Form L-Es - Declaration Of Estimated Tax For Individuals - City Of Lakewood

ADVERTISEMENT

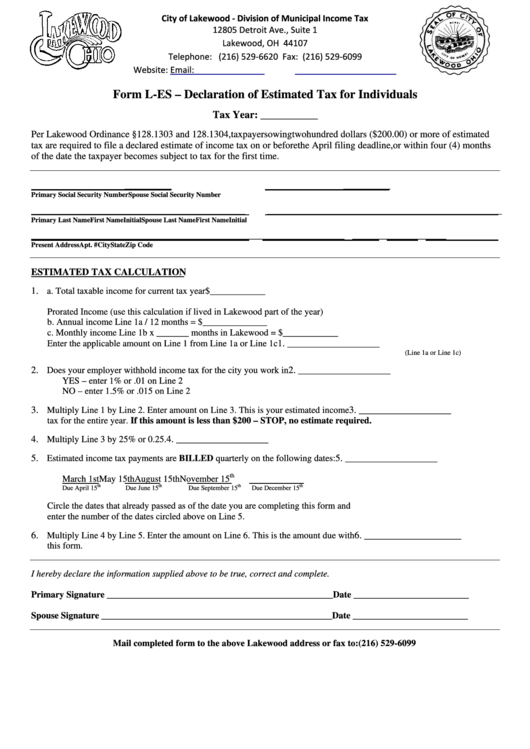

City of Lakewood - Division of Municipal Income Tax

12805 Detroit Ave., Suite 1

Lakewood, OH 44107

Telephone: (216) 529-6620 Fax: (216) 529-6099

Website:

Email:

taxdept@lakewoodoh.net

Form L-ES – Declaration of Estimated Tax for Individuals

Tax Year: ___________

Per Lakewood Ordinance §128.1303 and 128.1304, taxpayers owing two hundred dollars ($200.00) or more of estimated

tax are required to file a declared estimate of income tax on or before the April filing deadline, or within four (4) months

of the date the taxpayer becomes subject to tax for the first time.

_________

_________

Primary Social Security Number

Spouse Social Security Number

_________________________________________

_____________________________________________

Primary Last Name

First Name

Initial

Spouse Last Name

First Name

Initial

__________________________________________

_________________

_ ____

______________

Present Address

Apt. #

City

State

Zip Code

ESTIMATED TAX CALCULATION

1. a. Total taxable income for current tax year

$____________

Prorated Income (use this calculation if lived in Lakewood part of the year)

b. Annual income Line 1a / 12 months = $______________

c. Monthly income Line 1b x _______ months in Lakewood = $____________

Enter the applicable amount on Line 1 from Line 1a or Line 1c

1. ___________________

(Line 1a or Line 1c)

2. Does your employer withhold income tax for the city you work in

2. ___________________

YES – enter 1% or .01 on Line 2

NO – enter 1.5% or .015 on Line 2

3. Multiply Line 1 by Line 2. Enter amount on Line 3. This is your estimated income

3. ___________________

tax for the entire year. If this amount is less than $200 – STOP, no estimate required.

4. Multiply Line 3 by 25% or 0.25.

4. ___________________

5. Estimated income tax payments are BILLED quarterly on the following dates:

5. ___________________

th

March 1st

May 15th

August 15th

November 15

th

th

th

th

Due April 15

Due June 15

Due September 15

Due December 15

Circle the dates that already passed as of the date you are completing this form and

enter the number of the dates circled above on Line 5.

6. Multiply Line 4 by Line 5. Enter the amount on Line 6. This is the amount due with

6. ____________________

this form.

I hereby declare the information supplied above to be true, correct and complete.

Primary Signature _________________________________________________

Date _________________________

Spouse Signature __________________________________________________

Date _________________________

Mail completed form to the above Lakewood address or fax to: (216) 529-6099

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2