Instructions For 2017 Sales, Use And Withholding Taxes Monthly/quarterly Return (Form 5080)

ADVERTISEMENT

2017 Form 5080, Page 2

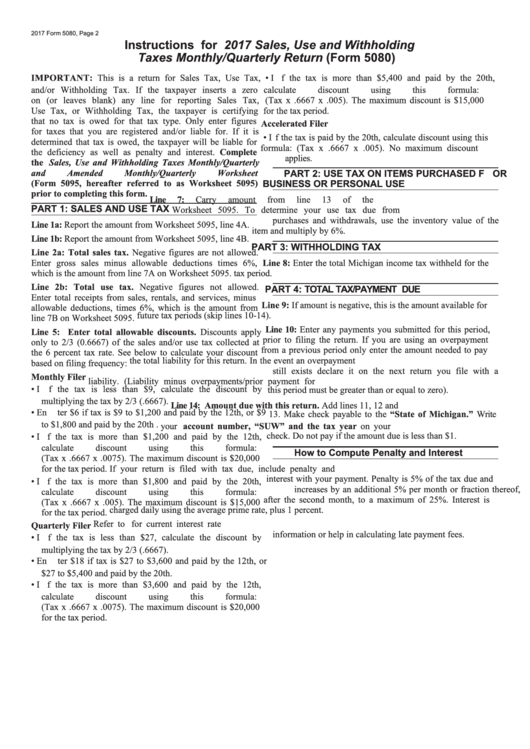

Instructions for 2017 Sales, Use and Withholding

Taxes Monthly/Quarterly Return (form 5080)

IMPORTANT: This is a return for Sales Tax, Use Tax,

• I f the tax is more than $5,400 and paid by the 20th,

and/or Withholding Tax. If the taxpayer inserts a zero

calculate

discount

using

this

formula:

on (or leaves blank) any line for reporting Sales Tax,

(Tax x .6667 x .005). The maximum discount is $15,000

Use Tax, or Withholding Tax, the taxpayer is certifying

for the tax period.

that no tax is owed for that tax type. Only enter figures

Accelerated Filer

for taxes that you are registered and/or liable for. If it is

• I f the tax is paid by the 20th, calculate discount using this

determined that tax is owed, the taxpayer will be liable for

formula: (Tax x .6667 x .005). No maximum discount

the deficiency as well as penalty and interest. Complete

applies.

the Sales, Use and Withholding Taxes Monthly/Quarterly

and

Amended

Monthly/Quarterly

Worksheet

PaRT 2: USE Tax ON ITEMS PURchaSEd f OR

(Form 5095, hereafter referred to as Worksheet 5095)

BUSINESS OR PERSONal USE

prior to completing this form.

Line

7:

Carry

amount

from

line

13

of

the

PaRT 1: SalES aNd USE Tax

Worksheet 5095. To determine your use tax due from

purchases and withdrawals, use the inventory value of the

Line 1a: Report the amount from Worksheet 5095, line 4A.

item and multiply by 6%.

Line 1b: Report the amount from Worksheet 5095, line 4B.

PaRT 3: WIThhOldINg Tax

Line 2a: Total sales tax. Negative figures are not allowed.

Enter gross sales minus allowable deductions times 6%,

Line 8: Enter the total Michigan income tax withheld for the

which is the amount from line 7A on Worksheet 5095.

tax period.

Line 2b: Total use tax. Negative figures not allowed.

PaRT 4: TOTal Tax/PayMENT dUE

Enter total receipts from sales, rentals, and services, minus

Line 9: If amount is negative, this is the amount available for

allowable deductions, times 6%, which is the amount from

future tax periods (skip lines 10-14).

line 7B on Worksheet 5095.

Line 10: Enter any payments you submitted for this period,

Line 5: Enter total allowable discounts. Discounts apply

prior to filing the return. If you are using an overpayment

only to 2/3 (0.6667) of the sales and/or use tax collected at

from a previous period only enter the amount needed to pay

the 6 percent tax rate. See below to calculate your discount

the total liability for this return. In the event an overpayment

based on filing frequency:

still exists declare it on the next return you file with a

Monthly Filer

liability. (Liability minus overpayments/prior payment for

• I f the tax is less than $9, calculate the discount by

this period must be greater than or equal to zero).

multiplying the tax by 2/3 (.6667).

Line 14: Amount due with this return. Add lines 11, 12 and

• En ter $6 if tax is $9 to $1,200 and paid by the 12th, or $9

13. Make check payable to the “State of Michigan.” Write

to $1,800 and paid by the 20th .

your account number, “SUW” and the tax year on your

check. Do not pay if the amount due is less than $1.

• I f the tax is more than $1,200 and paid by the 12th,

calculate

discount

using

this

formula:

how to compute Penalty and Interest

(Tax x .6667 x .0075). The maximum discount is $20,000

for the tax period.

If your return is filed with tax due, include penalty and

interest with your payment. Penalty is 5% of the tax due and

• I f the tax is more than $1,800 and paid by the 20th,

increases by an additional 5% per month or fraction thereof,

calculate

discount

using

this

formula:

after the second month, to a maximum of 25%. Interest is

(Tax x .6667 x .005). The maximum discount is $15,000

charged daily using the average prime rate, plus 1 percent.

for the tax period.

Refer to for current interest rate

Quarterly Filer

information or help in calculating late payment fees.

• I f the tax is less than $27, calculate the discount by

multiplying the tax by 2/3 (.6667).

• En ter $18 if tax is $27 to $3,600 and paid by the 12th, or

$27 to $5,400 and paid by the 20th.

• I f the tax is more than $3,600 and paid by the 12th,

calculate

discount

using

this

formula:

(Tax x .6667 x .0075). The maximum discount is $20,000

for the tax period.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1