Sale Of Your Home Ar2119 Instructions

ADVERTISEMENT

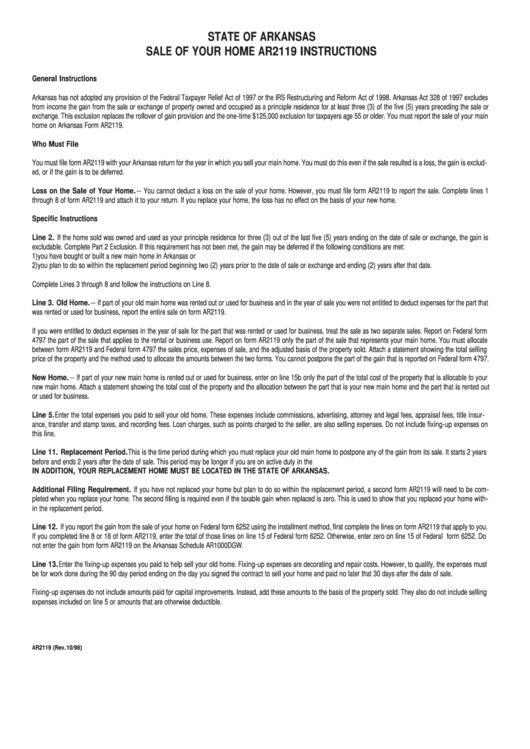

STATE OF ARKANSAS

SALE OF YOUR HOME AR2119 INSTRUCTIONS

General Instructions

Arkansas has not adopted any provision of the Federal Taxpayer Relief Act of 1997 or the IRS Restructuring and Reform Act of 1998. Arkansas Act 328 of 1997 excludes

from income the gain from the sale or exchange of property owned and occupied as a principle residence for at least three (3) of the five (5) years preceding the sale or

exchange. This exclusion replaces the rollover of gain provision and the one-time $125,000 exclusion for taxpayers age 55 or older. You must report the sale of your main

home on Arkansas Form AR2119.

Who Must File

You must file form AR2119 with your Arkansas return for the year in which you sell your main home. You must do this even if the sale resulted is a loss, the gain is exclud-

ed, or if the gain is to be deferred.

Loss on the Sale of Your Home.-- You cannot deduct a loss on the sale of your home. However, you must file form AR2119 to report the sale. Complete lines 1

through 8 of form AR2119 and attach it to your return. If you replace your home, the loss has no effect on the basis of your new home.

Specific Instructions

Line 2. If the home sold was owned and used as your principle residence for three (3) out of the last five (5) years ending on the date of sale or exchange, the gain is

excludable. Complete Part 2 Exclusion. If this requirement has not been met, the gain may be deferred if the following conditions are met:

1)

you have bought or built a new main home in Arkansas or

2)

you plan to do so within the replacement period beginning two (2) years prior to the date of sale or exchange and ending (2) years after that date.

Complete Lines 3 through 8 and follow the instructions on Line 8.

Line 3. Old Home.-- If part of your old main home was rented out or used for business and in the year of sale you were not entitled to deduct expenses for the part that

was rented or used for business, report the entire sale on form AR2119.

If you were entitled to deduct expenses in the year of sale for the part that was rented or used for business, treat the sale as two separate sales. Report on Federal form

4797 the part of the sale that applies to the rental or business use. Report on form AR2119 only the part of the sale that represents your main home. You must allocate

between form AR2119 and Federal form 4797 the sales price, expenses of sale, and the adjusted basis of the property sold. Attach a statement showing the total selling

price of the property and the method used to allocate the amounts between the two forms. You cannot postpone the part of the gain that is reported on Federal form 4797.

New Home.-- If part of your new main home is rented out or used for business, enter on line 15b only the part of the total cost of the property that is allocable to your

new main home. Attach a statement showing the total cost of the property and the allocation between the part that is your new main home and the part that is rented out

or used for business.

Line 5. Enter the total expenses you paid to sell your old home. These expenses include commissions, advertising, attorney and legal fees, appraisal fees, title insur-

ance, transfer and stamp taxes, and recording fees. Loan charges, such as points charged to the seller, are also selling expenses. Do not include fixing-up expenses on

this line.

Line 11. Replacement Period. This is the time period during which you must replace your old main home to postpone any of the gain from its sale. It starts 2 years

before and ends 2 years after the date of sale. This period may be longer if you are on active duty in the U.S. Armed forces or if you live and work outside the U.S.

IN ADDITION, YOUR REPLACEMENT HOME MUST BE LOCATED IN THE STATE OF ARKANSAS.

Additional Filing Requirement. If you have not replaced your home but plan to do so within the replacement period, a second form AR2119 will need to be com-

pleted when you replace your home. The second filing is required even if the taxable gain when replaced is zero. This is used to show that you replaced your home with-

in the replacement period.

Line 12. If you report the gain from the sale of your home on Federal form 6252 using the installment method, first complete the lines on form AR2119 that apply to you.

If you completed line 8 or 18 of form AR2119, enter the total of those lines on line 15 of Federal form 6252. Otherwise, enter zero on line 15 of Federal form 6252. Do

not enter the gain from form AR2119 on the Arkansas Schedule AR1000DGW.

Line 13. Enter the fixing-up expenses you paid to help sell your old home. Fixing-up expenses are decorating and repair costs. However, to qualify, the expenses must

be for work done during the 90 day period ending on the day you signed the contract to sell your home and paid no later that 30 days after the date of sale.

Fixing-up expenses do not include amounts paid for capital improvements. Instead, add these amounts to the basis of the property sold. They also do not include selling

expenses included on line 5 or amounts that are otherwise deductible.

AR2119 (Rev.10/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1