PRINT

CLEAR

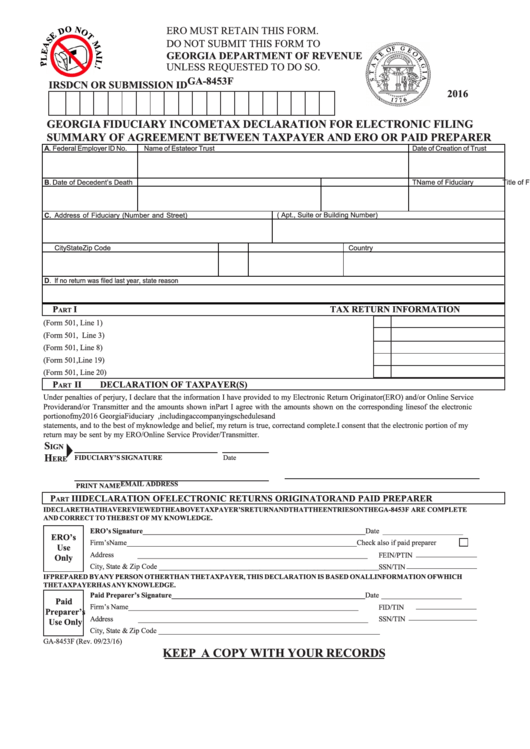

ERO MUST RETAIN THIS FORM.

DO NOT SUBMIT THIS FORM TO

GEORGIA DEPARTMENT OF REVENUE

UNLESS REQUESTED TO DO SO.

GA-8453F

IRS DCN OR SUBMISSION ID

2016

GEORGIA FIDUCIARY INCOME TAX DECLARATION FOR ELECTRONIC FILING

SUMMARY OF AGREEMENT BETWEEN TAXPAYER AND ERO OR PAID PREPARER

A. Federal Employer ID No.

Name of Estate or Trust

Date of Creation of Trust

Name of Fiduciary

Title of Fiduciary

T

elephone No.

B.

Date of Decedent’s Death

C.

Address of Fiduciary (Number and Street)

( Apt., Suite or Building Number)

City

State

Zip Code

Country

D.

If no return was filed last year, state reason

P

I

TAX RETURN INFORMATION

ART

1. Income of Fiduciary (Form 501, Line 1) ................................................................................................ 1.

2. Total (Form 501, Line 3) ........................................................................................................................ 2.

3. Total Tax (Form 501, Line 8) ................................................................................................................. 3.

4. Balance Due (Form 501, Line 19) .......................................................................................................... 4.

5. Refund (Form 501, Line 20) ................................................................................................................... 5.

P

II

DECLARATION OF TAXPAYER(S)

ART

Under penalties of perjury, I declare that the information I have provided to my Electronic Return Originator (ERO) and/or Online Service

Provider and/or Transmitter and the amounts shown in Part I agree with the amounts shown on the corresponding lines of the electronic

portion of my 2016 Georgia Fiduciary Tax Return. I declare that I have examined my tax return, including accompanying schedules and

statements, and to the best of my knowledge and belief, my return is true, correct and complete. I consent that the electronic portion of my

return may be sent by my ERO/Online Service Provider/Transmitter.

S

IGN

H

FIDUCIARY’S SIGNATURE

Date

ERE

EMAIL ADDRESS

PRINT NAME

P

III

DECLARATION OF ELECTRONIC RETURNS ORIGINATOR AND PAID PREPARER

ART

I DECLARE THAT I HAVE REVIEWED THE ABOVE TAXPAYER’S RETURN AND THAT THE ENTRIES ON THE GA-8453F ARE COMPLETE

AND CORRECT TO THE BEST OF MY KNOWLEDGE.

ERO’s Signature _____________________________________________________________

Date ______________________

ERO’s

Firm’s Name

_______________________________________________________________

Check also if paid preparer

Use

Address

_______________________________________________________________

FEIN/PTIN

Only

City, State & Zip Code _____________________________________________________________

SSN/TIN

IF PREPARED BYANY PERSON OTHER THAN THE TAXPAYER, THIS DECLARATION IS BASED ON ALL INFORMATION OF WHICH

THE TAXPAYER HAS ANY KNOWLEDGE.

Paid Preparer’s Signature _____________________________________________________

Date ______________________

Paid

Firm’s Name

_______________________________________________________________

FID/TIN

Preparer’s

Addre

ss

_______________________________________________________________

SSN/TIN

Use Only

City, State & Zip Code _____________________________________________________________

GA-8453F (Rev. 09/23/16)

KEEP A COPY WITH YOUR RECORDS

1

1