Instructions For Form Wi-Z - Wisconsin Income Tax

ADVERTISEMENT

INSTRUCTIONS FOR FORM WI-Z

Generally, if you file federal Form 1040EZ or file your federal

Exception If you checked the box on line 2 and are

return using TeleFile, you can file Wisconsin Form WI-Z.

required to use the Special Tax Worksheet for Dependents, fill

However, there are some limitations. Read “Which Form to

in on line 3 the amount of your tax from line 8 of the worksheet.

File for 1999” on page 2 of the Form 1A instructions to see

Line 4 Working Families Tax Credit You may claim a credit

which form is right for you.

if your income on line 1 of Form WI-Z is less than $10,000

($19,000 if married filing a joint return) and you do not qualify

Prepare one copy of Form WI-Z for your records and another

to be claimed as a dependent on another person's return. See

copy to be filed with the Department of Revenue.

the instructions for line 15 of Form 1A.

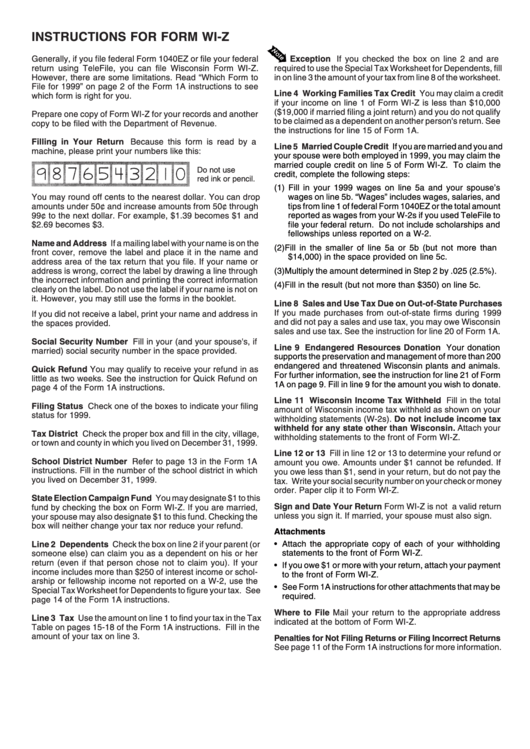

Filling in Your Return Because this form is read by a

Line 5 Married Couple Credit

If you are married and you and

machine, please print your numbers like this:

your spouse were both employed in 1999, you may claim the

married couple credit on line 5 of Form WI-Z. To claim the

Do not use

credit, complete the following steps:

red ink or pencil.

(1) Fill in your 1999 wages on line 5a and your spouse’s

wages on line 5b. “Wages” includes wages, salaries, and

You may round off cents to the nearest dollar. You can drop

amounts under 50¢ and increase amounts from 50¢ through

tips from line 1 of federal Form 1040EZ or the total amount

99¢ to the next dollar. For example, $1.39 becomes $1 and

reported as wages from your W-2s if you used TeleFile to

file your federal return. Do not include scholarships and

$2.69 becomes $3.

fellowships unless reported on a W-2.

Name and Address If a mailing label with your name is on the

(2) Fill in the smaller of line 5a or 5b (but not more than

front cover, remove the label and place it in the name and

$14,000) in the space provided on line 5c.

address area of the tax return that you file. If your name or

address is wrong, correct the label by drawing a line through

(3) Multiply the amount determined in Step 2 by .025 (2.5%).

the incorrect information and printing the correct information

(4) Fill in the result (but not more than $350) on line 5c.

clearly on the label. Do not use the label if your name is not on

it. However, you may still use the forms in the booklet.

Line 8 Sales and Use Tax Due on Out-of-State Purchases

If you made purchases from out-of-state firms during 1999

If you did not receive a label, print your name and address in

and did not pay a sales and use tax, you may owe Wisconsin

the spaces provided.

sales and use tax. See the instruction for line 20 of Form 1A.

Social Security Number Fill in your (and your spouse's, if

Line 9 Endangered Resources Donation

Your donation

married) social security number in the space provided.

supports the preservation and management of more than 200

endangered and threatened Wisconsin plants and animals.

Quick Refund You may qualify to receive your refund in as

For further information, see the instruction for line 21 of Form

little as two weeks. See the instruction for Quick Refund on

1A on page 9. Fill in line 9 for the amount you wish to donate.

page 4 of the Form 1A instructions.

Line 11 Wisconsin Income Tax Withheld Fill in the total

Filing Status Check one of the boxes to indicate your filing

amount of Wisconsin income tax withheld as shown on your

status for 1999.

withholding statements (W-2s). Do not include income tax

withheld for any state other than Wisconsin. Attach your

Tax District Check the proper box and fill in the city, village,

withholding statements to the front of Form WI-Z.

or town and county in which you lived on December 31, 1999.

Line 12 or 13 Fill in line 12 or 13 to determine your refund or

School District Number Refer to page 13 in the Form 1A

amount you owe. Amounts under $1 cannot be refunded. If

instructions. Fill in the number of the school district in which

you owe less than $1, send in your return, but do not pay the

you lived on December 31, 1999.

tax. Write your social security number on your check or money

order. Paper clip it to Form WI-Z.

State Election Campaign Fund You may designate $1 to this

Sign and Date Your Return Form WI-Z is not a valid return

fund by checking the box on Form WI-Z. If you are married,

unless you sign it. If married, your spouse must also sign.

your spouse may also designate $1 to this fund. Checking the

box will neither change your tax nor reduce your refund.

Attachments

• Attach the appropriate copy of each of your withholding

Line 2 Dependents Check the box on line 2 if your parent (or

statements to the front of Form WI-Z.

someone else) can claim you as a dependent on his or her

return (even if that person chose not to claim you). If your

• If you owe $1 or more with your return, attach your payment

income includes more than $250 of interest income or schol-

to the front of Form WI-Z.

arship or fellowship income not reported on a W-2, use the

• See Form 1A instructions for other attachments that may be

Special Tax Worksheet for Dependents to figure your tax. See

required.

page 14 of the Form 1A instructions.

Where to File Mail your return to the appropriate address

Line 3 Tax Use the amount on line 1 to find your tax in the Tax

indicated at the bottom of Form WI-Z.

Table on pages 15-18 of the Form 1A instructions. Fill in the

amount of your tax on line 3.

Penalties for Not Filing Returns or Filing Incorrect Returns

See page 11 of the Form 1A instructions for more information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1