REQUIRED - AUTHORIZATION TO CHARGE CREDIT CARD (IN THE EVENT OF NON-PAYMENT OF PREMIUM)

Bond Services, LLC does business with quality Surety Companies who require that premiums be paid within 45 days after issuance of any bond(s) and

within 45 days after date of renewal each year until we are furnished, by you or your attorney, with a discharge or other final judgment exonerating the bond or

surety in this matter. The credit card number may be checked for validity before issuance of the bond. No charge will be made unless or until non-payment of

premium as described below.

Bond Services, LLC will hold this authorization information on file until there is a non-payment of premium through normal means of billing practice. If,

after a billing cycle of 30 days from the date of issuance of the bond (specifically the date of execution on the bond form), premium is not received in this office

by close of business on the 30th day, then you authorize us to charge the card below for 'premium(s) due'.

Once the 'premium(s) due' becomes 31 days late, the card number below may be used to pay the premium for the bond or service which was provided

to you by Bond Services, LLC at 20325 N. 51st Ave., Suite 134, Glendale, AZ 85308.

Applicant agrees that Bond Services, LLC may pursue all avenues of collection, including use of collection agencies, and authorizes Bond Services, LLC

to submit credit card charges using the charge card listed below to recover all payments due and all other unpaid amounts due to non-payment of premium.

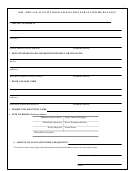

Card Type:

VISA

M/C

Card No:

Exp Date:

__________________________________

I hereby declare that I am the holder of the above credit card, or have been authorized by the holder of said card, to use it to pay premium(s) or services

provided by Bond Services, LLC. I also understand that this credit card may be charged for any future invoice renewal premiums that become more than (30)

days past due as described above.

Name on Card:

Card Holder Signature:

Date:

____________________________

_____________________________

INDEMNITORS ACKNOWLEDGE AND AGREE THAT: THE FIRST YEAR PREMIUM IS FULLY-EARNED WHEN THE BOND IS ISSUED EVEN IF THE

BOND IS SUBSEQUENTLY REDUCED OR TERMINATED DURING THE FIRST YEAR. IF A BOND IS REDUCED OR TERMINATED DURING THE

SECOND OR SUBSEQUENT YEAR AFTER A RENEWAL PREMIUM IS PAID, THE RENEWAL PREMIUM SHALL BE ADJUSTED PRO RATA UPON

REDUCTION OR TERMINATION

INDEMNITY AGREEMENT

The Indemnitors represent that all statements made in this Application and in any Application Supplement are true and made without reservation to induce the

Surety and its successors, assigns, co-sureties and reinsurers, severally not jointly, and/or for which surety business is underwritten by the Surety to extend

surety credit in any manner, included but not limited to providing or having provided the requested Bond and such other Bond or Bonds as may now or

hereafter be required by or on behalf of the Indemnitor.

Indemnitors hereby agree as follows:

(1) to pay all premiums when due;

(2) to deliver evidence satisfactory to Surety, of the release of all liability;

(3) to exonerate and Indemnify Surety from and against all claims, losses, liability damages of any type (including punitive damages), costs, fees,

expenses, suits, orders, judgments, or adjudications whatsoever which Surety may incur in connection with the extension of surety credit, including

the enforcement of the agreements contained herein (collectively “LOSS”);

(4) that Surety shall have the right, at its sole discretion, to pay, adjust, settle or compromise any LOSS and the voucher or other evidence of such payment,

settlement or compromise, whether Surety was liable therefore or not, shall be prima facie evidence of the Indemnitors’ liability;

(5) to pay the Surety immediately upon demand, in the amount Surety deems necessary to protect the Surety from any LOSS or potential LOSS, whether

or not Surety has made payment or posted a reserve, Surety having the right to use all or part of these funds in payment or settlement of any LOSS or

in reimbursement to Surety for payment of same;

(6) that Indemnitors hereby authorize Surety to investigate statements made herein and to check credit with creditors, credit reporting agencies and/or

lending institutions, and further authorize any present or former employer, or any other person, firm or corporation, to furnish information concerning

Indemnitors in connection with the Surety’s extension of surety credit and with Indemnitors’ compliance with obligations hereunder and under any bond or

underlying obligation, and Indemnitors hereby release any of the aforementioned from liability in consequence of furnishing or disclosing such information;

(7) that Surety may bring separate suits to recover hereunder as causes of action shall accrue and that the bringing of suit or recovery of judgment upon any

cause of action shall not prejudice or bar the bringing of other suits upon other causes of action, whether heretofore or thereafter arising;

(8) that any and all other rights which Surety may have or acquire against Indemnitors under other or additional agreements (along with this Agreement

collectively “INDEMNITY”) related to the extension of surety credit, shall be in addition to and not in lieu of the rights afforded Surety under this

Agreement;

(9) that if Surety executes any Bond(s) with any co-surety or reinsures all or any part of Bond(s), that all the terms of this agreement shall apply and

operate for the benefit of such co-surety and reinsurer, as their interest may appear;

(10) that these covenants shall be jointly and severally binding upon Indemnitors, their respective heirs, executors, administrators, successors and assigns;

(11) that Surety shall have the right to decline to issue or to cancel Bond(s) at any time, free of claim for loss or damage by Indemnitors, and Surety shall be

under no obligation to disclose its reasons therefore, the provision of any law to the contrary being hereby waived;

(12) that the exercise , delay of or failure by Surety to exercise any right, remedy or power whatsoever shall not preclude Surety’s simultaneous or subsequent

exercise or constitute any waiver of such or other rights, remedies or power;

(13) if any Bond(s) relate(s) to the assets of an estate, Indemnitors will provide reasonable access to all records concerning the estate and upon request

shall provide a written report of the condition of the estate.

Furthermore, Indemnitors grant, assign, pledge and convey to Surety as security, a lien against and a security interest in and to Indemnitors’ interest, title and

rights in the proceeds of any insurance policy affording coverage for all or part of any bonded obligation, and in contracts or obligations (and all proceeds

thereof without limitation) that grow in any manner whatsoever as a result of the extension of the Surety credit. While the lien and security interest are effective

immediately, Surety may exercise its remedies with respect to such, only in the event: a) Indemnitors’ failure to fulfill any obligation whatsoever for which i)

bond(s) are provided; ii) contained in any bond(s); iii) contained within any INDEMNITY agreement with the surety; and b) any assignment by Indemnitors for

the benefit of creditors or any agreement or proceeding of liquidation, receivership or bankruptcy whatsoever. Indemnitors hereby authorize Surety to file any

such financing statement, as Surety deems necessary or appropriate to perfect the liens and security interest granted herein.

Any person who knowingly and with intent to defraud any insurance company or other person, files an application for a surety bond containing false

information,

or conceals for the purpose of misleading information concerning any fact material thereto, commits a fraudulent insurance act which may subject such person

to criminal and/or civil penalties.

Signed this

day of

20

______________________________________________

_____________________________________________

__________

By:

_________________________________________________________________________________________________________ Indemnitor

2 of 2

1

1 2

2 3

3