Schedule It-20nol (State Form 439) - Corporate Income Tax Indiana Net Operating Loss Deduction Page 2

ADVERTISEMENT

IT-20NOL

Page 2

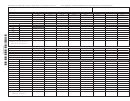

PART 2 — Computation of Indiana Net Operating Loss Deduction and Carryover

Make required entries, as specifi ed to compute the amount of Indiana modifi ed adjusted gross income used. Add all

entries across columns 2, 3, & 4 for each tax year; enter result in column 5. If result is a loss, also enter loss in

column 4 for the next carryover year.

Carryover: Update this schedule for each tax year. Claim the remaining NOL from column 4 as a positive deduction

on your return.

Note: Effective Jan. 1, 2012, a taxpayer is not entitled to carry back any net operating losses after Dec. 31, 2011.

(IC 6-3-2-2.6)

(1)

(2)

(3)

(4)

(5)

Taxable Income

Add Back other Deductions

Indiana Net Operating

Indiana Adjusted Gross

List Tax

as Last Determined

from Indiana Adjusted Gross

Loss Deduction for

Income or Remaining Unused

Period Ending

(if zero or less, enter -0-)

Income in the Taxable Year

the Taxable Year

Net Operating Loss

Carried to the following:

-

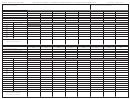

1st year

________

-

2nd year

________

-

3rd year

________

-

4th year

________

-

5th year

________

-

6th year

________

-

7th year

________

-

8th year

________

-

9th year

________

-

10th year

________

-

11th year

________

-

12th year

________

-

13th year

________

-

14th year

________

-

15th year

________

-

16th year

________

-

17th year

________

-

18th year

________

-

19th year

________

-

20th year

________

24100000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2