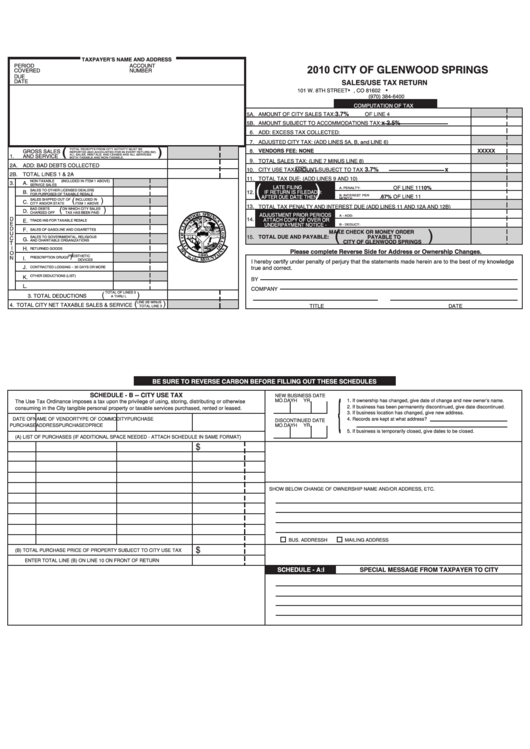

Sales/use Tax Return - City Of Glenwood Springs - 2010

ADVERTISEMENT

TAXPAYER’S NAME AND ADDRESS

PERIOD

ACCOUNT

2010 CITY OF GLENWOOD SPRINGS

COVERED

NUMBER

DUE

DATE

SALES/USE TAX RETURN

101 W. 8TH STREET P.O. BOX 458 GLENWOOD SPRINGS, CO 81602

(970) 384-6400

COMPUTATION OF TAX

3.7%

5A.

AMOUNT OF CITY SALES TAX:

OF LINE 4

x 2.5%

5B.

AMOUNT SUBJECT TO ACCOMMODATIONS TAX:

6.

ADD: EXCESS TAX COLLECTED:

7.

ADJUSTED CITY TAX: (ADD LINES 5A, B, and LINE 6)

(

)

TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE

8.

VENDORS FEE: NONE

XXXXX

GROSS SALES

REPORTED AND ACCOUNTED FOR IN EVERY RETURN INC.

1.

AND SERVICE

ALL SALES, RENTALS, AND LEASES AND ALL SERVICES

BOTH TAXABLE AND NON-TAXABLE.

9.

TOTAL SALES TAX: (LINE 7 MINUS LINE 8)

2A.

ADD: BAD DEBTS COLLECTED

x

3.7%

(FROM

10.

CITY USE TAX

AMOUNT SUBJECT TO TAX

SCHEDULE B)

2B.

TOTAL LINES 1 & 2A

11.

TOTAL TAX DUE: (ADD LINES 9 AND 10)

NON-TAXABLE

(INCLUDED IN ITEM 1 ABOVE)

3.

A.

(

)

SERVICE SALES

LATE FILING

10%

OF LINE 11

A. PENALTY:

SALES TO OTHER LICENSED DEALERS

B.

12.

IF RETURN IS FILED

ADD:

FOR PURPOSES OF TAXABLE RESALE

B. INTEREST PER

.67% OF LINE 11

AFTER DUE DATE THEN

(

)

MONTH

SALES SHIPPED OUT OF

INCLUDED IN

C.

CITY AND/OR STATE

ITEM 1 ABOVE

13.

TOTAL TAX PENALTY AND INTEREST DUE (ADD LINES 11 AND 12A AND 12B)

(

)

BAD DEBTS

ON WHICH CITY SALES

D.

CHARGED OFF

TAX HAS BEEN PAID

ADJUSTMENT PRIOR PERIODS

A - ADD:

D

14.

ATTACH COPY OF OVER OR

E.

TRADE-INS FOR TAXABLE RESALE

E

UNDERPAYMENT NOTICE -

B - DEDUCT:

D

(

)

F.

SALES OF GASOLINE AND CIGARETTES

MAKE CHECK OR MONEY ORDER

U

TOTAL DUE AND PAYABLE:

PAYABLE TO

15.

SALES TO GOVERNMENTAL, RELIGIOUS

C

G.

AND CHARITABLE ORGANIZATIONS

CITY OF GLENWOOD SPRINGS

T

I

H.

RETURNED GOODS

Please complete Reverse Side for Address or Ownership Changes.

