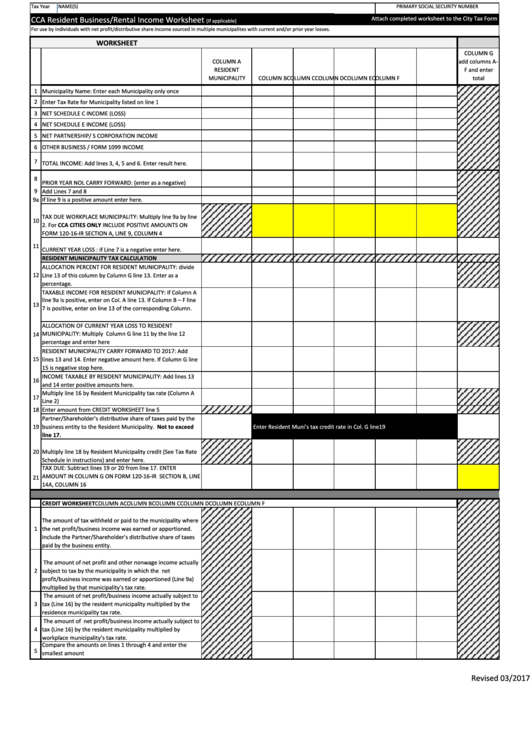

Cca Resident Business/rental Income Worksheet

ADVERTISEMENT

Tax Year

NAME(S)

PRIMARY SOCIAL SECURITY NUMBER

Attach completed worksheet to the City Tax Form

CCA Resident Business/Rental Income Worksheet

(If applicable)

For use by individuals with net profit/distributive share income sourced in multiple municipalites with current and/or prior year losses.

WORKSHEET

COLUMN G

COLUMN A

add columns A-

RESIDENT

F and enter

MUNICIPALITY

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

total

1 Municipality Name: Enter each Municipality only once

2 Enter Tax Rate for Municipality listed on line 1

3 NET SCHEDULE C INCOME (LOSS)

4 NET SCHEDULE E INCOME (LOSS)

5 NET PARTNERSHIP/ S CORPORATION INCOME

6 OTHER BUSINESS / FORM 1099 INCOME

7 TOTAL INCOME: Add lines 3, 4, 5 and 6. Enter result here.

8

PRIOR YEAR NOL CARRY FORWARD: (enter as a negative)

9 Add Lines 7 and 8

9a If line 9 is a positive amount enter here.

TAX DUE WORKPLACE MUNICIPALITY: Multiply line 9a by line

10

2. For CCA CITIES ONLY INCLUDE POSITIVE AMOUNTS ON

FORM 120-16-IR SECTION A, LINE 9, COLUMN 4

11

CURRENT YEAR LOSS : if Line 7 is a negative enter here.

RESIDENT MUNICIPALITY TAX CALCULATION

ALLOCATION PERCENT FOR RESIDENT MUNICIPALITY: divide

12

Line 13 of this column by Column G line 13. Enter as a

percentage.

TAXABLE INCOME FOR RESIDENT MUNICIPALITY: If Column A

line 9a is positive, enter on Col. A line 13. If Column B – F line

13

7 is positive, enter on line 13 of the corresponding Column.

ALLOCATION OF CURRENT YEAR LOSS TO RESIDENT

14

MUNICIPALITY: Multiply Column G line 11 by the line 12

percentage and enter here

RESIDENT MUNICIPALITY CARRY FORWARD TO 2017: Add

15

lines 13 and 14. Enter negative amount here. If Column G line

15 is negative stop here.

INCOME TAXABLE BY RESIDENT MUNICIPALITY: Add lines 13

16

and 14 enter positive amounts here.

Multiply line 16 by Resident Municipality tax rate (Column A

17

Line 2)

18 Enter amount from CREDIT WORKSHEET line 5

Partner/Shareholder's distributive share of taxes paid by the

19

business entity to the Resident Municipality. Not to exceed

Enter Resident Muni's tax credit rate in Col. G line19

line 17.

20 Multiply line 18 by Resident Municipality credit (See Tax Rate

Schedule in instructions) and enter here.

TAX DUE: Subtract lines 19 or 20 from line 17. ENTER

AMOUNT IN COLUMN G ON FORM 120-16-IR SECTION B, LINE

21

14A, COLUMN 16

CREDIT WORKSHEET

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

The amount of tax withheld or paid to the municipality where

1

the net profit/business income was earned or apportioned.

Include the Partner/Shareholder's distributive share of taxes

paid by the business entity.

The amount of net profit and other nonwage income actually

2

subject to tax by the municipality in which the net

profit/business income was earned or apportioned (Line 9a)

multiplied by that municipality’s tax rate.

The amount of net profit/business income actually subject to

3

tax (Line 16) by the resident municipality multiplied by the

residence municipality tax rate.

The amount of net profit/business income actually subject to

4

tax (Line 16) by the resident municipality multiplied by

workplace municipality’s tax rate.

Compare the amounts on lines 1 through 4 and enter the

5

smallest amount

Revised 03/2017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1