Consumers Tax On Sales & Services - Alaska Department Of Revenue

ADVERTISEMENT

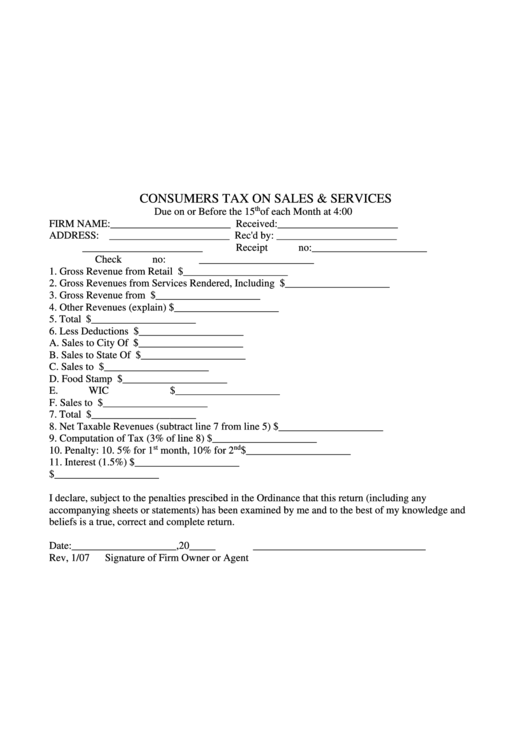

CONSUMERS TAX ON SALES & SERVICES

th

Due on or Before the 15

of each Month at 4:00 p.m.

FIRM NAME:_______________________

Received:_______________________

ADDRESS: _______________________

Rec'd by: _______________________

_______________________

Receipt no:______________________

Check no: ______________________

1. Gross Revenue from Retail Sales..................................................................$____________________

2. Gross Revenues from Services Rendered, Including Materials....................$____________________

3. Gross Revenue from Rentals.........................................................................$____________________

4. Other Revenues (explain)..............................................................................$____________________

5. Total Revenues..............................................................................................$____________________

6. Less Deductions Claimed..............................................................................$____________________

A. Sales to City Of Chevak....................................................................$____________________

B. Sales to State Of Alaska....................................................................$____________________

C. Sales to U.S. Government.................................................................$____________________

D. Food Stamp Sales..............................................................................$____________________

E. WIC Sales..........................................................................................$____________________

F. Sales to Elders....................................................................................$____________________

7. Total Deductions............................................................................................$____________________

8. Net Taxable Revenues (subtract line 7 from line 5)......................................$____________________

9. Computation of Tax (3% of line 8)................................................................$____________________

st

nd

10. Penalty: 10. 5% for 1

month, 10% for 2

month.......................................$____________________

11. Interest (1.5%)..............................................................................................$____________________

12.Total Amount of Tax Remitted Herewith.....................................................$____________________

I declare, subject to the penalties prescibed in the Ordinance that this return (including any

accompanying sheets or statements) has been examined by me and to the best of my knowledge and

beliefs is a true, correct and complete return.

Date:____________________,20_____

_________________________________

Rev, 1/07

Signature of Firm Owner or Agent

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1