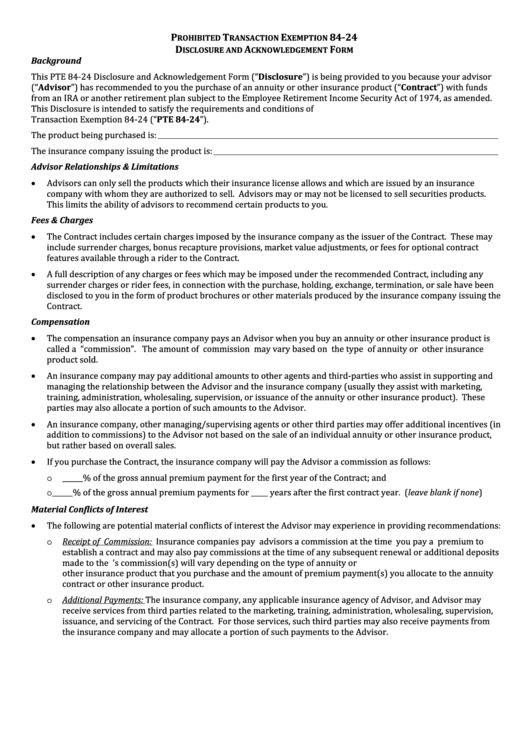

Prohibited Transaction Exemption 84-24 Disclosure And Acknowledgement Form

ADVERTISEMENT

P

T

E

84-24

ROHIBITED

RANSACTION

XEMPTION

D

A

F

ISCLOSURE AND

CKNOWLEDGEMENT

ORM

Background

This PTE 84-24 Disclosure and Acknowledgement Form (“Disclosure”) is being provided to you because your advisor

(“Advisor”) has recommended to you the purchase of an annuity or other insurance product (“Contract”) with funds

from an IRA or another retirement plan subject to the Employee Retirement Income Security Act of 1974, as amended.

This Disclosure is intended to satisfy the requirements and conditions of U.S. Department of Labor Prohibited

Transaction Exemption 84-24 (“PTE 84-24”).

The product being purchased is:

The insurance company issuing the product is:

Advisor Relationships & Limitations

Advisors can only sell the products which their insurance license allows and which are issued by an insurance

company with whom they are authorized to sell. Advisors may or may not be licensed to sell securities products.

This limits the ability of advisors to recommend certain products to you.

Fees & Charges

The Contract includes certain charges imposed by the insurance company as the issuer of the Contract. These may

include surrender charges, bonus recapture provisions, market value adjustments, or fees for optional contract

features available through a rider to the Contract.

A full description of any charges or fees which may be imposed under the recommended Contract, including any

surrender charges or rider fees, in connection with the purchase, holding, exchange, termination, or sale have been

disclosed to you in the form of product brochures or other materials produced by the insurance company issuing the

Contract.

Compensation

The compensation an insurance company pays an Advisor when you buy an annuity or other insurance product is

called a “commission”. The amount of commission may vary based on the type of annuity or other insurance

product sold.

An insurance company may pay additional amounts to other agents and third-parties who assist in supporting and

managing the relationship between the Advisor and the insurance company (usually they assist with marketing,

training, administration, wholesaling, supervision, or issuance of the annuity or other insurance product). These

parties may also allocate a portion of such amounts to the Advisor.

An insurance company, other managing/supervising agents or other third parties may offer additional incentives (in

addition to commissions) to the Advisor not based on the sale of an individual annuity or other insurance product,

but rather based on overall sales.

If you purchase the Contract, the insurance company will pay the Advisor a commission as follows:

______% of the gross annual premium payment for the first year of the Contract; and

o

______% of the gross annual premium payments for _____ years after the first contract year. (leave blank if none)

o

Material Conflicts of Interest

The following are potential material conflicts of interest the Advisor may experience in providing recommendations:

Receipt of Commission: Insurance companies pay advisors a commission at the time you pay a premium to

o

establish a contract and may also pay commissions at the time of any subsequent renewal or additional deposits

made to the contract. The amount of the Advisor’s commission(s) will vary depending on the type of annuity or

other insurance product that you purchase and the amount of premium payment(s) you allocate to the annuity

contract or other insurance product.

Additional Payments: The insurance company, any applicable insurance agency of Advisor, and Advisor may

o

receive services from third parties related to the marketing, training, administration, wholesaling, supervision,

issuance, and servicing of the Contract. For those services, such third parties may also receive payments from

the insurance company and may allocate a portion of such payments to the Advisor.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2