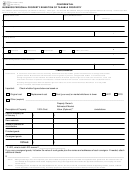

SCHEDULE C: INVENTORY

List all taxable inventory by type of property (example: merchandise, supplies, etc.). If needed you may attach additional sheets. Or, you may attach a computer-generated copy listing the information below. If you manage

or control property as a fiduciary on January 1, also list the names and addresses of each property owner. If you carry consigned goods, also list below the names and addresses of each consignor.

Good faith

Historical

Estimate of

Property owner name/address,

Property description by

Property address or address where

estimate

cost

Year

(and)

quantity of

if you manage or control property

Acquired**

type/category

taxable

of market

(or)

when

each type

as a fiduciary.

value*

new**

* If you provide an amount in the “good faith estimate of market value,” you need not complete a “historical cost when new” and “year acquired.” “Good faith estimate of market value” is not admissible in sub-

sequent protest, hearing, appeal, suit, or other proceeding involving the property except for: (1) proceedings to determine whether a person complied with rendition requirement; (2) proceedings for determi-

nation of fraud or intent to evade tax; or (3) a protest under Section 41.41, Tax Code.

** If you provide an amount in a “historical cost when new” and “year acquired,” you need not complete “good faith estimate of market value.”

Note: If you are a dealer/retailer of inventory that is subject to Sections 23.121, 23.124, 23.1241, or 23.127, Tax Code (alternate methods of appraising vehicles, vessels, outboard motors, and trailers, manu-

factured housing, and heavy equipment), list this type of property on the appropriate Dealer’s Inventory Declaration rather than this schedule.

1

1 2

2 3

3 4

4 5

5 6

6 7

7