Instructions & Worksheet For Quarterly Withholding Forms (Jw-1q) - Joint Economic Development Districts

ADVERTISEMENT

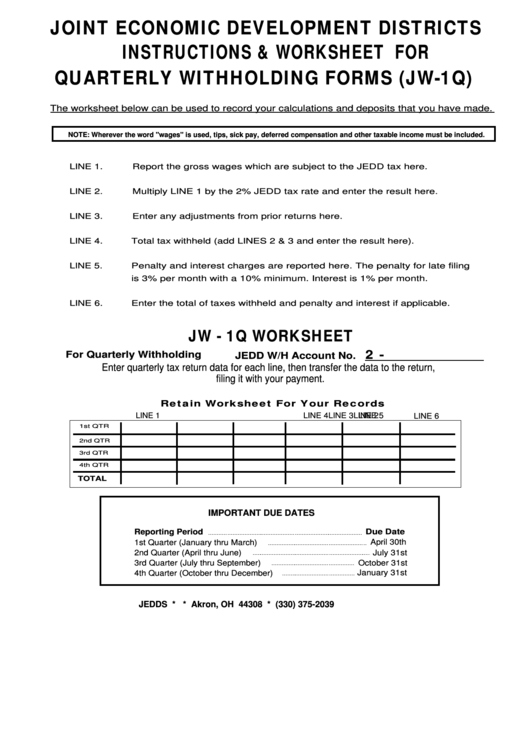

JOINT ECONOMIC DEVELOPMENT DISTRICTS

INSTRUCTIONS & WORKSHEET FOR

QUARTERLY WITHHOLDING FORMS (JW-1Q)

The worksheet below can be used to record your calculations and deposits that you have made.

NOTE: Wherever the word "wages" is used, tips, sick pay, deferred compensation and other taxable income must be included.

LINE 1.

Report the gross wages which are subject to the JEDD tax here.

LINE 2.

Multiply LINE 1 by the 2% JEDD tax rate and enter the result here.

LINE 3.

Enter any adjustments from prior returns here.

LINE 4.

Total tax withheld (add LINES 2 & 3 and enter the result here).

LINE 5.

Penalty and interest charges are reported here. The penalty for late filing

is 3% per month with a 10% minimum. Interest is 1% per month.

LINE 6.

Enter the total of taxes withheld and penalty and interest if applicable.

JW - 1Q WORKSHEET

2 -

For Quarterly Withholding

JEDD W/H Account No.

Enter quarterly tax return data for each line, then transfer the data to the return,

filing it with your payment.

Retain Worksheet For Your Records

LINE 1

LINE 2

LINE 3

LINE 4

LINE 5

LINE 6

1st QTR

2nd QTR

3rd QTR

4th QTR

TOTAL

IMPORTANT DUE DATES

Reporting Period

Due Date

April 30th

1st Quarter (January thru March)

2nd Quarter (April thru June)

July 31st

3rd Quarter (July thru September)

October 31st

January 31st

4th Quarter (October thru December)

JEDDS * P.O. Box 80538 * Akron, OH 44308 * (330) 375-2039

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1