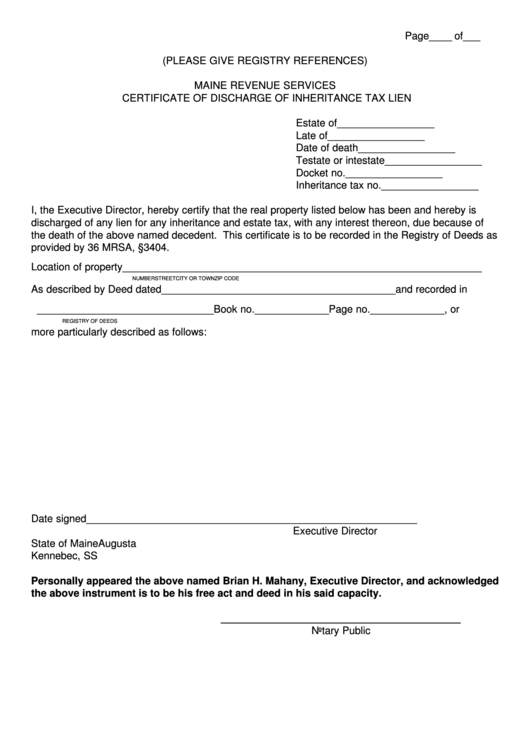

Maine Revenue Services Certificate Of Discharge Of Inheritance Tax Lien

ADVERTISEMENT

Page ____ of ___

(PLEASE GIVE REGISTRY REFERENCES)

MAINE REVENUE SERVICES

CERTIFICATE OF DISCHARGE OF INHERITANCE TAX LIEN

Estate of

_________________

Late of

_________________

Date of death

_________________

Testate or intestate _________________

Docket no.

_________________

Inheritance tax no.

_________________

I, the Executive Director, hereby certify that the real property listed below has been and hereby is

discharged of any lien for any inheritance and estate tax, with any interest thereon, due because of

the death of the above named decedent. This certificate is to be recorded in the Registry of Deeds as

provided by 36 MRSA, §3404.

Location of property _______________________________________________________________

NUMBER

STREET

CITY OR TOWN

ZIP CODE

As described by Deed dated _________________________________________ and recorded in

_______________________________ Book no. _____________ Page no. _____________ , or

REGISTRY OF DEEDS

more particularly described as follows:

Date signed ________________

__________________________________________

Executive Director

State of Maine

Augusta

Kennebec, SS

Personally appeared the above named Brian H. Mahany, Executive Director, and acknowledged

the above instrument is to be his free act and deed in his said capacity.

__________________________________________

Notary Public

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1