Page 4,

AV-9, Web, 7-16

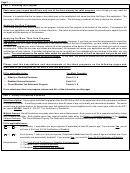

Part 5. Income Information

(complete only if you also completed Part 2 or Part 4)

Social Security Number (SSN) disclosure is mandatory for approval of the Elderly or Disabled Exclusion and the Circuit Breaker Property

Tax Deferment Program and will be used to establish the identification of the applicant. The SSN may be used for verification of

information provided on this application. The authority to require this number is given by 42 U.S.C. Section 405(c)(2)(C)(i). The SSN

and all income tax information will be kept confidential. The SSN may also be used to facilitate collection of property taxes if you do not

timely and voluntarily pay the taxes. Using the SSN will allow the tax collector to claim payment of an unpaid property tax bill from any

State income tax refund that might otherwise be owed to you. Your SSN may be shared with the State for this purpose. In addition, your

SSN may be used to garnish wages or attach bank accounts for failure to timely pay taxes.

Applicant’s Social Security Number

Spouse’s Social Security Number

Requirements:

1. You must provide a copy of your individual Federal Income Tax Return for the previous calendar year, unless you are not required

to file a Federal Income Tax Return. Married applicants filing separate returns must submit both returns. If you have not filed

your Federal Income Tax Return at the time you submit this application, submit a copy when you file your return. Your income

tax returns are confidential and will be treated as such. Your application will not be processed until the income tax information is

received. Please check the appropriate box concerning the submission of your Federal Income Tax Return.

Fill in applicable box:

Federal Income Tax Return submitted with this application.

Federal Income Tax Return will be submitted when filed with the IRS.

I will not file a Federal Income Tax Return with the IRS for the previous calendar year.

2. Provide the income information requested below for the previous calendar year. Provide the total amount for both spouses. If

you do not file a Federal Income Tax Return, you must attach documentation of the income that you report below (W-2,

SSA-1099, 1099-R, 1099-INT, 1099-DIV, financial institution statements, etc.).

a. Wages, Salaries, Tips, etc ........................................................................................$

b. Interest (Taxable and Tax Exempt) ............................................................................$

c. Dividends ...................................................................................................................$

d. Capital Gains .............................................................................................................$

e. IRA Distributions ........................................................................................................$

f. Pensions and Annuities ..............................................................................................$

g. Disability Payments (not included in Pensions and Annuities) ..................................$

h. Social Security Benefits (Taxable and Tax Exempt) ..................................................$

i. All other moneys received (Describe in Comments section.) .....................................$

Total ...............................................................................................................................$

Comments:

INFORMATION IS SUBJECT TO VERIFICATION WITH THE NORTH CAROLINA DEPARTMENT OF REVENUE.

1

1 2

2 3

3 4

4 5

5