Form Olf-2a - Reconciliation Of License Fee Withheld - City Of Paris

ADVERTISEMENT

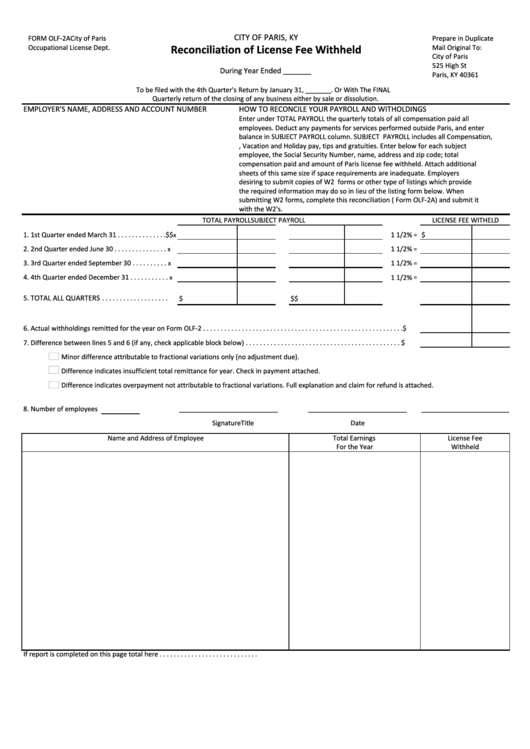

CITY OF PARIS, KY

FORM OLF-2A City of Paris

Prepare in Duplicate

Occupational License Dept.

Mail Original To:

Reconciliation of License Fee Withheld

City of Paris

525 High St

During Year Ended _______

Paris, KY 40361

To be filed with the 4th Quarter's Return by January 31, _______. Or With The FINAL

Quarterly return of the closing of any business either by sale or dissolution.

EMPLOYER'S NAME, ADDRESS AND ACCOUNT NUMBER

HOW TO RECONCILE YOUR PAYROLL AND WITHOLDINGS

Enter under TOTAL PAYROLL the quarterly totals of all compensation paid all

employees. Deduct any payments for services performed outside Paris, and enter

balance in SUBJECT PAYROLL column. SUBJECT PAYROLL includes all Compensation,

i.e., Vacation and Holiday pay, tips and gratuities. Enter below for each subject

employee, the Social Security Number, name, address and zip code; total

compensation paid and amount of Paris license fee withheld. Attach additional

sheets of this same size if space requirements are inadequate. Employers

desiring to submit copies of W2 forms or other type of listings which provide

the required information may do so in lieu of the listing form below. When

submitting W2 forms, complete this reconciliation ( Form OLF-2A) and submit it

with the W2's.

TOTAL PAYROLL

SUBJECT PAYROLL

LICENSE FEE WITHELD

1. 1st Quarter ended March 31 . . . . . . . . . . . . . .

$

$

1 1/2%

$

x

=

2. 2nd Quarter ended June 30 . . . . . . . . . . . . . . .

1 1/2%

x

=

3. 3rd Quarter ended September 30 . . . . . . . . . .

1 1/2%

x

=

4. 4th Quarter ended December 31 . . . . . . . . . . .

1 1/2%

x

=

5. TOTAL ALL QUARTERS . . . . . . . . . . . . . . . . . . .

$

$

$

6. Actual withholdings remitted for the year on Form OLF-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

7. Difference between lines 5 and 6 (if any, check applicable block below) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Minor difference attributable to fractional variations only (no adjustment due).

Difference indicates insufficient total remittance for year. Check in payment attached.

Difference indicates overpayment not attributable to fractional variations. Full explanation and claim for refund is attached.

8. Number of employees

___________________________

___________________________

________________________

Signature

Title

Date

Name and Address of Employee

Total Earnings

License Fee

For the Year

Withheld

If report is completed on this page total here . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1