

Schedule Two: Establishing Expenses Qualify for Exception Two

1. Related Member _____________________________________________________________________

2

2. Expense Amount Not Added Back. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Receipts

3a

a. Intangible Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b

b. Interest Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3c

c. _________________________________________________ . . . . . . . . . .

3d

d. _________________________________________________ . . . . . . . . . .

3e

e. _________________________________________________ . . . . . . . . . .

4

4. Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: The receipts of a disregarded entity/subchapter K entity, which may be a related entity in and unto itself, may not be com-

bined with receipts of its owner for purposes of this schedule.

5. An informed corporate officer must sign the statement below, executed under penalty of perjury.

“With respect to the transaction(s) giving rise to the related member interest/intangible expenses and costs, including both the

direct interest/intangible expense transaction(s) between the taxpayer and the related member and any prior organizational restruc-

turing transaction(s) that facilitated such direct interest/intangible expense transactions, tax avoidance (which included the avoid-

ance of a meaningful amount of Alabama tax) was not a principal motivating factor.”

Signature: ______________________________________________

Date: ____________________________________________

Office: _________________________________________________

Separate related members require separate schedules.

THIS FORM MUST BE ATTACHED TO FORM 20C

1

1 2

2