Instructions For Form 5082 Sales, Use And Withholding Taxes Amended Annual Return - 2017

ADVERTISEMENT

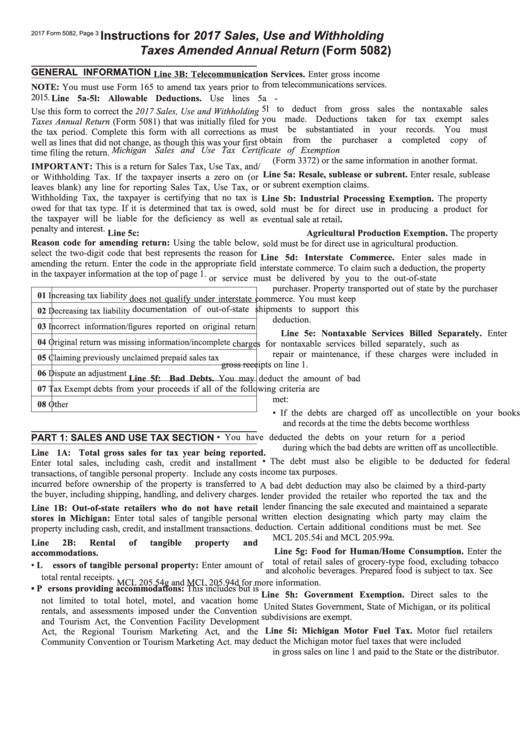

instructions for 2017 Sales, Use and Withholding

2017 Form 5082, Page 3

Taxes Amended Annual Return (form 5082)

gEnERAl infORmATiOn

Line 3B: Telecommunication Services. Enter gross income

from telecommunications services.

NOTE: You must use Form 165 to amend tax years prior to

2015.

Line 5a-5l: Allowable Deductions. Use lines 5a -

5l to deduct from gross sales the nontaxable sales

Use this form to correct the 2017 Sales, Use and Withholding

you made. Deductions taken for tax exempt sales

Taxes Annual Return (Form 5081) that was initially filed for

must be substantiated in your records. You must

the tax period. Complete this form with all corrections as

obtain

from

the

purchaser

a

completed

copy

of

well as lines that did not change, as though this was your first

Michigan Sales and Use Tax Certificate of Exemption

time filing the return.

(Form 3372) or the same information in another format.

IMPORTANT: This is a return for Sales Tax, Use Tax, and/

Line 5a: Resale, sublease or subrent. Enter resale, sublease

or Withholding Tax. If the taxpayer inserts a zero on (or

or subrent exemption claims.

leaves blank) any line for reporting Sales Tax, Use Tax, or

Withholding Tax, the taxpayer is certifying that no tax is

Line 5b: Industrial Processing Exemption. The property

owed for that tax type. If it is determined that tax is owed,

sold must be for direct use in producing a product for

the taxpayer will be liable for the deficiency as well as

eventual sale at retail.

penalty and interest.

Line 5c: Agricultural Production Exemption. The property

Reason code for amending return: Using the table below,

sold must be for direct use in agricultural production.

select the two-digit code that best represents the reason for

Line 5d: Interstate Commerce. Enter sales made in

amending the return. Enter the code in the appropriate field

interstate commerce. To claim such a deduction, the property

in the taxpayer information at the top of page 1.

or service must be delivered by you to the out-of-state

purchaser. Property transported out of state by the purchaser

01

Increasing tax liability

does not qualify under interstate commerce. You must keep

documentation of out-of-state shipments to support this

02

Decreasing tax liability

deduction.

03

Incorrect information/figures reported on original return

Line 5e: Nontaxable Services Billed Separately. Enter

04

Original return was missing information/incomplete

charges for nontaxable services billed separately, such as

repair or maintenance, if these charges were included in

05

Claiming previously unclaimed prepaid sales tax

gross receipts on line 1.

06

Dispute an adjustment

Line 5f: Bad Debts. You may deduct the amount of bad

07

Tax Exempt

debts from your proceeds if all of the following criteria are

met:

08

Other

• If the debts are charged off as uncollectible on your books

and records at the time the debts become worthless

• You have deducted the debts on your return for a period

PART 1: SAlES AnD USE TAx SECTiOn

during which the bad debts are written off as uncollectible.

Line 1A: Total gross sales for tax year being reported.

• The debt must also be eligible to be deducted for federal

Enter total sales, including cash, credit and installment

income tax purposes.

transactions, of tangible personal property. Include any costs

incurred before ownership of the property is transferred to

A bad debt deduction may also be claimed by a third-party

the buyer, including shipping, handling, and delivery charges.

lender provided the retailer who reported the tax and the

lender financing the sale executed and maintained a separate

Line 1B: Out-of-state retailers who do not have retail

written election designating which party may claim the

stores in Michigan: Enter total sales of tangible personal

deduction. Certain additional conditions must be met. See

property including cash, credit, and installment transactions.

MCL 205.54i and MCL 205.99a.

Line

2B:

Rental

of

tangible

property

and

Line 5g: Food for Human/Home Consumption. Enter the

accommodations.

total of retail sales of grocery-type food, excluding tobacco

• L essors of tangible personal property: Enter amount of

and alcoholic beverages. Prepared food is subject to tax. See

total rental receipts.

MCL 205.54g and MCL 205.94d for more information.

• P ersons providing accommodations: This includes but is

Line 5h: Government Exemption. Direct sales to the

not limited to total hotel, motel, and vacation home

United States Government, State of Michigan, or its political

rentals, and assessments imposed under the Convention

subdivisions are exempt.

and Tourism Act, the Convention Facility Development

Line 5i: Michigan Motor Fuel Tax. Motor fuel retailers

Act, the Regional Tourism Marketing Act, and the

may deduct the Michigan motor fuel taxes that were included

Community Convention or Tourism Marketing Act.

in gross sales on line 1 and paid to the State or the distributor.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2