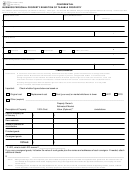

Check the total market value of your property:

Under $20,000

$20,000 or more

If you checked “Under $20,000” please complete only Schedule A. Otherwise, complete Schedule B and/or C, whichever is

applicable. When required by the chief appraiser, you must render any taxable property that you own or manage and control as a

fiduciary on January 1. [Section 22.01(b), Tax Code] For this type of property, complete Schedule A, B, and/or C, whichever is

applicable. When required by the chief appraiser, you must file a report listing the name and address of each owner of property

that is in your possession or under your management on January 1 by bailment, lease, consignment, or other arrangement.

[Section 22.04(a), Tax Code] For this type of property, complete Schedule D.

Are you the property owner, an employee of the property owner, or an employee of a property

Yes

No

owner on behalf of an affiliated entity of the property owner?

This form must be signed and dated. By signing this document, you attest that the information contained on it is

true and correct to the best of your knowledge and belief.

If you checked “Yes” above, sign and date on the first signature line below. No notarization is required.

Date

I f you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and correct to the best of my knowledge and belief.

Date

Subscribed and sworn before me this

day of

, 20

.

Notary Public, State of Texas

Section 22.26 of the Property Tax Code states:

(a) Each rendition statement or property report required or authorized by this chapter must be signed by an

individual who is required to file the statement or report.

(b) When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent

who has been designated in writing by the board of directors or by an authorized officer to sign in behalf of the

corporation must sign the statement or report.

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail

felony under Section 37.10, Penal Code.

1

1 2

2 3

3 4

4 5

5 6

6 7

7