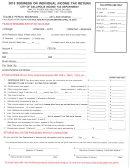

City of Montgomery Individual Income Tax Return 2015

Page 2

To be completed only by those who have taxable income other than wages.

15.

Income not reported on W-2 form(s) or Schedule C (attach 1099-MISC or federal forms/schedules) …………………..……$

16.

Net profit (loss) from profession and/or business operation: Attach Federal Schedule C ............. $

17.

Net profit (loss) from rents*, partnership(s), farming, estates, trusts, etc.

Attach copy of Federal Schedule(s) E, F, and Form(s) K-1 ......................................................... $

*If rental property is located within the City of Montgomery, a current tenant listing must accompany this tax filing.

A tenant listing includes name, address, move in/move out date, and phone number, if available.

18.

Total net profit (loss) from business activities: Line 16 plus Line 17 .............................................. $

19.

Business loss total from previous tax returns: Limited to five (5) prior years ................................. $(

)

Note: Losses from business activities may not be used as a deduction from W-2 wages or other compensation

20.

Subtotal Line 18 and Line 19

a. If the result is a loss, enter the amount to be carried forward… ……….……………………….…$(

)

b. If the result is a gain, enter the amount on this line……………………………………………………………………………….$

21.

Net other taxable income: (Line 15 plus Line 20b) Enter on Line 4, Page 1……………………………………………………….$

Exemptions from filing: Any person under 18 years of age who has not previously filed a return and has no earned income; or any retired person

who has previously filed a return establishing retired status with the City’s tax office and who will continue to have no earned income.

Instructions

(For complete line-by-line instructions in more detail, visit our website at and click on Tax Forms)

This form is to be used by individuals who receive income reported on Federal Forms W-2, W-2G, Form 5754, 1099-MISC, or

Federal Schedules C, E, F or K-1. Individuals who file as Sole Proprietors of Single Member LLCs should also use this form.

LINE 1:

List total of all qualifying wages from all W-2 forms. “Qualifying” wages: generally includes amounts reported in the Medicare

wage base; and compensation of pre-1986 employees exempt from Medicare solely because of the Medicare grandfathering

provision. Qualifying wages include, but are not limited to: Deferred Compensation i.e. 401(k) and 457(b), deferred

annuity plans and stock options. **Interest, dividends, capital gains, pension/retirement income are not taxable.**

LINE 2:

Deductible expenses: Allowable only on wages taxable to Montgomery. Attach Federal Form 2106 for unreimbursed employee

business expenses included in qualifying wages (Line 1). Moving expense deduction may not be used unless reimbursement is

included in qualifying wages (Line 1). Attach Federal Form 3903 for allowable moving expense deduction.

Income may be pro-rated for residents who move into or out of Montgomery during the current year. It is also necessary to

adjust any credit claimed for other city tax withheld or paid.

LINE 4:

All other taxable income. (From Page 2 - includes Federal 1040, Line 21 income). Gambling winnings are taxable and should

be included on this line. Business losses may not be used to offset W-2 wages or other compensation.

LINE 7c: Credit for tax withheld and paid to another municipality may not exceed 1% of those wages actually taxed. Tax withheld at a

rate higher than 1% must be reduced (e.g., tax paid to Cincinnati divided by 2.1 equals Montgomery credit). If a refund was

issued from another city, please adjust credit accordingly and provide documentation, such as the city tax return or refund

request. No credit is given for county taxes or school district taxes.

LINE 8:

Balance of tax due must accompany return. If paying by credit card, please include full 16-digit card number, expiration

date, and verification code.

LINE 9:

Overpayment will be applied to 2016 estimate unless a refund is requested in writing. By law, all refunds and credits in

excess of $10 are reported to IRS.

LINE 10: Estimate 2016 income: multiply estimated income by 1%. Estimated tax shall be based on preceding full year’s tax liability.

LINE 13a: You may pay the full amount of estimated tax with the filing of this form. First quarter payment of at least 22.5% of amount

calculated on Line 12 must be entered on this line. Subsequent payments due the 15th of June, September and December.

LINE 14: Total of payment accompanying return (Line 6 plus Line 11c).

LINE 15: Enter any taxable income not reported on W-2 form(s). Income reported on 1099-INT, 1099-R and 1099-D is not taxable.

LINE 16: Attach copy of Federal Schedule(s) C. If tax paid to another city, attach copy of other city return.

LINE 17: Attach copy of Federal Schedule(s) E, Schedule F, and/or K-1 form(s). If landlord property is within City of Montgomery,

a listing of current tenants, including name, address, move in/move out date, and phone number, if available, must be

provided for the tax filing to be complete.

LINE 19: Business losses may not be used to offset W-2 wages or other compensation. Operating loss may be carried forward;

maximum period of five years.

LINE 21: Net other taxable income. Enter on Page 1, Line 4.

Examples of deductions that are NOT allowed:

Individual Retirement Account (IRA); Simplified Employee Pension (SEP) plan; Keogh (H.R. 10) Retirement Plan.

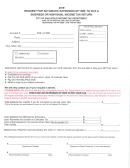

Extension Policy: Extension requests must be received by the Montgomery Tax Office on or before April 18, 2016.

The City of Montgomery Tax Office accepts a copy of the Federal Extension form as an extension request. Only those extension

requests received in duplicate with a self-addressed, postpaid envelope will have a copy returned after being appropriately marked.

Filing an extension does not grant an extension of time to pay. 90% of tax liability is due by December 15, 2016.

Note: Unless accompanied by W-2 form(s), Federal 1040 form and pertinent schedules, payment of the balance of the 2015 tax

declared due (Line 8) and at least 22.5% of the estimated tax for 2016, this form is not a complete legal final return or declaration.

1

1 2

2