Form Dr-908 - Computation Of Insurance Premium Tax

ADVERTISEMENT

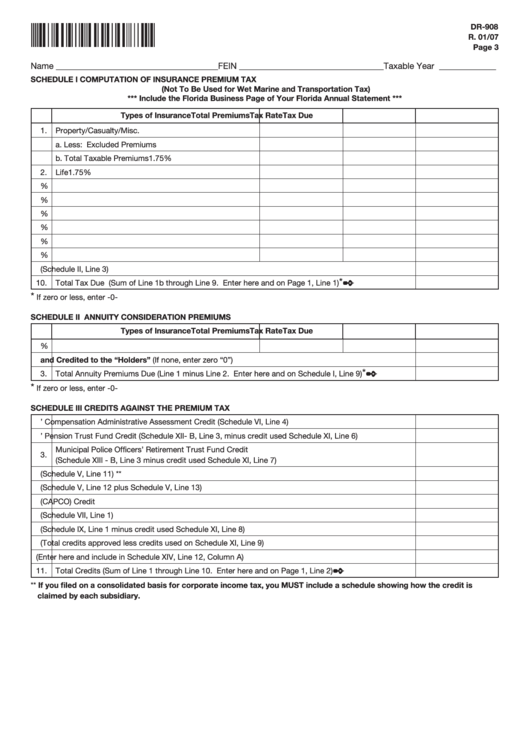

DR-908

R. 01/07

Page 3

Name _____________________________________ FEIN _________________________________ Taxable Year _____________

SChEDUlE I

CoMPUTATIoN oF INSURANCE PREMIUM TAx

(Not To Be Used for Wet Marine and Transportation Tax)

*** Include the Florida Business Page of Your Florida Annual Statement ***

Types of Insurance

Total Premiums

Tax Rate

Tax Due

1.

Property/Casualty/Misc.

a. Less: Excluded Premiums

b. Total Taxable Premiums

1.75%

2.

Life

1.75%

3.

Accident and health

1.75%

4.

Prepaid Limited health

1.75%

5.

Commercial Self-Insurance

1.60%

6.

Group Self-Insurance

1.60%

7.

Medical Malpractice Self-Insurance

1.60%

8.

Assessable Mutual Insurers

1.60%

9.

Annuity Premium (Schedule II, Line 3)

*

✒

10.

Total Tax Due (Sum of Line 1b through Line 9. Enter here and on Page 1, Line 1)

*

If zero or less, enter -0-

SChEDUlE II

ANNUITY CoNSIDERATIoN PREMIUMS

Types of Insurance

Total Premiums

Tax Rate

Tax Due

1.

Annuity Premiums

1.00%

Premium Tax Savings Derived and Credited to the “holders” (If none, enter zero “0”)

2.

*

✒

3.

Total Annuity Premiums Due (Line 1 minus Line 2. Enter here and on Schedule I, Line 9)

*

If zero or less, enter -0-

SChEDUlE III

CREDITS AgAINST ThE PREMIUM TAx

1.

Workers’ Compensation Administrative Assessment Credit (Schedule VI, Line 4)

2.

Firefighters’ Pension Trust Fund Credit (Schedule XII- B, Line 3, minus credit used Schedule XI, Line 6)

Municipal Police Officers’ Retirement Trust Fund Credit

3.

(Schedule XIII - B, Line 3 minus credit used Schedule XI, Line 7)

4.

Eligible Corporate Income Tax and Emergency Excise Tax Credit (Schedule V, Line 11) **

5.

Salary Tax Credit (Schedule V, Line 12 plus Schedule V, Line 13)

6.

Certified Capital Company (CAPCO) Credit

7.

Florida Life and health Insurance Guaranty Association Credit (Schedule VII, Line 1)

8.

Community Contribution Credit (Schedule IX, Line 1 minus credit used Schedule XI, Line 8)

9.

Child Care Tax Credits (Total credits approved less credits used on Schedule XI, Line 9)

10.

Capital Investment Tax Credit (Enter here and include in Schedule XIV, Line 12, Column A)

✒

11.

Total Credits (Sum of Line 1 through Line 10. Enter here and on Page 1, Line 2)

** If you filed on a consolidated basis for corporate income tax, you MUST include a schedule showing how the credit is

claimed by each subsidiary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10