O

/

PROSTHETIC

N

I.

PRESCRIPTION DRUGS

DEVICES

I hereby certify under penalty of perjury that the statements made herein are to the best of my knowledge

J.

true and correct.

CONTRACTED LODGING – 30 DAYS OR MORE

K.

OTHER DEDUCTIONS (LIST)

BY

L.

COMPANY

(

TOTAL OF LINES 3

)

3. TOTAL DEDUCTIONS

A THRU L

(

)

LINE 2B MINUS

4.

TOTAL CITY NET TAXABLE SALES & SERVICE

TITLE

DATE

TOTAL LINE 3

TAXPAYER’S NAME AND ADDRESS

PERIOD

ACCOUNT

TAXPAYER’S NAME AND ADDRESS

CITY OF GLENWOOD SPRINGS

COVERED

NUMBER

PERIOD

ACCOUNT

CITY OF GLENWOOD SPRINGS

DUE

COVERED

NUMBER

SALES/USE TAX RETURN

DATE

DUE

SALES/USE TAX RETURN

DATE

101 W. 8TH STREET P.O. BOX 458 GLENWOOD SPRINGS, CO 81602

(970) 384-6400

101 W. 8TH STREET P.O. BOX 458 GLENWOOD SPRINGS, CO 81602

(970) 384-6400

COMPUTATION OF TAX

3.7%

COMPUTATION OF TAX

5A.

AMOUNT OF CITY SALES TAX:

OF LINE 4

3.7%

5A.

AMOUNT OF CITY SALES TAX:

OF LINE 4

x 2.5%

5B.

AMOUNT SUBJECT TO ACCOMMODATIONS TAX:

x 2.5%

5B.

AMOUNT SUBJECT TO ACCOMMODATIONS TAX:

6.

ADD: EXCESS TAX COLLECTED:

6.

ADD: EXCESS TAX COLLECTED:

7.

ADJUSTED CITY TAX: (ADD LINES 5A, B, and LINE 6)

(

)

7.

ADJUSTED CITY TAX: (ADD LINES 5A, B, and LINE 6)

8.

VENDORS FEE, IF PAID BY DUE DATE: DEDUCT 2% OF LIINE 7, UP TO $50

TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE

GROSS SALES

REPORTED AND ACCOUNTED FOR IN EVERY RETURN INC.

(

)

1.

AND SERVICE

ALL SALES, RENTALS, AND LEASES AND ALL SERVICES

8.

VENDORS FEE, IF PAID BY DUE DATE: DEDUCT 2% OF LIINE 7, UP TO $50

TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE

GROSS SALES

BOTH TAXABLE AND NON-TAXABLE.

9.

TOTAL SALES TAX: (LINE 7 MINUS LINE 8)

REPORTED AND ACCOUNTED FOR IN EVERY RETURN INC.

1.

AND SERVICE

ALL SALES, RENTALS, AND LEASES AND ALL SERVICES

2A.

ADD: BAD DEBTS COLLECTED

BOTH TAXABLE AND NON-TAXABLE.

9.

TOTAL SALES TAX: (LINE 7 MINUS LINE 8)

(FROM

x

3.7%

10.

CITY USE TAX

AMOUNT SUBJECT TO TAX

SCHEDULE B)

2A.

ADD: BAD DEBTS COLLECTED

2B.

TOTAL LINES 1 & 2A

x

3.7%

(FROM

10.

CITY USE TAX

AMOUNT SUBJECT TO TAX

11.

TOTAL TAX DUE: (ADD LINES 9 AND 10)

SCHEDULE B)

2B.

TOTAL LINES 1 & 2A

(

)

NON-TAXABLE

(INCLUDED IN ITEM 1 ABOVE)

3.

A.

11.

TOTAL TAX DUE: (ADD LINES 9 AND 10)

LATE FILING

SERVICE SALES

10%

OF LINE 11

A. PENALTY:

(

)

NON-TAXABLE

(INCLUDED IN ITEM 1 ABOVE)

3.

A.

12.

IF RETURN IS FILED

ADD:

SALES TO OTHER LICENSED DEALERS

B.

LATE FILING

SERVICE SALES

10%

OF LINE 11

FOR PURPOSES OF TAXABLE RESALE

AFTER DUE DATE THEN

B. INTEREST PER

A. PENALTY:

.67% OF LINE 11

IF RETURN IS FILED

ADD:

MONTH

12.

