PRINT

CLEAR

1

Page

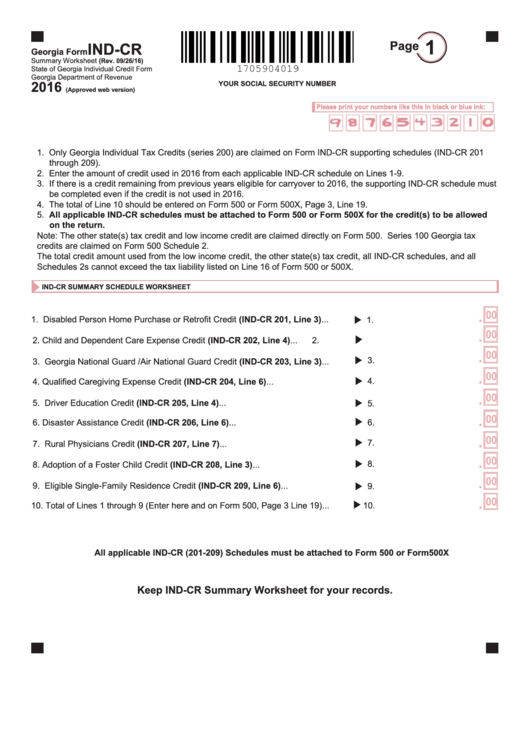

IND-CR

Georgia Form

Summary Worksheet

(Rev. 09/26/16)

State of Georgia Individual Credit Form

Georgia Department of Revenue

2016

YOUR SOCIAL SECURITY NUMBER

(Approved web version)

Please print your numbers like this in black or blue ink:

Please print your numbers like this in black or blue ink:

1. Only Georgia Individual Tax Credits (series 200) are claimed on Form IND-CR supporting schedules (IND-CR 201

through 209).

2. Enter the amount of credit used in 2016 from each applicable IND-CR schedule on Lines 1-9.

3. If there is a credit remaining from previous years eligible for carryover to 2016, the supporting IND-CR schedule must

be completed even if the credit is not used in 2016.

4. The total of Line 10 should be entered on Form 500 or Form 500X, Page 3, Line 19.

5. All applicable IND-CR schedules must be attached to Form 500 or Form 500X for the credit(s) to be allowed

on the return.

Note: The other state(s) tax credit and low income credit are claimed directly on Form 500. Series 100 Georgia tax

credits are claimed on Form 500 Schedule 2.

The total credit amount used from the low income credit, the other state(s) tax credit, all IND-CR schedules, and all

Schedules 2s cannot exceed the tax liability listed on Line 16 of Form 500 or 500X.

IND-CR SUMMARY SCHEDULE WORKSHEET

.

00

1. Disabled Person Home Purchase or Retrofit Credit (IND-CR 201, Line 3) ...........

1.

.

00

2 . Child and Dependent Care Expense Credit (IND-CR 202, Line 4) .......................

2.

.

00

3.

3. Georgia National Guard /Air National Guard Credit (IND-CR 203, Line 3) ...........

.

00

4.

4. Qualified Caregiving Expense Credit (IND-CR 204, Line 6) ................................

.

00

5. Driver Education Credit (IND-CR 205, Line 4) ......................................................

5.

.

00

6 . Disaster Assistance Credit (IND-CR 206, Line 6) ................................................

6.

.

00

7.

7. Rural Physicians Credit (IND-CR 207, Line 7) ......................................................

.

00

8.

8. Adoption of a Foster Child Credit (IND-CR 208, Line 3) ......................................

.

00

9. Eligible Single-Family Residence Credit (IND-CR 209, Line 6) ............................

9.

.

00

1 0 . Total of Lines 1 through 9 (Enter here and on Form 500, Page 3 Line 19).........

10.

All applicable IND-CR (201-209) Schedules must be attached to Form 500 or Form 500X

Keep IND-CR Summary Worksheet for your records.

1

1