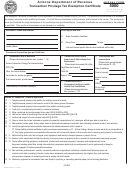

Your Name (as shown on page 1)

Arizona Transaction Privilege Tax License Number

11. Electricity, natural gas or liquefied petroleum gas sold to a qualified manufacturing or smelting business. A manufacturing or

smelting business that claims this exemption authorizes the release by the vendor of the information required to be provided to

the Department of Revenue pursuant to A.R.S. §42-5063(C)(6). (Utilities classification only.)

12. Sale or lease of tangible personal property to affiliated Native Americans if the solicitation for sale, signing of the contract,

delivery of the goods and payment for the goods all occur on the reservation. NOTE: The vendor shall retain adequate

documentation to substantiate the transaction.

13. Foreign

diplomat.

NOTE:

Limited

to

authorization

on

the

U.S.

Department

of

State

Diplomatic

Tax

Exemption Card.

The vendor shall retain a copy of the U.S. Department of State Diplomatic Tax Exemption

Card and any other documentation issued by the U.S. Department of State.

Motor vehicle purchases or

leases must be pre-authorized by the Office of Foreign Missions (“OFM”).

See “Vehicle Tax Exemption”

at

*

14.

Other Deduction: Cite the Arizona Revised Statutes authority for the deduction. A.R.S. §

Description:

*

15.

Other Cities Deduction: Cite the Model City Tax Code authority for the deduction. M.C.T.C §

Description:

*

Refer to

(TPT)/RatesandDeductionCodes.aspx

for a complete list of state and city

exemptions (deductions) and the business classes (codes) under which the deductions apply.

E. Describe the tangible personal property or service purchased or leased and its use below.

(Use additional pages if needed.)

F. Certification

A vendor that has reason to believe that this Certificate is not accurate or complete will not be relieved of the burden of

proving entitlement to the exemption. A vendor that accepts a Certificate in good faith will be relieved of the burden of proof

and the purchaser may be required to establish the accuracy of the claimed exemption. If the purchaser cannot establish

the accuracy and completeness of the information provided in the Certificate, the purchaser is liable for an amount equal to

the transaction privilege tax, penalty and interest which the vendor would have been required to pay if the vendor had not

accepted the Certificate. Misuse of this Certificate will subject the purchaser to payment of the A.R.S. § 42-5009 amount equal

to any tax, penalty or interest. Willful misuse of this Certificate will subject the purchaser to criminal penalties of a felony

pursuant to A.R.S. § 42-1127(B).

I, (print full name)

, hereby certify that these transactions are

exempt from Arizona transaction privilege tax and that the information on this Certificate is true, accurate and complete.

Further, if purchasing or leasing as an agent or officer, I certify that I am authorized to execute this Certificate on behalf of

the purchaser named above.

SIGNATURE OF PURCHASER

DATE

TITLE

Page 2 of 2

ADOR 10308 (7/17)

Print Form

Reset Form

1

1 2

2