SALES TO OTHER LICENSED DEALERS

(

)

B.

SALES SHIPPED OUT OF

INCLUDED IN

C.

B. INTEREST PER

.67% OF LINE 11

FOR PURPOSES OF TAXABLE RESALE

AFTER DUE DATE THEN

CITY AND/OR STATE

ITEM 1 ABOVE

13.

TOTAL TAX PENALTY AND INTEREST DUE (ADD LINES 11 AND 12A AND 12B)

MONTH

(

)

SALES SHIPPED OUT OF

INCLUDED IN

(

)

C.

BAD DEBTS

ON WHICH CITY SALES

D.

CITY AND/OR STATE

ITEM 1 ABOVE

13.

TOTAL TAX PENALTY AND INTEREST DUE (ADD LINES 11 AND 12A AND 12B)

CHARGED OFF

TAX HAS BEEN PAID

ADJUSTMENT PRIOR PERIODS

A - ADD:

(

)

BAD DEBTS

ON WHICH CITY SALES

14.

D

D.

ATTACH COPY OF OVER OR

E.

ADJUSTMENT PRIOR PERIODS

TRADE-INS FOR TAXABLE RESALE

CHARGED OFF

TAX HAS BEEN PAID

UNDERPAYMENT NOTICE -

A - ADD:

E

B - DEDUCT:

14.

ATTACH COPY OF OVER OR

D

(

)

E.

D

TRADE-INS FOR TAXABLE RESALE

F.

SALES OF GASOLINE AND CIGARETTES

MAKE CHECK OR MONEY ORDER

UNDERPAYMENT NOTICE -

E

B - DEDUCT:

U

(

)

15.

TOTAL DUE AND PAYABLE:

PAYABLE TO

D

F.

C

SALES TO GOVERNMENTAL, RELIGIOUS

SALES OF GASOLINE AND CIGARETTES

MAKE CHECK OR MONEY ORDER

G.

CITY OF GLENWOOD SPRINGS

U

AND CHARITABLE ORGANIZATIONS

T

15.

TOTAL DUE AND PAYABLE:

PAYABLE TO

SALES TO GOVERNMENTAL, RELIGIOUS

C

G.

CITY OF GLENWOOD SPRINGS

I

H.

AND CHARITABLE ORGANIZATIONS

RETURNED GOODS

Please complete Reverse Side for Address or Ownership Changes.

T

O

/

I

H.

RETURNED GOODS

PROSTHETIC

Please complete Reverse Side for Address or Ownership Changes.

N

I.

PRESCRIPTION DRUGS

I hereby certify under penalty of perjury that the statements made herein are to the best of my knowledge

O

DEVICES

/

PROSTHETIC

N

I.

PRESCRIPTION DRUGS

true and correct.

J.

I hereby certify under penalty of perjury that the statements made herein are to the best of my knowledge

CONTRACTED LODGING – 30 DAYS OR MORE

DEVICES

true and correct.

J.

CONTRACTED LODGING – 30 DAYS OR MORE

K.

OTHER DEDUCTIONS (LIST)

BY

K.

OTHER DEDUCTIONS (LIST)

BY

L.

COMPANY

L.

(

TOTAL OF LINES 3

)

COMPANY

3. TOTAL DEDUCTIONS

A THRU L

(

TOTAL OF LINES 3

)

(

)

3. TOTAL DEDUCTIONS

LINE 2B MINUS

TITLE

DATE

4.

TOTAL CITY NET TAXABLE SALES & SERVICE

A THRU L

TOTAL LINE 3

(

)

LINE 2B MINUS

4.

TOTAL CITY NET TAXABLE SALES & SERVICE

TITLE

DATE

TOTAL LINE 3

TAXPAYER’S NAME AND ADDRESS

PERIOD

ACCOUNT

CITY OF GLENWOOD SPRINGS

COVERED

NUMBER

DUE

SALES/USE TAX RETURN

DATE

101 W. 8TH STREET P.O. BOX 458 GLENWOOD SPRINGS, CO 81602

(970) 384-6400

COMPUTATION OF TAX

3.7%

5A.

AMOUNT OF CITY SALES TAX:

OF LINE 4

x 2.5%

5B.

AMOUNT SUBJECT TO ACCOMMODATIONS TAX:

6.

ADD: EXCESS TAX COLLECTED:

7.

ADJUSTED CITY TAX: (ADD LINES 5A, B, and LINE 6)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1