California Schedule B (100s) Draft - S Corporation Depreciation And Amortization - 2008 Page 3

ADVERTISEMENT

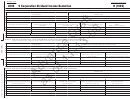

TAXABLE YEAR

CALIFORNIA SCHEDULE

2008

S Corporation Dividend Income Deduction

H (100S)

See instructions for Schedule H (100S). Attach additional sheets if necessary.

Part I

Elimination of Intercompany Dividends (R&TC Section 25106)

(a)

(b)

Dividend payer

Dividend payee

1

2

3

(c)

(d)

(e)

(f)

(g)

Total amount of dividends received

Amount that qualifies for 100%

Amount from column (d) paid out of

Amount from column (d) paid out of

Balance

elimination

current year E&P

prior year E&P

column (c) minus column (d)

1

2

3

4

Enter total amounts of each column on line 4 above. If no entry in Part III, enter total from Part I, line 4, column (d) on Form 100S, Side 1, line 9.

Part II Deduction for Dividends Paid to a Fully Included Member of a Water’s-Edge Combined Report (R&TC Section 24411)

(Foreign dividends paid by partially included members of a water’s-edge combined report cannot be computed on this schedule.)

(a)

(b)

Dividend payer

Name of member of the water’s-edge group receiving dividend

1

2

3

(c)

(d)

(e)

(f)

(g)

Percentage of ownership of dividend payer

Amount of qualified dividends received by

Amount from column (d) paid out of

Amount from column (d) paid out of

Deductible dividends column (d) X .75 or

payee (see instructions)

current year E&P

prior year E&P

100% dividends from construction projects

1

2

3

4 Total amounts in column (g). Enter here and on Form 100S, Side 1, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part III Deduction for Dividends Paid to a California Corporation by an Insurance Company (R&TC Section 24410)

(a)

(b)

Dividend payer

Dividend payee

1

2

3

(c)

(d)

(e)

(f)

(g)

Percentage of ownership of dividend payer

Total insurance dividends received

Qualified dividend percentage

Amount of qualified insurance dividends

Deductible dividends

(must be at least 80%)

(see instructions)

column (d) x column (e)

85% of column (f)

1

2

3

4 Total amounts in column (g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Add amounts from Part I, line 4, column (d) and Part III, line 4, column (g). Enter here and on Form 100S, Side 1, line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3