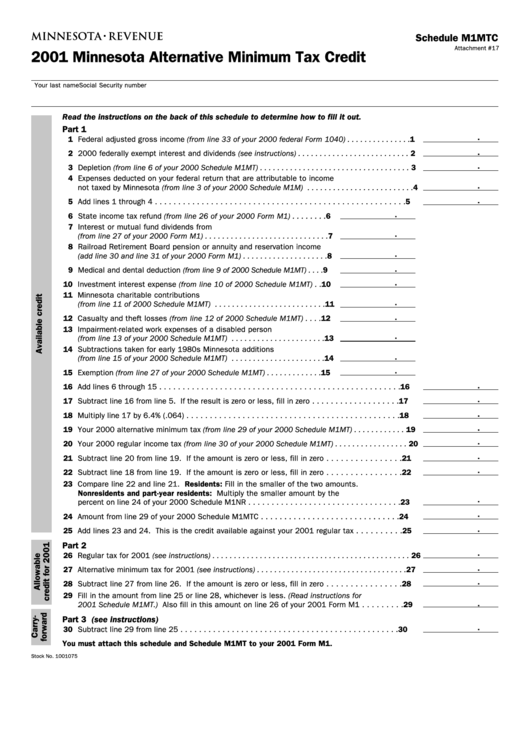

Schedule M1mtc - Attachment #17 To Form M1 - Minnesota Alternative Minimum Tax Credit - 2001

ADVERTISEMENT

Schedule M1MTC

Attachment #17

2001 Minnesota Alternative Minimum Tax Credit

Your last name

Social Security number

Read the instructions on the back of this schedule to determine how to fill it out.

Part 1

.

1 Federal adjusted gross income (from line 33 of your 2000 federal Form 1040) . . . . . . . . . . . . . . . 1

.

2 2000 federally exempt interest and dividends (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.

3 Depletion (from line 6 of your 2000 Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Expenses deducted on your federal return that are attributable to income

.

not taxed by Minnesota (from line 3 of your 2000 Schedule M1M) . . . . . . . . . . . . . . . . . . . . . . . . . 4

.

5 Add lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.

6 State income tax refund (from line 26 of your 2000 Form M1) . . . . . . . . 6

7 Interest or mutual fund dividends from U.S. bonds

.

(from line 27 of your 2000 Form M1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Railroad Retirement Board pension or annuity and reservation income

.

(add line 30 and line 31 of your 2000 Form M1) . . . . . . . . . . . . . . . . . . . . 8

.

9 Medical and dental deduction (from line 9 of 2000 Schedule M1MT) . . . . 9

.

10 Investment interest expense (from line 10 of 2000 Schedule M1MT) . . 10

11 Minnesota charitable contributions

.

(from line 11 of 2000 Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.

12 Casualty and theft losses (from line 12 of 2000 Schedule M1MT) . . . . 12

13 Impairment-related work expenses of a disabled person

.

(from line 13 of your 2000 Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . . 13

14 Subtractions taken for early 1980s Minnesota additions

.

(from line 15 of your 2000 Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . . 14

.

15 Exemption (from line 27 of your 2000 Schedule M1MT) . . . . . . . . . . . . . 15

.

16 Add lines 6 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

.

17 Subtract line 16 from line 5. If the result is zero or less, fill in zero . . . . . . . . . . . . . . . . . . . 17

.

18 Multiply line 17 by 6.4% (.064) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

.

19 Your 2000 alternative minimum tax (from line 29 of your 2000 Schedule M1MT) . . . . . . . . . . . . 19

.

20 Your 2000 regular income tax (from line 30 of your 2000 Schedule M1MT) . . . . . . . . . . . . . . . . . 20

.

21 Subtract line 20 from line 19. If the amount is zero or less, fill in zero . . . . . . . . . . . . . . . . 21

.

22 Subtract line 18 from line 19. If the amount is zero or less, fill in zero . . . . . . . . . . . . . . . . 22

23 Compare line 22 and line 21. Residents: Fill in the smaller of the two amounts.

Nonresidents and part-year residents: Multiply the smaller amount by the

.

percent on line 24 of your 2000 Schedule M1NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

.

24 Amount from line 29 of your 2000 Schedule M1MTC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

.

25 Add lines 23 and 24. This is the credit available against your 2001 regular tax . . . . . . . . . . 25

Part 2

.

26 Regular tax for 2001 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

.

27 Alternative minimum tax for 2001 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

.

28 Subtract line 27 from line 26. If the amount is zero or less, fill in zero . . . . . . . . . . . . . . . . 28

29 Fill in the amount from line 25 or line 28, whichever is less. (Read instructions for

.

2001 Schedule M1MT.) Also fill in this amount on line 26 of your 2001 Form M1 . . . . . . . . . 29

Part 3 (see instructions)

.

30 Subtract line 29 from line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

You must attach this schedule and Schedule M1MT to your 2001 Form M1.

Stock No. 1001075

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1