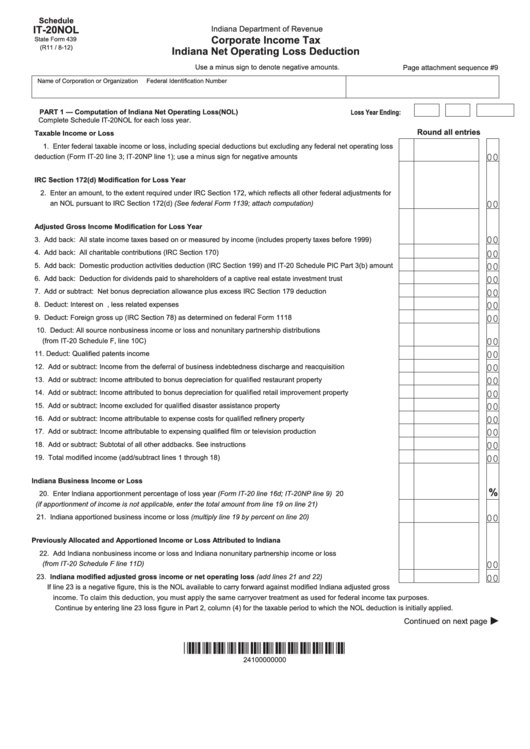

Schedule

IT-20NOL

Indiana Department of Revenue

Corporate Income Tax

State Form 439

(R11 / 8-12)

Indiana Net Operating Loss Deduction

Use a minus sign to denote negative amounts.

Page attachment sequence #9

Name of Corporation or Organization

Federal Identification Number

PART 1 — Computation of Indiana Net Operating Loss (NOL)

Loss Year Ending:

Complete Schedule IT-20NOL for each loss year.

Round all entries

Taxable Income or Loss

1. Enter federal taxable income or loss, including special deductions but excluding any federal net operating loss

00

deduction (Form IT-20 line 3; IT-20NP line 1); use a minus sign for negative amounts ...........................................

1

IRC Section 172(d) Modification for Loss Year

2. Enter an amount, to the extent required under IRC Section 172, which reflects all other federal adjustments for

00

an NOL pursuant to IRC Section 172(d) (See federal Form 1139; attach computation) ..........................................

2

Adjusted Gross Income Modification for Loss Year

00

3. Add back: All state income taxes based on or measured by income (includes property taxes before 1999) ..........

3

00

4. Add back: All charitable contributions (IRC Section 170) ........................................................................................

4

00

5. Add back: Domestic production activities deduction (IRC Section 199) and IT-20 Schedule PIC Part 3(b) amount ....

5

00

6. Add back: Deduction for dividends paid to shareholders of a captive real estate investment trust .........................

6

00

7. Add or subtract: Net bonus depreciation allowance plus excess IRC Section 179 deduction ................................

7

00

8. Deduct: Interest on U.S. government obligations, less related expenses ................................................................

8

00

9. Deduct: Foreign gross up (IRC Section 78) as determined on federal Form 1118 ...................................................

9

10. Deduct: All source nonbusiness income or loss and nonunitary partnership distributions

00

(from IT-20 Schedule F, line 10C) ............................................................................................................................. 10

00

11. Deduct: Qualified patents income ............................................................................................................................ 11

00

12. Add or subtract: Income from the deferral of business indebtedness discharge and reacquisition ......................... 12

00

13. Add or subtract: Income attributed to bonus depreciation for qualified restaurant property ..................................... 13

00

14. Add or subtract: Income attributed to bonus depreciation for qualified retail improvement property ....................... 14

00

15. Add or subtract: Income excluded for qualified disaster assistance property .......................................................... 15

00

16. Add or subtract: Income attributable to expense costs for qualified refinery property .............................................. 16

00

17. Add or subtract: Income attributable to expensing qualified film or television production ........................................ 17

00

18. Add or subtract: Subtotal of all other addbacks. See instructions ............................................................................ 18

00

19. Total modified income (add/subtract lines 1 through 18) .......................................................................................... 19

Indiana Business Income or Loss

%

20. Enter Indiana apportionment percentage of loss year (Form IT-20 line 16d; IT-20NP line 9) ................................... 20

(if apportionment of income is not applicable, enter the total amount from line 19 on line 21)

00

21. Indiana apportioned business income or loss (multiply line 19 by percent on line 20) ............................................. 21

Previously Allocated and Apportioned Income or Loss Attributed to Indiana

22. Add Indiana nonbusiness income or loss and Indiana nonunitary partnership income or loss

00

(from IT-20 Schedule F line 11D) .............................................................................................................................. 22

00

23. Indiana modified adjusted gross income or net operating loss (add lines 21 and 22) ..................................... 23

If line 23 is a negative figure, this is the NOL available to carry forward against modified Indiana adjusted gross

income. To claim this deduction, you must apply the same carryover treatment as used for federal income tax purposes.

Continue by entering line 23 loss figure in Part 2, column (4) for the taxable period to which the NOL deduction is initially applied.

Continued on next page

*24100000000*

24100000000

1

1 2

2