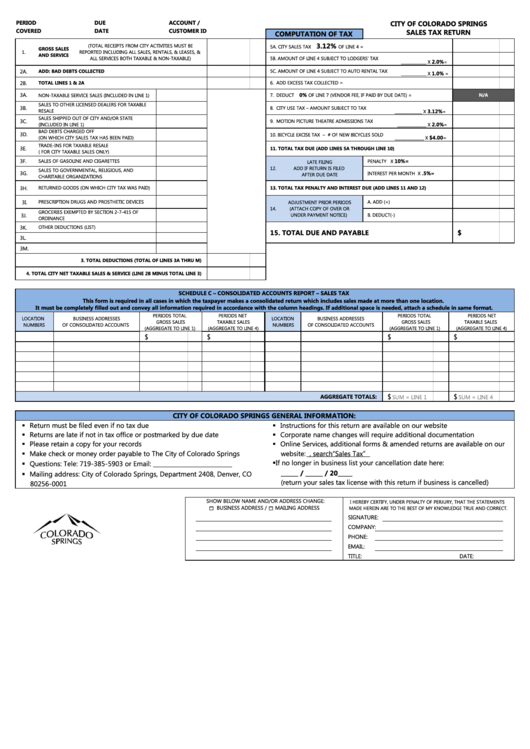

Sales Tax Return - City Of Colorado Springs

ADVERTISEMENT

PERIOD

DUE

ACCOUNT /

CITY OF COLORADO SPRINGS

COVERED

DATE

CUSTOMER ID

SALES TAX RETURN

COMPUTATION OF TAX

3.12%

(TOTAL RECEIPTS FROM CITY ACTIVITIES MUST BE

5A. CITY SALES TAX

OF LINE 4 =

GROSS SALES

1.

REPORTED INCLUDING ALL SALES, RENTALS, & LEASES, &

AND SERVICE

ALL SERVICES BOTH TAXABLE & NON-TAXABLE)

5B. AMOUNT OF LINE 4 SUBJECT TO LODGERS’ TAX

2.0%

_____________ X

=

2A.

ADD: BAD DEBTS COLLECTED

5C. AMOUNT OF LINE 4 SUBJECT TO AUTO RENTAL TAX

1.0%

_____________ X

=

2B.

TOTAL LINES 1 & 2A

6. ADD EXCESS TAX COLLECTED =

3A.

NON-TAXABLE SERVICE SALES (INCLUDED IN LINE 1)

0%

N/A

7. DEDUCT

OF LINE 7 (VENDOR FEE, IF PAID BY DUE DATE) =

SALES TO OTHER LICENSED DEALERS FOR TAXABLE

3B.

8. CITY USE TAX – AMOUNT SUBJECT TO TAX

3.12%

RESALE

______________ X

=

SALES SHIPPED OUT OF CITY AND/OR STATE

3C.

9. MOTION PICTURE THEATRE ADMISSIONS TAX

2.0%

(INCLUDED IN LINE 1)

_______________ X

=

BAD DEBTS CHARGED OFF

3D.

10. BICYCLE EXCISE TAX – # OF NEW BICYCLES SOLD

$4.00

(ON WHICH CITY SALES TAX HAS BEEN PAID)

_______________ X

=

TRADE-INS FOR TAXABLE RESALE

3E.

11. TOTAL TAX DUE (ADD LINES 5A THROUGH LINE 10)

( FOR CITY TAXABLE SALES ONLY)

3F.

SALES OF GASOLINE AND CIGARETTES

10%=

PENALTY X

LATE FILING

12.

ADD IF RETURN IS FILED

SALES TO GOVERNMENTAL, RELIGIOUS, AND

3G.

.5%

INTEREST PER MONTH X

=

AFTER DUE DATE

CHARITABLE ORGANIZATIONS

3H.

RETURNED GOODS (ON WHICH CITY TAX WAS PAID)

13. TOTAL TAX PENALTY AND INTEREST DUE (ADD LINES 11 AND 12)

3I.

PRESCRIPTION DRUGS AND PROSTHETIC DEVICES

ADJUSTMENT PRIOR PERIODS

A. ADD (+)

14.

(ATTACH COPY OF OVER OR

GROCERIES EXEMPTED BY SECTION 2-7-415 OF

3J.

UNDER PAYMENT NOTICE)

B. DEDUCT(-)

ORDINANCE

3K.

OTHER DEDUCTIONS (LIST)

15. TOTAL DUE AND PAYABLE

$

3L.

3M.

3. TOTAL DEDUCTIONS (TOTAL OF LINES 3A THRU M)

4. TOTAL CITY NET TAXABLE SALES & SERVICE (LINE 2B MINUS TOTAL LINE 3)

SCHEDULE C – CONSOLIDATED ACCOUNTS REPORT – SALES TAX

This form is required in all cases in which the taxpayer makes a consolidated return which includes sales made at more than one location.

It must be completely filled out and convey all information required in accordance with the column headings. If additional space is needed, attach a schedule in same format.

PERIODS TOTAL

PERIODS NET

PERIODS TOTAL

PERIODS NET

LOCATION

BUSINESS ADDRESSES

LOCATION

BUSINESS ADDRESSES

GROSS SALES

TAXABLE SALES

GROSS SALES

TAXABLE SALES

NUMBERS

OF CONSOLIDATED ACCOUNTS

NUMBERS

OF CONSOLIDATED ACCOUNTS

(AGGREGATE TO LINE 1)

(AGGREGATE TO LINE 4)

(AGGREGATE TO LINE 1)

(AGGREGATE TO LINE 4)

$

$

$

$

$

$

AGGREGATE TOTALS:

SUM = LINE 1

SUM = LINE 4

CITY OF COLORADO SPRINGS GENERAL INFORMATION:

Return must be filed even if no tax due

Instructions for this return are available on our website

Returns are late if not in tax office or postmarked by due date

Corporate name changes will require additional documentation

Please retain a copy for your records

Online Services, additional forms & amended returns are available on our

website: ColoradoSprings.gov, search “Sales Tax”

Make check or money order payable to The City of Colorado Springs

Questions: Tele: 719-385-5903 or Email:

If no longer in business list your cancellation date here:

______ / ______ / 20_____

Mailing address: City of Colorado Springs, Department 2408, Denver, CO

(return your sales tax license with this return if business is cancelled)

80256-0001

SHOW BELOW NAME AND/OR ADDRESS CHANGE:

I HEREBY CERTIFY, UNDER PENALTY OF PERJURY, THAT THE STATEMENTS

BUSINESS ADDRESS / MAILING ADDRESS

MADE HEREIN ARE TO THE BEST OF MY KNOWLEDGE TRUE AND CORRECT.

SIGNATURE:

COMPANY:

PHONE:

EMAIL:

TITLE:

DATE:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1