Form Or-706-Disc - Request For Discharge From Personal Liability - 2016

ADVERTISEMENT

Clear This Page

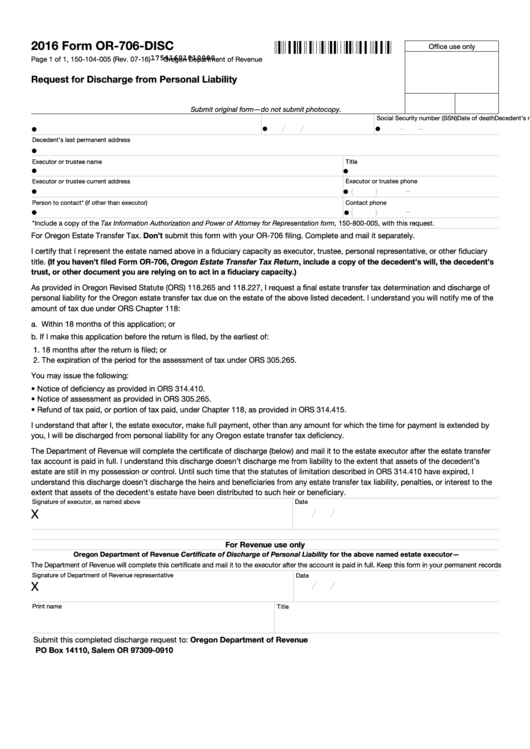

2016 Form OR-706-DISC

Office use only

17541601010000

Page 1 of 1, 150-104-005 (Rev. 07-16)

Oregon Department of Revenue

Request for Discharge from Personal Liability

Submit original form—do not submit photocopy.

Decedent’s name

Date of death

Social Security number (SSN)

•

/

/

•

–

–

•

Decedent’s last permanent address

•

Executor or trustee name

Title

•

•

Executor or trustee phone

Executor or trustee current address

•

•

–

(

)

Person to contact* (if other than executor)

Contact phone

•

•

–

(

)

*Include a copy of the Tax Information Authorization and Power of Attorney for Representation form, 150-800-005, with this request.

For Oregon Estate Transfer Tax. Don’t submit this form with your OR-706 filing. Complete and mail it separately.

I certify that I represent the estate named above in a fiduciary capacity as executor, trustee, personal representative, or other fiduciary

title. (If you haven’t filed Form OR-706, Oregon Estate Transfer Tax Return, include a copy of the decedent’s will, the decedent’s

trust, or other document you are relying on to act in a fiduciary capacity.)

As provided in Oregon Revised Statute (ORS) 118.265 and 118.227, I request a final estate transfer tax determination and discharge of

personal liability for the Oregon estate transfer tax due on the estate of the above listed decedent. I understand you will notify me of the

amount of tax due under ORS Chapter 118:

a. Within 18 months of this application; or

b. If I make this application before the return is filed, by the earliest of:

1. 18 months after the return is filed; or

2. The expiration of the period for the assessment of tax under ORS 305.265.

You may issue the following:

• Notice of deficiency as provided in ORS 314.410.

• Notice of assessment as provided in ORS 305.265.

• Refund of tax paid, or portion of tax paid, under Chapter 118, as provided in ORS 314.415.

I understand that after I, the estate executor, make full payment, other than any amount for which the time for payment is extended by

you, I will be discharged from personal liability for any Oregon estate transfer tax deficiency.

The Department of Revenue will complete the certificate of discharge (below) and mail it to the estate executor after the estate transfer

tax account is paid in full. I understand this discharge doesn’t discharge me from liability to the extent that assets of the decedent’s

estate are still in my possession or control. Until such time that the statutes of limitation described in ORS 314.410 have expired, I

understand this discharge doesn’t discharge the heirs and beneficiaries from any estate transfer tax liability, penalties, or interest to the

extent that assets of the decedent’s estate have been distributed to such heir or beneficiary.

Signature of executor, as named above

Date

/

/

X

For Revenue use only

Oregon Department of Revenue Certificate of Discharge of Personal Liability for the above named estate executor—

The Department of Revenue will complete this certificate and mail it to the executor after the account is paid in full. Keep this form in your permanent records.

Signature of Department of Revenue representative

Date

/

/

X

Print name

Title

Submit this completed discharge request to: Oregon Department of Revenue

PO Box 14110, Salem OR 97309-0910

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1