Form Ow-8-P - Oklahoma Underpayment Of Estimated Tax Worksheet

ADVERTISEMENT

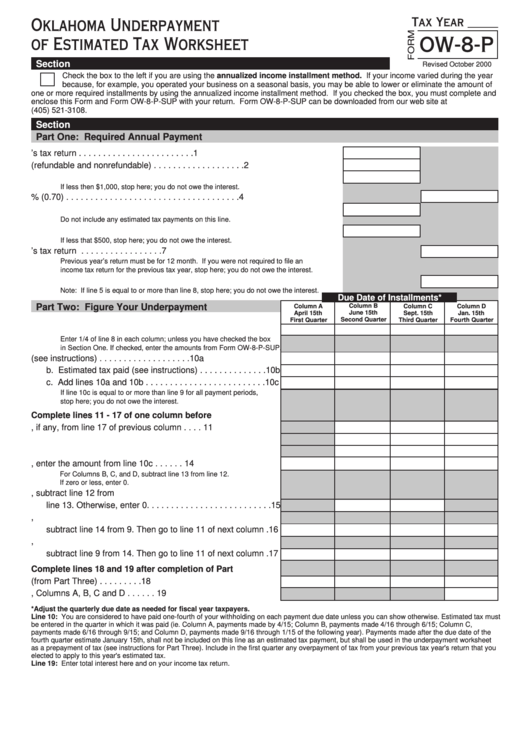

Tax Year _____

Oklahoma Underpayment

of Estimated Tax Worksheet

OW-8-P

Section One... Annualized Method

Revised October 2000

Check the box to the left if you are using the annualized income installment method. If your income varied during the year

because, for example, you operated your business on a seasonal basis, you may be able to lower or eliminate the amount of

one or more required installments by using the annualized income installment method. If you checked the box, you must complete and

enclose this Form and Form OW-8-P-SUP with your return. Form OW-8-P-SUP can be downloaded from our web site at

or by calling our forms order line at (405) 521-3108.

Section Two... Worksheet

Part One: Required Annual Payment

1. Tax shown on your current year’s tax return . . . . . . . . . . . . . . . . . . . . . . . . 1

2. Oklahoma credits (refundable and nonrefundable) . . . . . . . . . . . . . . . . . . . 2

3. Oklahoma tax liability. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . 3

If less then $1,000, stop here; you do not owe the interest.

4. Multiply line 3 by 70% (0.70) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5. Withholding taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Do not include any estimated tax payments on this line.

6. Subtract line 5 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

If less that $500, stop here; you do not owe the interest.

7. Tax liability shown on your previous year’s tax return . . . . . . . . . . . . . . . . . 7

Previous year’s return must be for 12 month. If you were not required to file an

income tax return for the previous tax year, stop here; you do not owe the interest.

8. Required annual payment. Enter the smaller of line 4 or line 7 . . . . . . . . . 8

Note: If line 5 is equal to or more than line 8, stop here; you do not owe the interest.

Due Date of Installments*

Part Two: Figure Your Underpayment

Column B

Column A

Column C

Column D

June 15th

Jan. 15th

April 15th

Sept. 15th

Second Quarter

Fourth Quarter

First Quarter

Third Quarter

9. Required annual payment . . . . . . . . . . . . . . . . . . . . . . . . . 9

Enter 1/4 of line 8 in each column; unless you have checked the box

in Section One. If checked, enter the amounts from Form OW-8-P-SUP.

10. a. Tax withheld (see instructions) . . . . . . . . . . . . . . . . . . .10a

b. Estimated tax paid (see instructions) . . . . . . . . . . . . . .10b

c. Add lines 10a and 10b . . . . . . . . . . . . . . . . . . . . . . . . . 10c

If line 10c is equal to or more than line 9 for all payment periods,

stop here; you do not owe the interest.

Complete lines 11 - 17 of one column before continuing...

11. Enter amount, if any, from line 17 of previous column . . . . 11

12. Add lines 10c and 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13. Add amounts on lines 15 and 16 of the previous column . 13

14. For Column A only, enter the amount from line 10c . . . . . . 14

For Columns B, C, and D, subtract line 13 from line 12.

If zero or less, enter 0.

15. If the amount on line 14 is zero, subtract line 12 from

line 13. Otherwise, enter 0. . . . . . . . . . . . . . . . . . . . . . . . . .15

16. Underpayment. If line 9 is equal to or more than line 14,

subtract line 14 from 9. Then go to line 11 of next column .16

17. Overpayment. If line 14 is equal to or more than line 9,

subtract line 9 from 14. Then go to line 11 of next column .17

Complete lines 18 and 19 after completion of Part Three...

18. Interest due for each quarter (from Part Three) . . . . . . . . .18

19. Total Interest. Add line 18, Columns A, B, C and D . . . . . . 19

*Adjust the quarterly due date as needed for fiscal year taxpayers.

Line 10: You are considered to have paid one-fourth of your withholding on each payment due date unless you can show otherwise. Estimated tax must

be entered in the quarter in which it was paid (ie. Column A, payments made by 4/15; Column B, payments made 4/16 through 6/15; Column C,

payments made 6/16 through 9/15; and Column D, payments made 9/16 through 1/15 of the following year). Payments made after the due date of the

fourth quarter estimate January 15th, shall not be included on this line as an estimated tax payment, but shall be used in the underpayment worksheet

as a prepayment of tax (see instructions for Part Three). Include in the first quarter any overpayment of tax from your previous tax year's return that you

elected to apply to this year's estimated tax.

Line 19: Enter total interest here and on your income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2