Shareholder'S Instructions For Form 100s Schedule K-1 - Shareholder'S Share Of Income, Deductions, Credits, Etc Page 4

ADVERTISEMENT

•

Note: The at-risk limitations of IRC

Line 21

In the case of a pass-through entity which

Section 465, the passive activity limitations of

reports a profit for the taxable or income

Reduce your basis in stock of the S corpora-

IRC Section 469 and the pass-through rules

year, your profit interest in the entity at the

tion by the distributions on line 21. If these

of IRC Section 1366 may limit the amount of

end of your taxable year.

distributions exceed your basis in stock, the

•

credits that you may take. Credits on line 12

In the case of a pass-through entity which

excess is treated as gain from the sale or

and line 13 may be passive activity credits to

reports a loss for the taxable or income

exchange of property and is reported on

shareholders who do not materially

year, your loss interest in the entity at the

Schedule D.

participate.

end of your taxable year.

Line 22

•

In the case of a pass-through entity which

Passive activity credits are limited to tax attrib-

If the line 22 payments are made on indebted-

is sold or liquidates during the taxable or

utable to passive activities. If you do not

ness with a reduced basis, the repayments

income year, your capital account interest

materially participate in the activities of the

result in income to you to the extent the

in the entity at the time of the sale or

S corporation, get form FTB 3801-CR, Pas-

repayments are more than the adjusted basis

liquidation.

sive Activity Credit Limitations, to determine

of the loan. See IRC Section 1367(b)(2) for

the amount of the credit you may take.

‘‘Proportionate interest’’ includes an interest in

information on reduction in basis of a loan

a pass-through entity including a partnership,

and restoration of basis of a loan with a

Adjustments and Tax Preference

S corporation, RIC, REIT or REMIC.

reduced basis. See federal Revenue

Items

Ruling 68-537, 1968-2 C.B. 372, for more

For purposes of R&TC Section 17062(b)(4),

information.

‘‘gross receipts’’ means the sum of gross

Line 14a through Line 14e

receipts from the production of business

Use the information reported on line 14a

Supplemental Information

income (within the meaning of subdivisions (a)

through line 14e (as well as adjustments and

Line 23

and (c) of R&TC Section 25120) and the

tax preference items from other sources) to

The S corporation will provide supplemental

gross receipts from the production of nonbusi-

prepare Schedule P (540, 540NR or 541),

information required to be reported to you on

ness income (within the meaning of subdivi-

Alternative Minimum Tax and Credit

this line. If the S corporation is claiming tax

sion (d) of R&TC Section 25120).

Limitations.

benefits from an EZ, LARZ, LAMBRA, TTA or

‘‘Proportionate interest’’ includes an interest in

For more information, get federal

MEA, it will give you your pro rata share of (1)

a pass-through entity. See R&TC Sec-

Schedule K-1 (Form 1120S) instructions for

business income apportioned to the EZ,

tion 17062 for more information.

Adjustments and Tax Preference Items.

LARZ, LAMBRA, MEA or TTA, and (2) busi-

If the S corporation listed any credit recapture

ness capital gains and losses included in (1)

Other State Taxes

on this line, see your tax booklet for informa-

on this line. Get form FTB 3805Z, FTB 3806,

tion on how to report the credit recapture.

Line 15a through Line 15e

FTB 3807, FTB 3808 or FTB 3809 to claim

Table 1

You may claim a credit against your individual

any applicable credit or business expense

The income data contained in Table 1 is not

tax for your share of net income taxes paid by

deduction.

reflected in column (e) because the source of

the S corporation to certain other states which

The S corporation may have provided an

such income must be determined at the

either tax the corporation as an S corporation

amount showing your proportionate interest in

shareholder level. The shareholder must make

or do not recognize S corporation status. For

the S corporation’s aggregate gross receipts,

a determination whether the nonbusiness

purposes of this credit, net income taxes

less returns and allowances on Schedule K-1

intangible income item is from a California

include your share of taxes on, according to,

(100S), line 23. Legislation enacted in 1996

or measured by income.

source.

allows a qualified taxpayer to exclude from

Net nonbusiness income is computed by sub-

Residents are taxed on their pro rata share of

alternative minimum taxable income adjust-

tracting related nonbusiness expenses from

all income and generally receive a credit for

ments and items of tax preference attributable

the nonbusiness income.

taxes paid to other states. Nonresidents and

to any trade or business. A ‘‘qualified tax-

part-year residents use column (e) for your

Table 2

payer’’ is defined as an individual, estate or

pro rata share of California source pass-

trust that:

If the shareholder and S corporation are

through income.

•

engaged in a single unitary business, the

Is the owner of, or has an ownership inter-

shareholder’s share of the S corporation’s

For more information, get California

est in a trade or business; and

•

business income is entered on Table 2,

Schedule S, Other State Tax Credit.

Has aggregate gross receipts, less returns

Part A. The shareholder will then add that

and allowances, of less than $1,000,000

Other Items

income to its own business income and

from all trades or businesses that the tax-

apportion the combined business income.

Note: Amounts on line 16a through line 22

payer is an owner of or has an ownership

may not necessarily be California source

interest in, in the amount of that taxpayer’s

The shareholder’s share of the S corporation’s

amounts. However, enter the same amount in

proportionate interest in each trade or

payroll, property and sales data is in Table 2,

column (e) as entered in column (d).

business.

Part C. The business income in Table 2,

Part A is combined with the taxpayer’s other

Line 16a through Line 19

‘‘Aggregate gross receipts, less returns and

business income from the unitary business.

Refer to the instructions for federal

allowances’’ means the sum of the gross

The apportionment numerator and denomina-

Schedule K-1 (1120S).

receipts of the trades or businesses which

tor data are added to the appropriate numera-

you own and the proportionate interest of the

Line 20

tor and denominator of the shareholder’s

gross receipts of the trades or businesses

The S corporation must issue a federal

payroll, property, and sales factors.

which you own and of pass-through entities in

Form 1099-DIV to you for this distribution.

which you hold an interest.

Report this amount as a taxable dividend on

your individual return.

‘‘Proportionate interest’’ is defined as:

Page 4

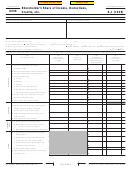

Schedule K-1 (100S) 1998

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4