Print

Clear

Page 1

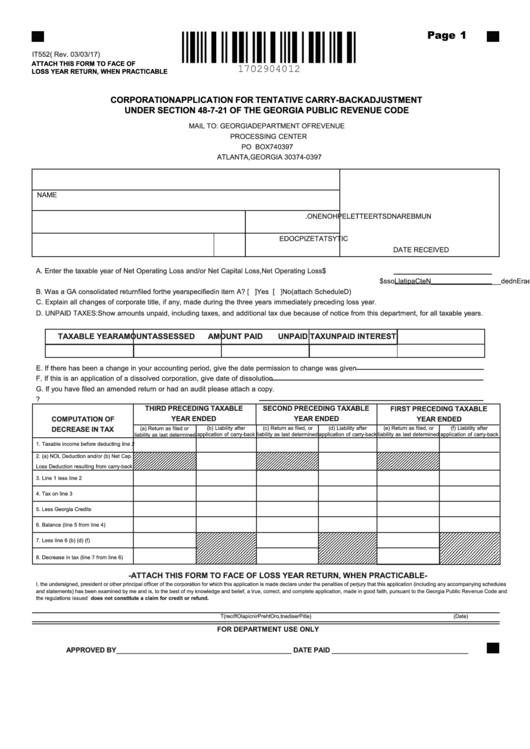

IT 552 ( Rev. 03/03/17)

ATTACH THIS FORM TO FACE OF

LOSS YEAR RETURN, WHEN PRACTICABLE

CORPORATION APPLICATION FOR TENTATIVE CARRY-BACK ADJUSTMENT

UNDER SECTION 48-7-21 OF THE GEORGIA PUBLIC REVENUE CODE

MAIL TO: GEORGIA DEPARTMENT OF REVENUE

PROCESSING CENTER

PO BOX 740397

ATLANTA, GEORGIA 30374-0397

F

E

D

E

R

A

L

E

M

P

L

O

Y

E

R

D I

E

N

T

F I

C I

A

I T

O

N

N

O

.

F

O

R

D

E

P

A

R

T

M

E

N

T

U

S

E

O

N

L

Y

NAME

N

U

M

B

E

R

A

N

D

S

T

R

E

E

T

T

E

L

E

P

H

O

N

E

N

O

.

C

T I

Y

S

T

A

T

E

Z

P I

C

O

D

E

DATE RECEIVED

A. Enter the taxable year of Net Operating Loss and/or Net Capital Loss,

Net Operating Loss $

Y

e

r a

E

n

d

e

d

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

_

N

t e

C

a

i p

l a t

L

o

s s

$

B. Was a GA consolidated return filed for the year specified in item A? [

]Yes [

]No

(attach Schedule D)

C. Explain all changes of corporate title, if any, made during the three years immediately preceding loss year.

D. UNPAID TAXES: Show amounts unpaid, including taxes, and additional tax due because of notice from this department, for all taxable years.

TAXABLE YEAR

AMOUNT ASSESSED

AMOUNT PAID

UNPAID TAX

UNPAID INTEREST

E. If there has been a change in your accounting period, give the date permission to change was given

F. If this is an application of a dissolved corporation, give date of dissolution

G. If you have filed an amended return or had an audit please attach a copy.

H. Are you a financial institution required to file Form 900 with Georgia?

THIRD PRECEDING TAXABLE

SECOND PRECEDING TAXABLE

FIRST PRECEDING TAXABLE

YEAR ENDED

YEAR ENDED

COMPUTATION OF

YEAR ENDED

(b) Liability after

(c) Return as filed, or

(d) Liability after

(e) Return as filed, or

(f) Liability after

DECREASE IN TAX

(a) Return as filed or

application of carry-back

liability as last determined

application of carry-back

liability as last determined

application of carry-back

liability as last determined

1. Taxable income before deducting line 2

2. (a) NOL Deduction and/or (b) Net Cap.

Loss Deduction resulting from carry-back

3. Line 1 less line 2

4. Tax on line 3

5. Less Georgia Credits

6. Balance (line 5 from line 4)

7. Less line 6 (b) (d) (f)

8. Decrease in tax (line 7 from line 6)

-ATTACH THIS FORM TO FACE OF LOSS YEAR RETURN, WHEN PRACTICABLE-

I, the undersigned, president or other principal officer of the corporation for which this application is made declare under the penalties of perjury that this application (including any accompanying schedules

and statements) has been examined by me and is, to the best of my knowledge and belief, a true, correct, and complete application, made in good faith, pursuant to the Georgia Public Revenue Code and

the regulations issued thereunder. It is understood that this is a tentative carry-back adjustment subject to later detailed audit and does not constitute a claim for credit or refund.

P

e r

s

d i

e

n

, t

r o

O

h t

r e

r P

n i

c

p i

l a

O

f

c i f

r e

T (

itle)

(Date)

FOR DEPARTMENT USE ONLY

APPROVED BY_____________________________________________ DATE PAID ___________________________________

1

1