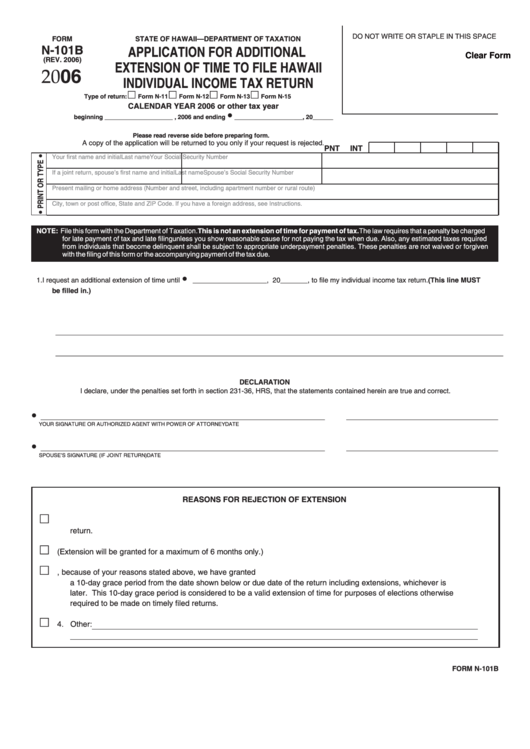

DO NOT WRITE OR STAPLE IN THIS SPACE

FORM

STATE OF HAWAII—DEPARTMENT OF TAXATION

N-101B

APPLICATION FOR ADDITIONAL

Clear Form

(REV. 2006)

EXTENSION OF TIME TO FILE HAWAII

2006

INDIVIDUAL INCOME TAX RETURN

£

£

£

£

Type of return:

Form N-11

Form N-12

Form N-13

Form N-15

CALENDAR YEAR 2006 or other tax year

—

beginning ____________________ , 2006 and ending

____________________, 20______

Please read reverse side before preparing form.

A copy of the application will be returned to you only if your request is rejected.

PNT

INT

Your first name and initial

Last name

Your Social Security Number

If a joint return, spouse’s first name and initial

Last name

Spouse’s Social Security Number

Present mailing or home address (Number and street, including apartment number or rural route)

City, town or post office, State and ZIP Code. If you have a foreign address, see Instructions.

NOTE: File this form with the Department of Taxation. This is not an extension of time for payment of tax. The law requires that a penalty be charged

for late payment of tax and late filing unless you show reasonable cause for not paying the tax when due. Also, any estimated taxes required

from individuals that become delinquent shall be subject to appropriate underpayment penalties. These penalties are not waived or forgiven

with the filing of this form or the accompanying payment of the tax due.

—

1.

I request an additional extension of time until

___________________, 20 _______, to file my individual income tax return. (This line MUST

be filled in.)

2.

State in detail why you need an additional extension. _________________________________________________________________________

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that the statements contained herein are true and correct.

—

_________________________________________________________________________

_______________________________________

YOUR SIGNATURE OR AUTHORIZED AGENT WITH POWER OF ATTORNEY

DATE

—

_________________________________________________________________________

_______________________________________

SPOUSE’S SIGNATURE (IF JOINT RETURN)

DATE

REASONS FOR REJECTION OF EXTENSION

£

1. The request was not in this office or mailed on or before the expiration of the automatic 4-month extension for filing the

return.

£

2. The 6-month limitation has expired. (Extension will be granted for a maximum of 6 months only.)

£

3. We have NOT approved the application. However, because of your reasons stated above, we have granted

a 10-day grace period from the date shown below or due date of the return including extensions, whichever is

later. This 10-day grace period is considered to be a valid extension of time for purposes of elections otherwise

required to be made on timely filed returns.

£

4. Other:

FORM N-101B

1

1